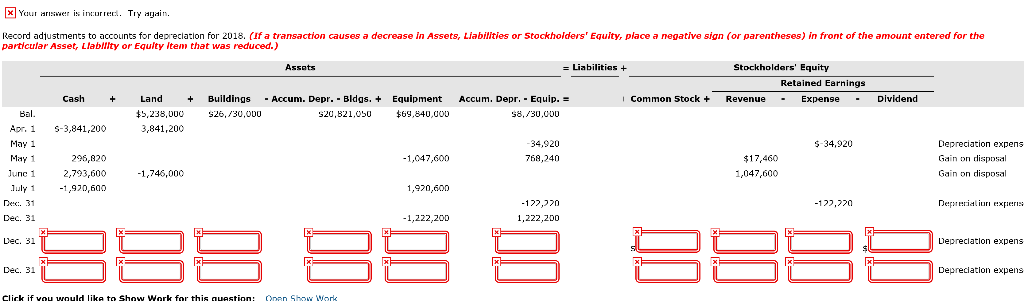

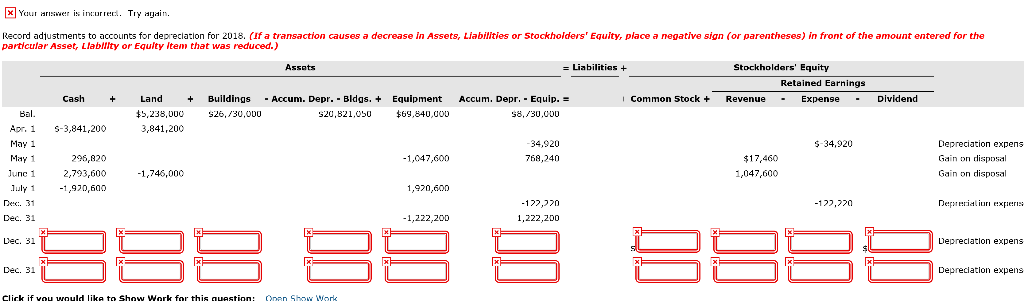

How to solve the last two red rows?

please show how.

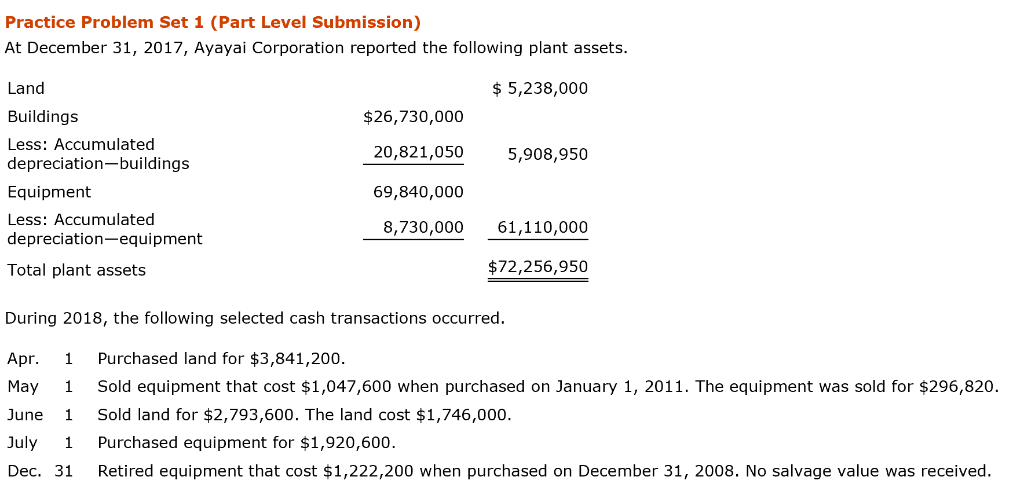

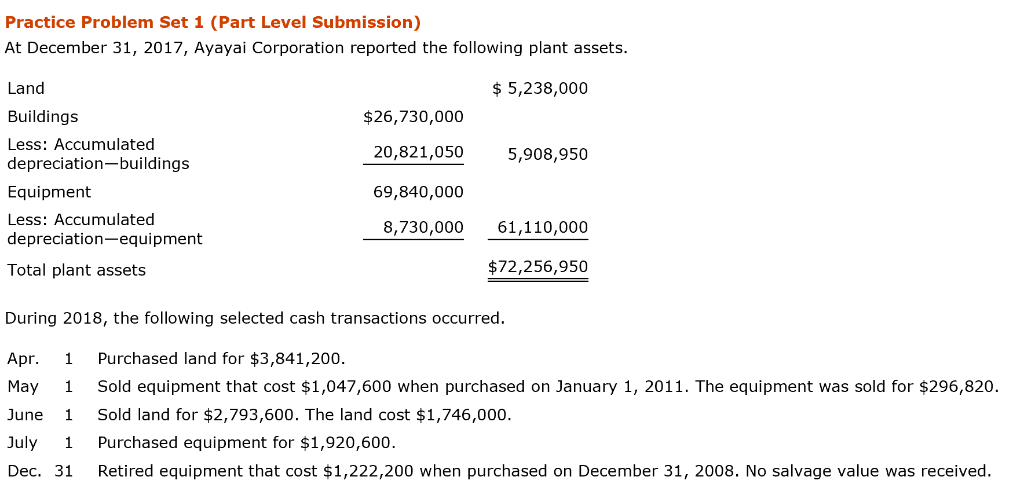

Practice Problem Set 1 (Part Level Submission) At December 31, 2017, Ayayai Corporation reported the following plant assets. Land $5,238,000 Buildings $26,730,000 Less: Accumulated depreciation-buildings 20,821,050 5,908,950 Equipment 69,840,000 Less: Accumulated depreciation-equipment 8,730,000 61,110,000 $72,256,950 Total plant assets During 2018, the following selected cash transactions occurred Purchased land for $3,841,200. Apr. 1 Sold equipment that cost $1,047,600 when purchased on January 1, 2011. The equipment was sold for $296,820. May 1 Sold land for $2,793,600. The land cost $1,746,000. June 1 Purchased equipment for $1,920,600. July 1 Retired equipment that cost $1,222,200 when purchased on December 31, 2008. No salvage value was received Dec. 31 x Yut awer is incurre. Try anain Record adjustments particular Asset, Llablllty or Equity Item that was reduced.) accounts for depreciation for 2018. (Ifa transaction causes decrease in Assets, Liabilities or Stockholders' Equity, place a negative sian (or parentheses) in front of the amount entered for the Assats Liabilitias + Stockholdars' Equity Retained Earnings Accum. Depr. Bldgs. + Accum. Depr. Equip. Dividend Cash Land Buildings Equipment + Common Stock + Revenue Expense Hal t5,238,000 $69.840.000 s8./30.000 S26,/30,000 S20.821.05u Apr. 1 - 3,841,200 3,841,200 May 1 34,920 s-34,920 Depreciation expens May 1 Gain on disposal Gain on disposal 296,820 -1,047.600 768 240 $17,460 1,047,600 June 1 2,793,600 -1,746,000 -1.920.600 July 1 1,920,600 Deprialiurn experi -122,20 -122.220 -1.222.200 BB Dec. 31 LDepreciation expens Dec. 31 Depreciation expens Click if you would like to Show Work for this question: Opan ShoK Work Practice Problem Set 1 (Part Level Submission) At December 31, 2017, Ayayai Corporation reported the following plant assets. Land $5,238,000 Buildings $26,730,000 Less: Accumulated depreciation-buildings 20,821,050 5,908,950 Equipment 69,840,000 Less: Accumulated depreciation-equipment 8,730,000 61,110,000 $72,256,950 Total plant assets During 2018, the following selected cash transactions occurred Purchased land for $3,841,200. Apr. 1 Sold equipment that cost $1,047,600 when purchased on January 1, 2011. The equipment was sold for $296,820. May 1 Sold land for $2,793,600. The land cost $1,746,000. June 1 Purchased equipment for $1,920,600. July 1 Retired equipment that cost $1,222,200 when purchased on December 31, 2008. No salvage value was received Dec. 31 x Yut awer is incurre. Try anain Record adjustments particular Asset, Llablllty or Equity Item that was reduced.) accounts for depreciation for 2018. (Ifa transaction causes decrease in Assets, Liabilities or Stockholders' Equity, place a negative sian (or parentheses) in front of the amount entered for the Assats Liabilitias + Stockholdars' Equity Retained Earnings Accum. Depr. Bldgs. + Accum. Depr. Equip. Dividend Cash Land Buildings Equipment + Common Stock + Revenue Expense Hal t5,238,000 $69.840.000 s8./30.000 S26,/30,000 S20.821.05u Apr. 1 - 3,841,200 3,841,200 May 1 34,920 s-34,920 Depreciation expens May 1 Gain on disposal Gain on disposal 296,820 -1,047.600 768 240 $17,460 1,047,600 June 1 2,793,600 -1,746,000 -1.920.600 July 1 1,920,600 Deprialiurn experi -122,20 -122.220 -1.222.200 BB Dec. 31 LDepreciation expens Dec. 31 Depreciation expens Click if you would like to Show Work for this question: Opan ShoK Work