Answered step by step

Verified Expert Solution

Question

1 Approved Answer

how to solve the given problems 1. The following information is available to reconcile Hinckley Company's book balance of cash with its bank statement cash

how to solve the given problems

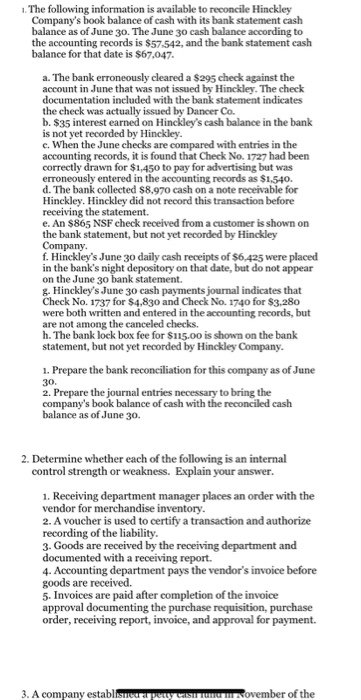

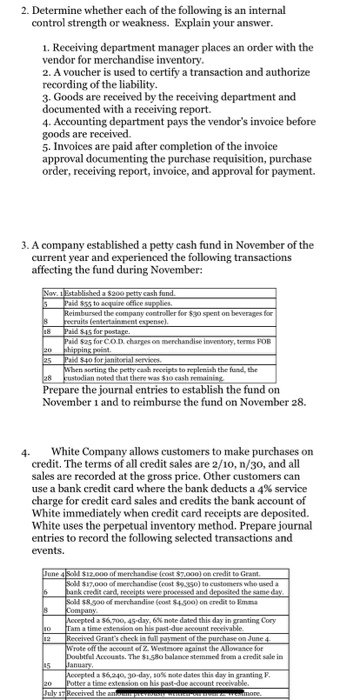

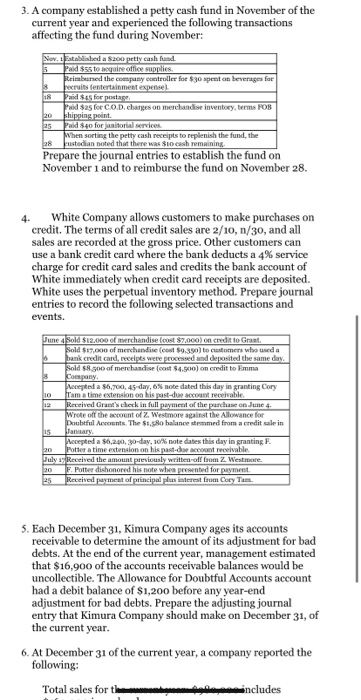

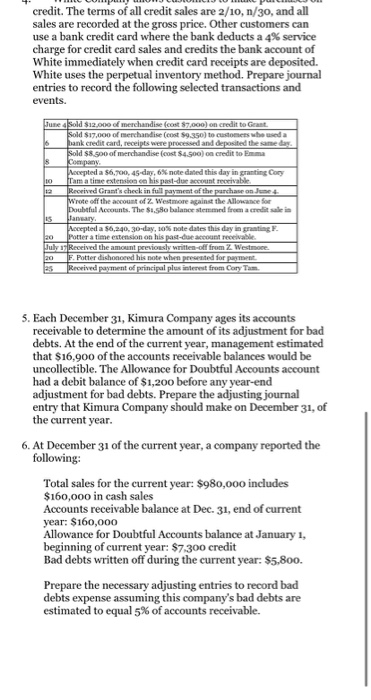

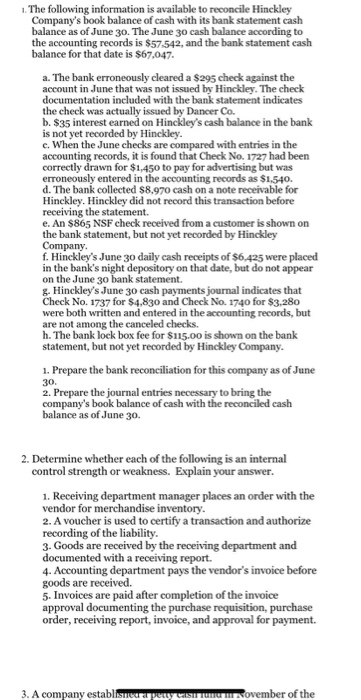

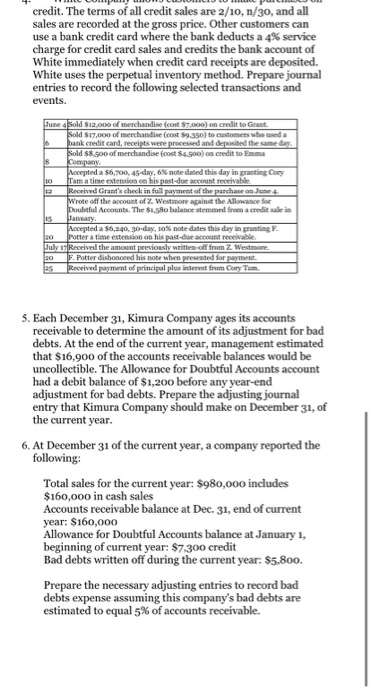

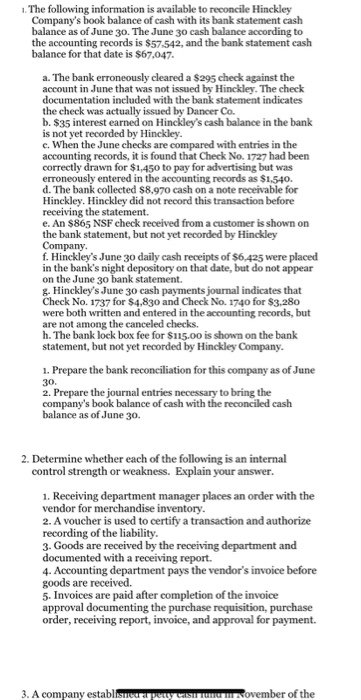

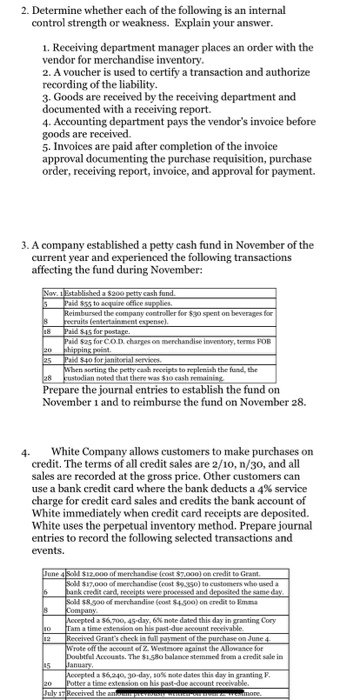

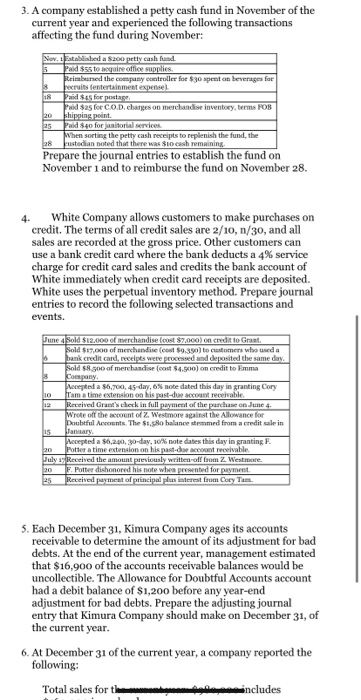

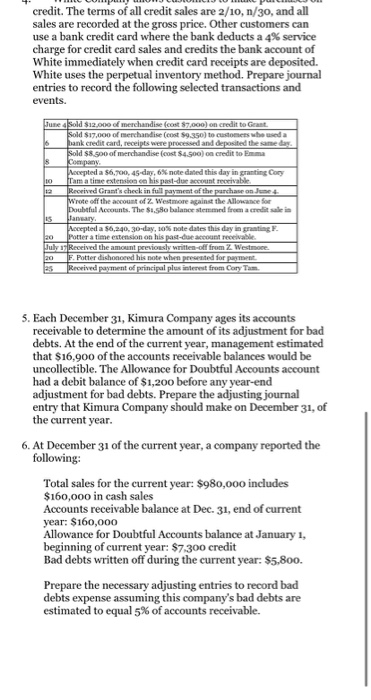

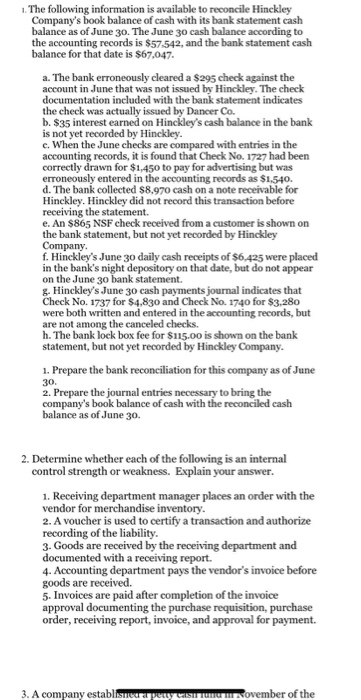

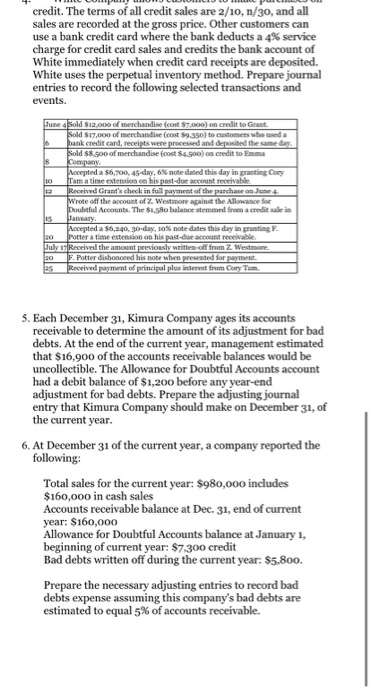

1. The following information is available to reconcile Hinckley Company's book balance of cash with its bank statement cash balance as of June 30. The June 30 cash balance according to the accounting records is $57,542, and the bank statement cash balance for that date is $67,047. a. The bank erroneously cleared a $295 check against the account in June that was not issued by Hinckley. The check documentation included with the bank statement indicates the check was actually issued by Dancer Co. b. $35 interest earned on Hinckley's cash balance in the bank is not yet recorded by Hinckley. c. When the June checks are compared with entries in the accounting records, it is found that Check No. 1727 had been correctly drawn for $1,450 to pay for advertising but was erroneously entered in the accounting records as $1,540. d. The bank collected $8.970 cash on a note receivable for Hinckley. Hinckley did not record this transaction before receiving the statement. e. An $865 NSF check received from a customer is shown on the bank statement, but not yet recorded by Hinckley Company. f. Hinckley's June 30 daily cash receipts of $6.425 were placed in the bank's night depository on that date, but do not appear on the June 30 bank statement. g. Hinckley's June 30 cash payments journal indicates that Check No. 1737 for $4,830 and Check No. 1740 for $3,280 were both written and entered in the accounting records, but are not among the canceled checks. h. The bank lock box fee for $115.00 is shown on the bank statement, but not yet recorded by Hinckley Company. 1. Prepare the bank reconciliation for this company as of June 30 2. Prepare the journal entries necessary to bring the company's book balance of cash with the reconciled cash balance as of June 30. 2. Determine whether each of the following is an internal control strength or weakness. Explain your answer. 1. Receiving department manager places an order with the vendor for merchandise inventory. 2. A voucher is used to certify a transaction and authorize recording of the liability. 3. Goods are received by the receiving department and documented with a receiving report. 4. Accounting department pays the vendor's invoice before goods are received. 5. Invoices are paid after completion of the invoice approval documenting the purchase requisition, purchase order, receiving report, invoice, and approval for payment. 3. A company establisherapetyan Rovember of the 2. Determine whether each of the following is an internal control strength or weakness. Explain your answer. 1. Receiving department manager places an order with the vendor for merchandise inventory. 2. A voucher is used to certify a transaction and authorize recording of the liability. 3. Goods are received by the receiving department and documented with a receiving report. 4. Accounting department pays the vendor's invoice before goods are received 5. Invoices are paid after completion of the invoice approval documenting the purchase requisition, purchase order, receiving report, invoice, and approval for payment. 3. A company established a petty cash fund in November of the current year and experienced the following transactions affecting the fund during November: Nov. istablished a $200 petty cash fund. Pass to our office supplies Reimbursed the company controller for sent on beverages for recruits entertainment expense) Pads for postage Pal as for COD. charges on merchandise inventory, terms FOB Paisto for janitorial Services M en sorting the petty cash receipts to replenish the fund, the kustodian noted that there was $10 cash remaining Prepare the journal entries to establish the fund on November 1 and to reimburse the fund on November 28. 4. White Company allows customers to make purchases on credit. The terms of all credit sales are 2/10, n/30, and all sales are recorded at the gross price. Other customers can use a bank credit card where the bank deducts a 4% service charge for credit card sales and credits the bank account of White immediately when credit card receipts are deposited. White uses the perpetual inventory method. Prepare journal entries to record the following selected transactions and events. June 12.000 of merchandise od 7.000) on credit to Grant 17.00 w ande ) to customers who used hankit card receipts were p endand deposited the same day So o oo merchandise (cost $4.500) on credit to m a Mereted a 56.70.45-day, note dated this day in granting Cory fram a time extension on his past due count receivable Received Grant's check in full payment of the purchase on June 4 Wrote of the act of Westmore gainst the Allowance for Date Accounts. The $1.580 balance stemmed from a credit sale in heted a 56, 24, Jo-day, 30% tedate this day in granting F. 20 Fottera time extensione his past due count receivable July 1 Received the g o re 3. A company established a petty cash fund in November of the current year and experienced the following transactions affecting the fund during November: Nov. Etablished a $200 petty cash fund Paid to gain office supplies Reimbed the company controller i enton leverages for recruits entertainment expensel 18 SES for postage P as for COD changes on merchandis e POS 20shipping point 15 Pads for a services When sorting the petty cash receipts toplish the found the were was so Prepare the journal entries to establish the fund on November 1 and to reimburse the fund on November 28. 4. White Company allows customers to make purchases on credit. The terms of all credit sales are 2/10, n/30, and all sales are recorded at the gross price. Other customers can use a bank credit card where the bank deducts a 4% service charge for credit card sales and credits the bank account of White immediately when credit card receipts are deposited. White uses the perpetual inventory method. Prepare journal entries to record the following selected transactions and events. June Sold $12.000 of merchandise loost $7.000) on credit to Grant Sold $17, of merchandise (cow $9.3 ) to customers who used a bank credit card, receipts were processed and deposited the same day Nold 5.0 of merchandise at $4.500) on credit to Emma Company Mereted a $700, 45 , N ote date this day in granting Cory extension on this pas Received Grant's check in full payment of the purchase on June 4 Wroke of the mount of Westmore in the Allowance for Dwful ents. The $. balance stemmed from a credite in Heeleda 6,200, 30-day, tedate this day in granting F. July R 30 25 ed the written off from Z West Potter dish is not whes rested for payment kredyment of principals interest from Cry 5. Each December 31, Kimura Company ages its accounts receivable to determine the amount of its adjustment for bad debts. At the end of the current year, management estimated that $16.900 of the accounts receivable balances would be uncollectible. The Allowance for Doubtful Accounts account had a debit balance of $1,200 before any year-end adjustment for bad debts. Prepare the adjusting journal entry that Kimura Company should make on December 31, of the current year. 6. At December 31 of the current year, a company reported the following: Total sales for t ... ncludes credit. The terms of all credit sales are 2/10, n/30, and all sales are recorded at the gross price. Other customers can use a bank credit card where the bank deducts a 4% service charge for credit card sales and credits the bank account of White immediately when credit card receipts are deposited. White uses the perpetual inventory method. Prepare journal entries to record the following selected transactions and events. une sold Sa m echandise cost 7.0 credit to Grant Sold $17.000 of merchandise est to c h e da bank credit card, receipts were proceden de hemel Sou o oferchandise forte credit to Company Weertadas . 45 day, 6% de dated this day in an y Iramatieso his pastore R ived Gr's check in the purchase wrote of the act of Westmeathe Acceso Doubtful A . The si so bile free s e Repeda 56.40.30-day, so notedate this day Potter a time extension on this page a r e Received the wi f e Wed Potter dishoned this note whered for a t Revived payment of principal plustest from Cory Time 25 5. Each December 31, Kimura Company ages its accounts receivable to determine the amount of its adjustment for bad debts. At the end of the current year, management estimated that $16,900 of the accounts receivable balances would be uncollectible. The Allowance for Doubtful Accounts account had a debit balance of $1,200 before any year-end adjustment for bad debts. Prepare the adjusting journal entry that Kimura Company should make on December 31, of the current year. 6. At December 31 of the current year, a company reported the following: Total sales for the current year: $980,000 includes $160,000 in cash sales Accounts receivable balance at Dec 31, end of current year: $160,000 Allowance for Doubtful Accounts balance at January 1, beginning of current year: $7.300 credit Bad debts written off during the current year: $5,800. Prepare the necessary adjusting entries to record bad debts expense assuming this company's bad debts are estimated to equal 5% of accounts receivable. 1. The following information is available to reconcile Hinckley Company's book balance of cash with its bank statement cash balance as of June 30. The June 30 cash balance according to the accounting records is $57,542, and the bank statement cash balance for that date is $67,047. a. The bank erroneously cleared a $295 check against the account in June that was not issued by Hinckley. The check documentation included with the bank statement indicates the check was actually issued by Dancer Co. b. $35 interest earned on Hinckley's cash balance in the bank is not yet recorded by Hinckley. e. When the June checks are compared with entries in the accounting records, it is found that Check No. 1727 had been correctly drawn for $1,450 to pay for advertising but was erroneously entered in the accounting records as $1,540. d. The bank collected $8.970 cash on a note receivable for Hinckley. Hinckley did not record this transaction before receiving the statement. e. An $865 NSF check received from a customer is shown on the bank statement, but not yet recorded by Hinckley Company. f. Hinckley's June 30 daily cash receipts of $6.425 were placed in the bank's night depository on that date, but do not appear on the June 30 bank statement. g. Hinckley's June 30 cash payments journal indicates that Check No. 1737 for $4,830 and Check No. 1740 for $3,280 were both written and entered in the accounting records, but are not among the canceled checks. h. The bank lock box fee for $115.00 is shown on the bank statement, but not yet recorded by Hinckley Company. 1. Prepare the bank reconciliation for this company as of June 30 2. Prepare the journal entries necessary to bring the company's book balance of cash with the reconciled cash balance as of June 30. 2. Determine whether each of the following is an internal control strength or weakness. Explain your answer. 1. Receiving department manager places an order with the vendor for merchandise inventory. 2. A voucher is used to certify a transaction and authorize recording of the liability. 3. Goods are received by the receiving department and documented with a receiving report. 4. Accounting department pays the vendor's invoice before goods are received. 5. Invoices are paid after completion of the invoice approval documenting the purchase requisition, purchase order, receiving report, invoice, and approval for payment. 3. A company establisherapety was n o vember of the credit. The terms of all credit sales are 2/10, n/30, and all sales are recorded at the gross price. Other customers can use a bank credit card where the bank deducts a 4% service charge for credit card sales and credits the bank account of White immediately when credit card receipts are deposited. White uses the perpetual inventory method. Prepare journal entries to record the following selected transactions and events. une sold Sa m echandise cost 7.0 on credit to Gant Sold 17.000 of merchandise (est ) to c h oda bank credit card, receipts were process and the new Sol e ofendhandise fot credit to Company Wecepted a 45 day, 6% de dated this day in an y fram a time since his past or so me Received Gr 's check inful the purchas e wrote of the act of Westmeathe Acceso Doubtful A . The so balanced feat Leopted a 56.20 -day, so notedate this day Potter a time tension on this page a r e Received the wi f e Wed Potter dishonored this note whiperted for a t Received payment principal plus interest from Cory Time 25 5. Each December 31, Kimura Company ages its accounts receivable to determine the amount of its adjustment for bad debts. At the end of the current year, management estimated that $16,900 of the accounts receivable balances would be uncollectible. The Allowance for Doubtful Accounts account had a debit balance of $1,200 before any year-end adjustment for bad debts. Prepare the adjusting journal entry that Kimura Company should make on December 31, of the current year. 6. At December 31 of the current year, a company reported the following: Total sales for the current year: $980,000 includes $160,000 in cash sales Accounts receivable balance at Dec 31, end of current year: $160,000 Allowance for Doubtful Accounts balance at January 1, beginning of current year: $7.300 credit Bad debts written off during the current year: $5,800. Prepare the necessary adjusting entries to record bad debts expense assuming this company's bad debts are estimated to equal 5% of accounts receivable

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started