Answered step by step

Verified Expert Solution

Question

1 Approved Answer

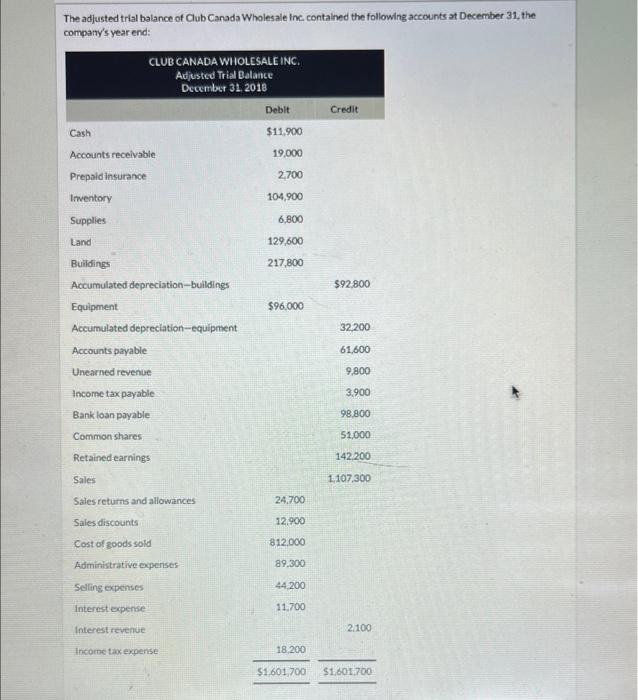

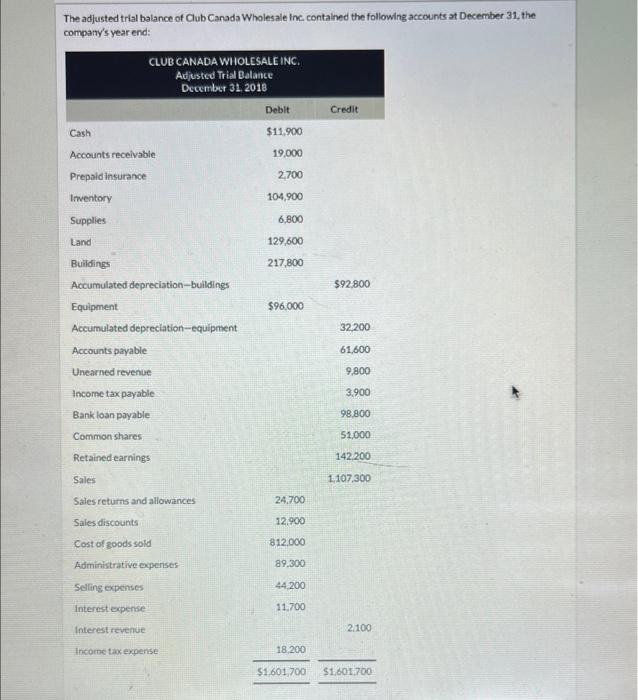

how to solve the questions (3 parts) The adjusted trial balance of Club Canada Wholesale inc contained the following accounts at December 31 , the

how to solve the questions (3 parts)

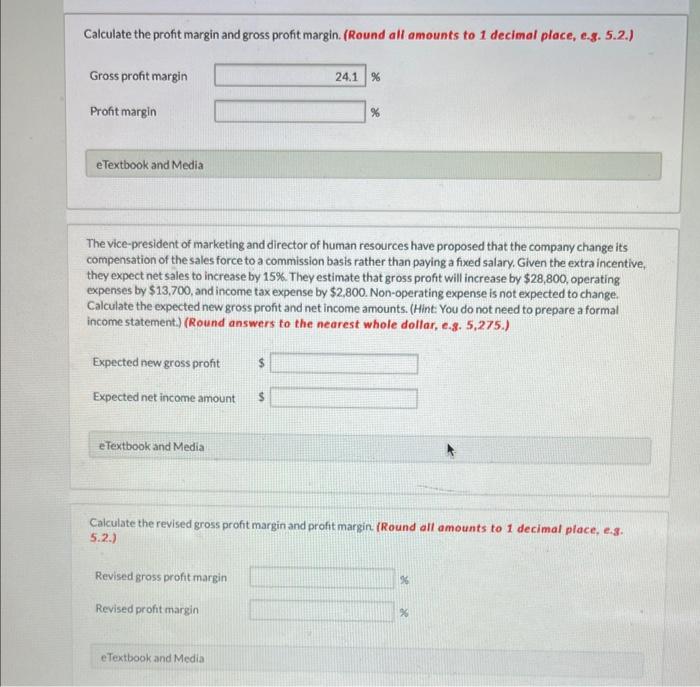

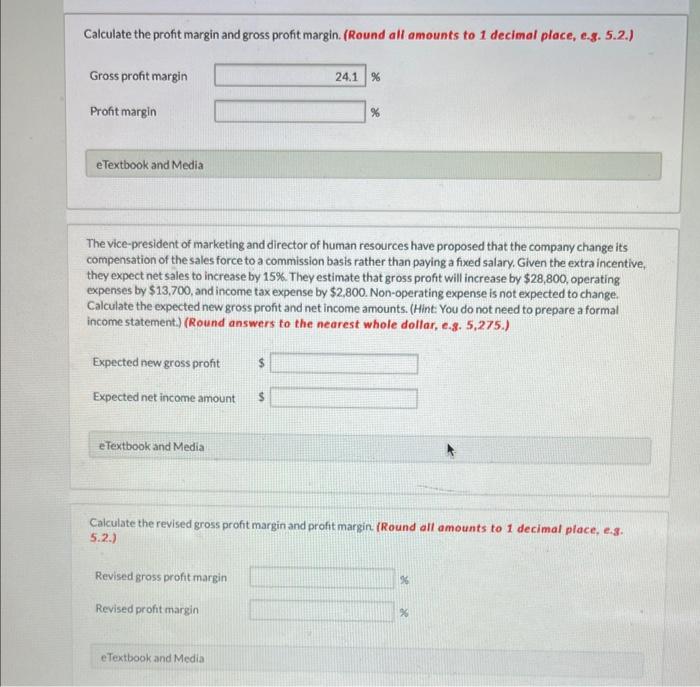

The adjusted trial balance of Club Canada Wholesale inc contained the following accounts at December 31 , the Calculate the profit margin and gross profit margin. (Round all amounts to 1 decimal place, e.s. 5.2.) Gross profit margin Profit margin eTextbook and Media The vice-president of marketing and director of human resources have proposed that the company change its compensation of the sales force to a commission basis rather than paying a fixed salary. Given the extra incentive, they expect net sales to increase by 15%. They estimate that gross profit will increase by $28,800, operating expenses by $13,700, and income tax expense by $2,800. Non-operating expense is not expected to change. Calculate the expected new gross profit and net income amounts. (Hint: You do not need to prepare a formal income statement) (Round answers to the nearest whole dollar, e.9. 5, 275.) Expected new gross profit Expected net income amount $ eTextbook and Media Calculate the revised gross profit margin and profit margin (Round all amounts to 1 decimal place, e.s. 5.2.) Revised gross profit margin Revised profit margin

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started