How to make a sheets?

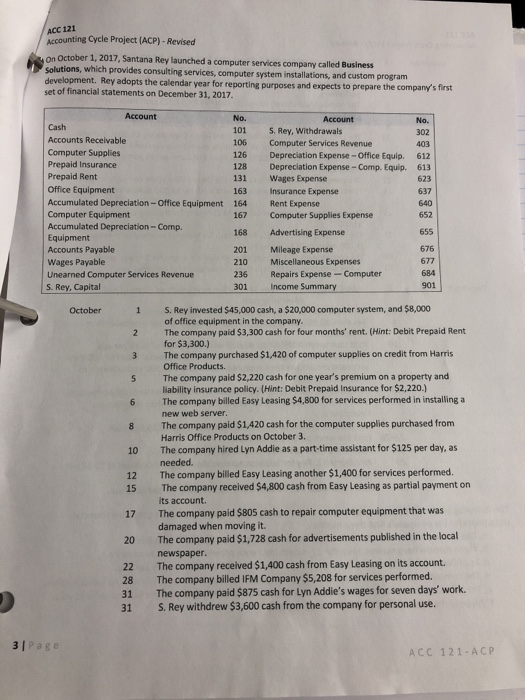

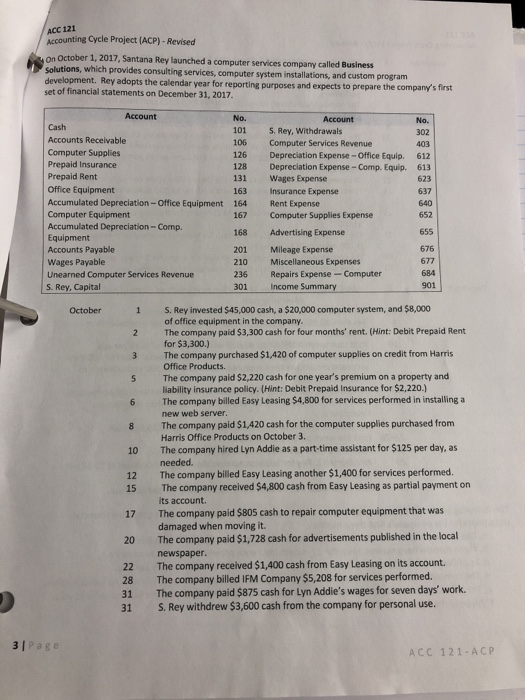

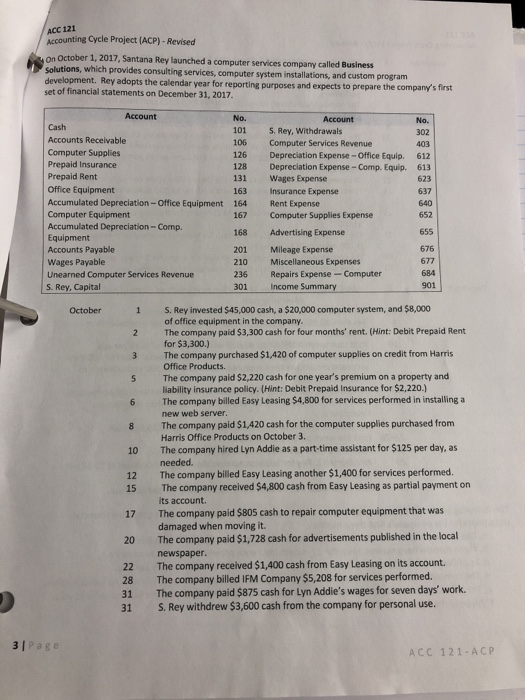

ACC 121 AcCounting Cycle Project (ACP) - Revised on October 1, 2017, Santana Rey launched a computer services company called Business Solutions, which provides consulting services, computer system installations, and custom program development. Rey adopts the calendar year for reporting purposes and expects to prepare the company's first set of financial statements on December 31, 2017. Account No. Account No. Cash 101 S. Rey, Withdrawals Computer Services Revenue Depreciation Expense-Office Equip. Depreciation Expense- Comp. Equip. Wages Expense Insurance Expense 302 Accounts Receivable 106 403 Computer Supplies 126 612 Prepaid Insurance 128 613 Prepaid Rent 131 623 Office Equipment 163 637 Accumulated Depreciation-Office Equipment 164 Rent Expense Computer Supplies Expense 640 Computer Equipment Accumulated Depreciation-Comp. Equipment Accounts Payable Wages Payable 652 167 655 168 Advertising Expense 201 Mileage Expense Miscellaneous Expenses Repairs Expense- Computer 676 677 210 684 Unearned Computer Services Revenue 236 901 301 Income Summary S. Rey, Capital S. Rey invested $45,000 cash, a $20,000 computer system, and $8,000 of office equipment in the company. The company paid $3,300 cash for four months' rent. (Hint: Debit Prepaid Rent for $3,300.) The company purchased $1,420 of computer supplies on credit from Harris October 1 Office Products. The company paid $2,220 cash for one year's premium on a property and liability insurance policy. (Hint: Debit Prepaid Insurance for $2,220.) The company billed Easy Leasing $4,800 for services performed in installing a 6 new web server. The company paid $1,420 cash for the computer supplies purchased from Harris Office Products on October 3. The company hired Lyn Addie as a part-time assistant for $125 per day, as 8 10 needed. The company billed Easy Leasing another $1,400 for services performed. The company received $4,800 cash from Easy Leasing as partial payment on 12 15 its account. The company paid $805 cash to repair computer equipment that was damaged when moving it. The company paid $1,728 cash for advertisements published in the local 17 20 newspaper. The company received $1,400 cash from Easy Leasing on its account. The company billed IFM Company $5,208 for services performed. The company paid $875 cash for Lyn Addie's wages for seven days' work S. Rey withdrew $3,600 cash from the company for personal use. 22 28 31 31 3 Page ACC 121-ACP