Answered step by step

Verified Expert Solution

Question

1 Approved Answer

How to solve A . As a financial manager of Kudrato Bhd , you are required to measure the cost of various sources of financing

How to solve

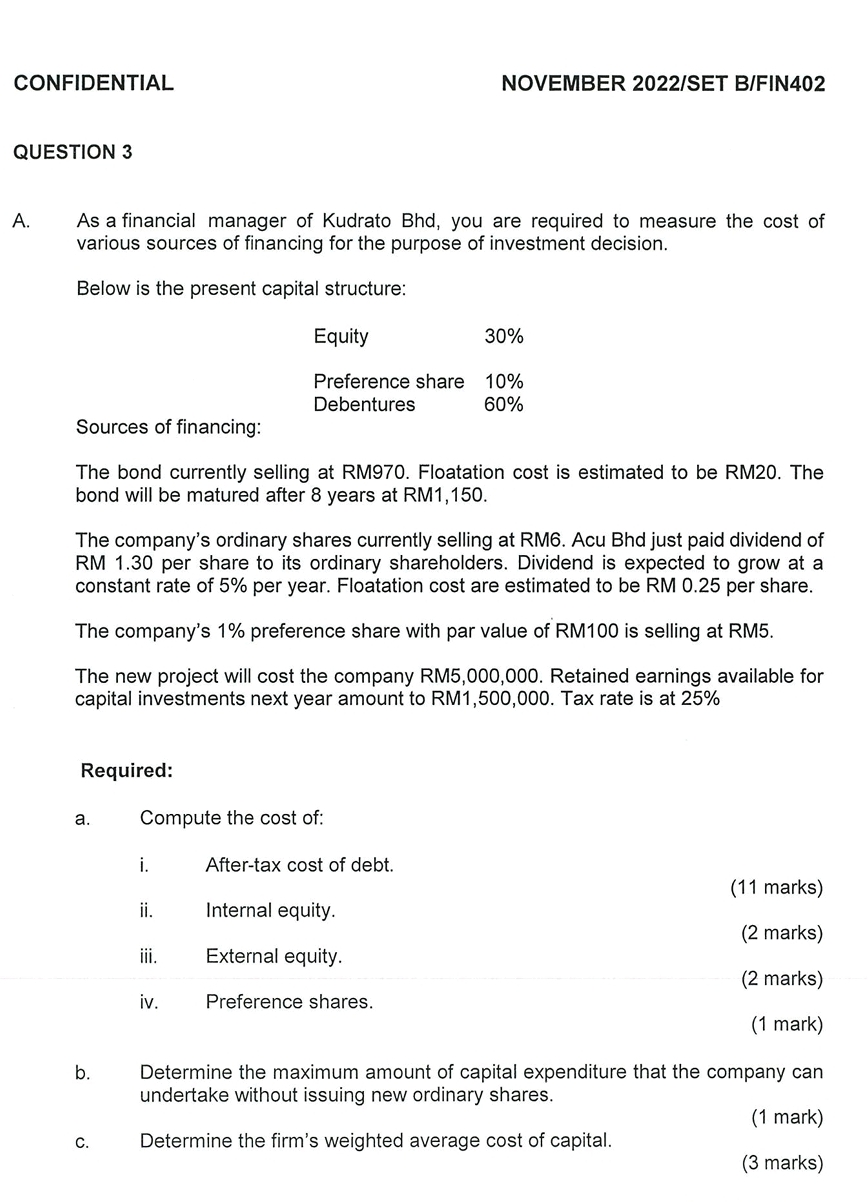

A As a financial manager of Kudrato Bhd you are required to measure the cost of

various sources of financing for the purpose of investment decision.

Below is the present capital structure:

Sources of financing:

The bond currently selling at RM Floatation cost is estimated to be RM The

bond will be matured after years at RM

The company's ordinary shares currently selling at RM Acu Bhd just paid dividend of

RM per share to its ordinary shareholders. Dividend is expected to grow at a

constant rate of per year. Floatation cost are estimated to be RM per share.

The company's preference share with par value of RM is selling at RM

The new project will cost the company RM Retained earnings available for

capital investments next year amount to RM Tax rate is at

Required:

a Compute the cost of:

i Aftertax cost of debt.

ii Internal equity.

iii. External equity.

iv Preference shares.

b Determine the maximum amount of capital expenditure that the company can

undertake without issuing new ordinary shares.

c Determine the firm's weighted average cost of capital.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started