Answered step by step

Verified Expert Solution

Question

1 Approved Answer

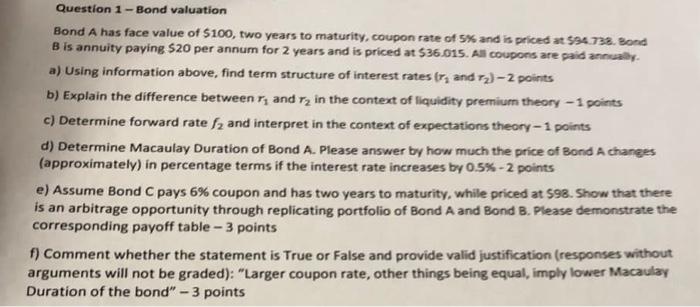

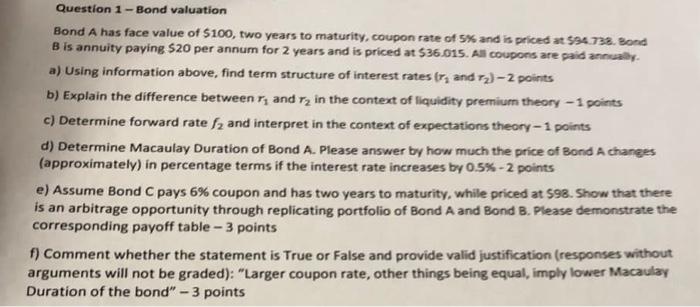

How to solve in details e, f parts of Question-1? please help Question 1 - Bond valuation Bond A has face value of $100, two

How to solve in details e, f parts of Question-1? please help

Question 1 - Bond valuation Bond A has face value of $100, two vears to maturity, coupon rate of 5% and is priced at 594.738. Bond B is annuity paying $20 per annum for 2 years and is priced at $36.015. All coupons are paid annualy. a) Using information above, find term structure of interest rates (r1 and r2)2 points b) Explain the difference between r1 and r2 in the context of liquidity premium theory - 1 points c) Determine forward rate f2 and interpret in the context of expectations theory - 1 points d) Determine Macaulay Duration of Bond A. Please answer by how much the price of Bond A changes (approximately) in percentage terms if the interest rate increases by 0.5%2 points e) Assume Bond C pays 6% coupon and has two years to maturity, while priced at 598.5 Show that there is an arbitrage opportunity through replicating portfolio of Bond A and Bond B. Please dernonstrate the corresponding payoff table 3 points ) Comment whether the statement is True or False and provide valid justification (responses without rguments will not be graded): "Larger coupon rate, other things being equal, imply lower Macaulay uration of the bond" 3 points

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started