Answered step by step

Verified Expert Solution

Question

1 Approved Answer

How to solve QUESTION 2 Mellany Pharmacy Bhd needs to buy a new processing machine costing RM 1 , 3 5 0 , 0 0

How to solve

QUESTION

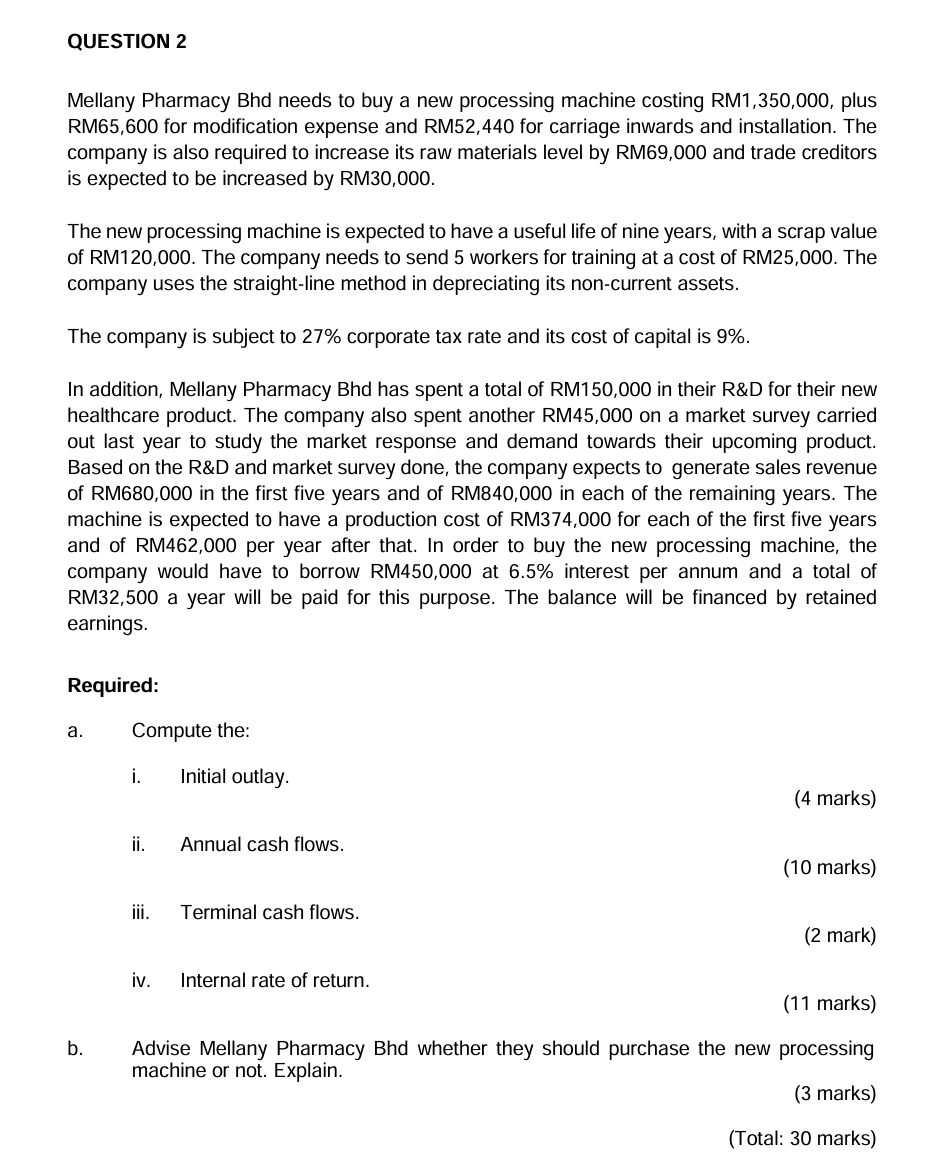

Mellany Pharmacy Bhd needs to buy a new processing machine costing RM plus

RM for modification expense and RM for carriage inwards and installation. The

company is also required to increase its raw materials level by RM and trade creditors

is expected to be increased by RM

The new processing machine is expected to have a useful life of nine years, with a scrap value

of RM The company needs to send workers for training at a cost of RM The

company uses the straightline method in depreciating its noncurrent assets.

The company is subject to corporate tax rate and its cost of capital is

In addition, Mellany Pharmacy Bhd has spent a total of RM in their R&D for their new

healthcare product. The company also spent another RM on a market survey carried

out last year to study the market response and demand towards their upcoming product.

Based on the R&D and market survey done, the company expects to generate sales revenue

of RM in the first five years and of RM in each of the remaining years. The

machine is expected to have a production cost of RM for each of the first five years

and of RM per year after that. In order to buy the new processing machine, the

company would have to borrow RM at interest per annum and a total of

RM a year will be paid for this purpose. The balance will be financed by retained

earnings.

Required:

a Compute the:

i Initial outlay.

ii Annual cash flows.

iii. Terminal cash flows.

iv Internal rate of return.

b Advise Mellany Pharmacy Bhd whether they should purchase the new processing

machine or not. Explain.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started