Answered step by step

Verified Expert Solution

Question

1 Approved Answer

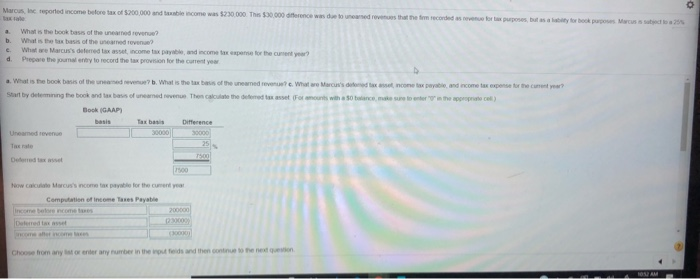

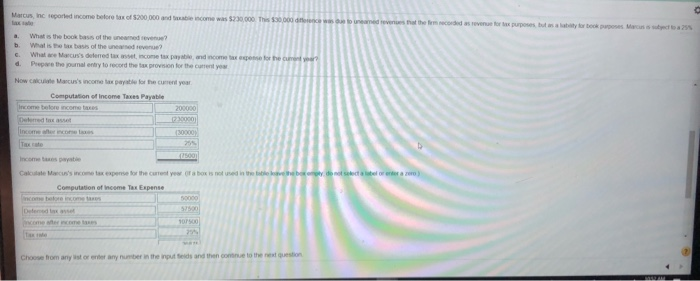

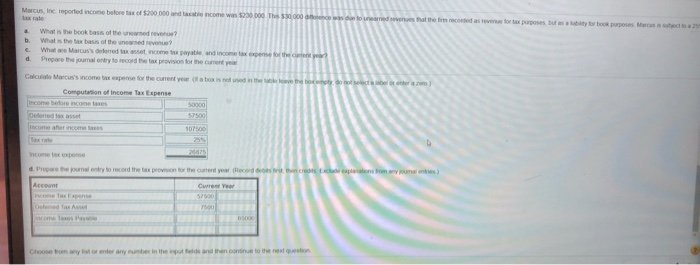

how to solve A-D show computations and entry titles please Marcus, in reported income before tax of $200,000 and table income was $230.000 This $30.000

how to solve A-D show computations and entry titles please

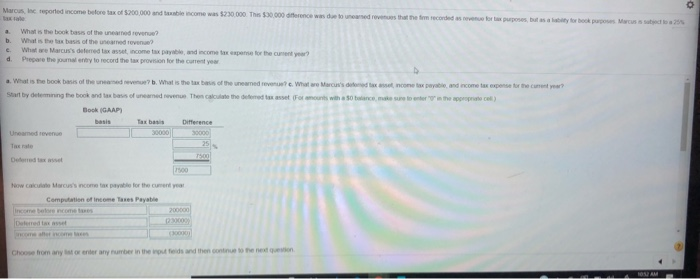

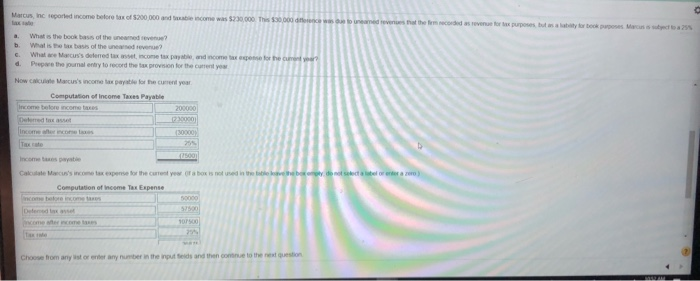

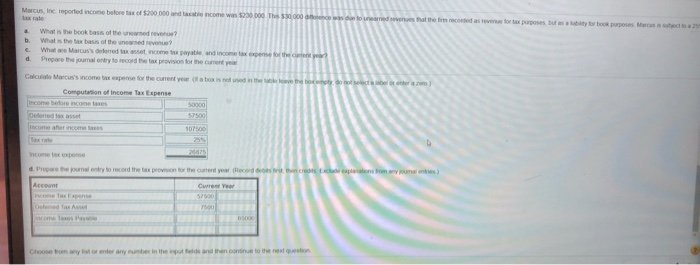

Marcus, in reported income before tax of $200,000 and table income was $230.000 This $30.000 difference was due to conserves that the form orded as for purposes, but salty for books Marcas 25 a b. e. d What is the book basis of the neared reven What is the basis of the neared revenue! What we Marcus's deferred taxat, income tax payable, and income tax expense for the current year? Prepare the many to record the tax pron for the current year a. What is the book basis of the need? What is the tax basis of the newned revenue. What are Marcu's dead text income tax payable and income tax expense for the current year? Start by determining the book and tax basis of named vee Then calculate the deemed to set for amounts with a stance, make sure to worries the appropriate Book GAAP basis Tax basis Difference Uncamervence 30000 30000 25 Dered to How cache Marcus's come to be for the current year Computation of income Taxes Payable 200000 Deferred 2.30000 Choose from any sonder any number in the routes and then continente FOAM Marcus, inc reported income before tax of 200000 and become was $230,000. This $30.000 de med reveal them recorded as revenue for purposes but is book is csoda a. What is the book basis of the deve? b What is the basis of the deve? C What we Marcus's deferred tax income tax and comes for the d Prepare the journal entry to record the provision for the current you Nowe Marcus's income tax pays for the current year Computation of Income Taxes Payable 200000 230000 30000 17500 Calculate cus's income tax expense for the current year of a box is not used Computation of income Tax Expense come before income 50000 Deterd comerc 07500 Choose from any store any number in the input Belds and then come to the next question Marcus, Inc reported income buforex of $200 000 and tastencome was $250.000 This 3,000 corred to that the recorded as revenue for tax purposes, but as a bit tortor purposes and What is the book basis of the warned? b. What is the box basis of the named What we Marc's deferred to income tax payable and income tax expense for the you d Prepare the journal entry to record the provision for the current year Calculate Marcus's incompete for the current yearbox is not used in the love they do not worth) Computation of Income Tax Expense Income before income taxes Drexet 107400 Sono income d. Prepare the entry to record the proven to the current year Records, the contro unas) Crear come Tax Expen De toute Choose from oneraryumber in the bed and then continue to the next question Marcus, in reported income before tax of $200,000 and table income was $230.000 This $30.000 difference was due to conserves that the form orded as for purposes, but salty for books Marcas 25 a b. e. d What is the book basis of the neared reven What is the basis of the neared revenue! What we Marcus's deferred taxat, income tax payable, and income tax expense for the current year? Prepare the many to record the tax pron for the current year a. What is the book basis of the need? What is the tax basis of the newned revenue. What are Marcu's dead text income tax payable and income tax expense for the current year? Start by determining the book and tax basis of named vee Then calculate the deemed to set for amounts with a stance, make sure to worries the appropriate Book GAAP basis Tax basis Difference Uncamervence 30000 30000 25 Dered to How cache Marcus's come to be for the current year Computation of income Taxes Payable 200000 Deferred 2.30000 Choose from any sonder any number in the routes and then continente FOAM Marcus, inc reported income before tax of 200000 and become was $230,000. This $30.000 de med reveal them recorded as revenue for purposes but is book is csoda a. What is the book basis of the deve? b What is the basis of the deve? C What we Marcus's deferred tax income tax and comes for the d Prepare the journal entry to record the provision for the current you Nowe Marcus's income tax pays for the current year Computation of Income Taxes Payable 200000 230000 30000 17500 Calculate cus's income tax expense for the current year of a box is not used Computation of income Tax Expense come before income 50000 Deterd comerc 07500 Choose from any store any number in the input Belds and then come to the next question Marcus, Inc reported income buforex of $200 000 and tastencome was $250.000 This 3,000 corred to that the recorded as revenue for tax purposes, but as a bit tortor purposes and What is the book basis of the warned? b. What is the box basis of the named What we Marc's deferred to income tax payable and income tax expense for the you d Prepare the journal entry to record the provision for the current year Calculate Marcus's incompete for the current yearbox is not used in the love they do not worth) Computation of Income Tax Expense Income before income taxes Drexet 107400 Sono income d. Prepare the entry to record the proven to the current year Records, the contro unas) Crear come Tax Expen De toute Choose from oneraryumber in the bed and then continue to the next

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started