Answered step by step

Verified Expert Solution

Question

1 Approved Answer

how to get to the answer of optimal debt is worth 30? 20. An unlevered firm decides to issue perpetual debt which is worth either

how to get to the answer of optimal debt is worth 30?

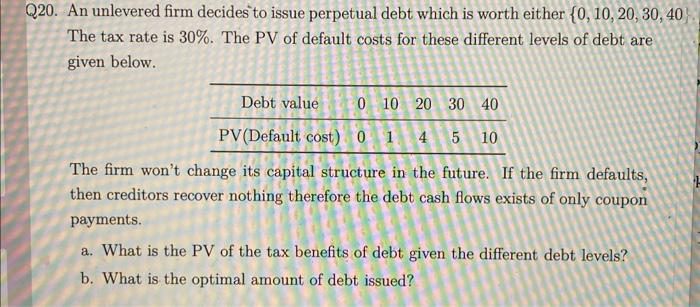

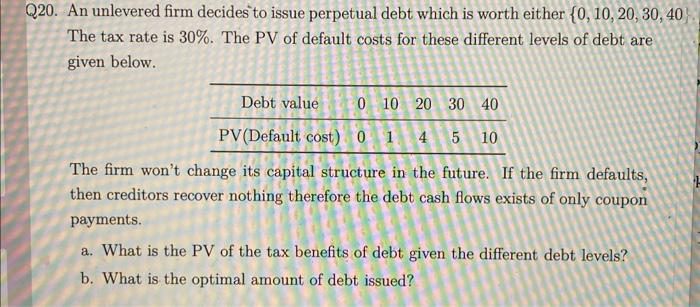

20. An unlevered firm decides to issue perpetual debt which is worth either {0,10,20,30,40 The tax rate is 30%. The PV of default costs for these different levels of debt are given below. The firm won't change its capital structure in the future. If the firm defaults, then creditors recover nothing therefore the debt cash flows exists of only coupon payments. a. What is the PV of the tax benefits of debt given the different debt levels? b. What is the optimal amount of debt issued

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started