How to solve these problems using PRESENT VALUE (pv) function in excel?

How to solve these problems using PRESENT VALUE (pv) function in excel?

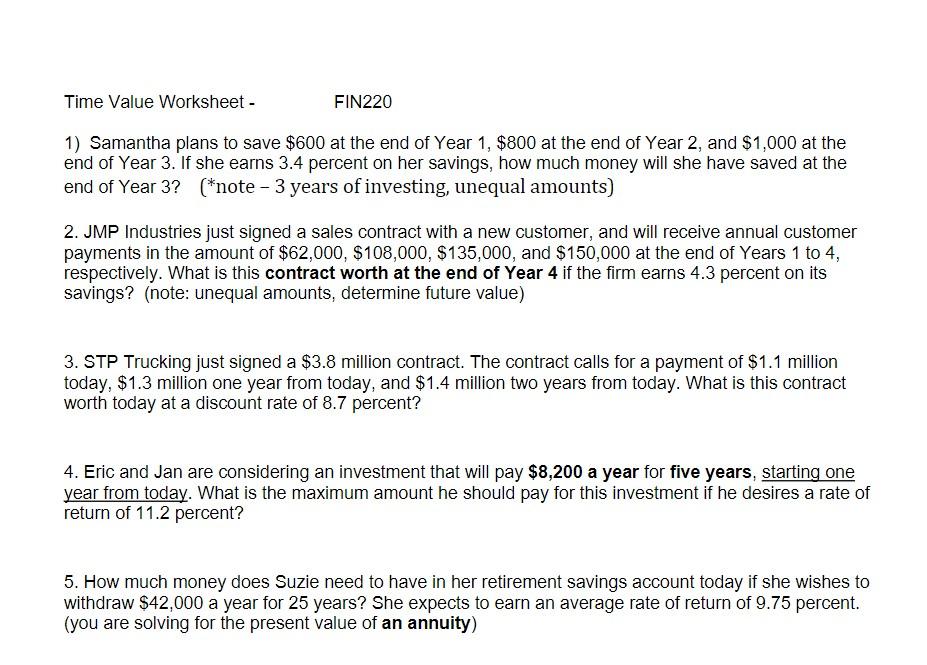

1) Samantha plans to save $600 at the end of Year 1, $800 at the end of Year 2, and $1,000 at the end of Year 3. If she earns 3.4 percent on her savings, how much money will she have saved at the end of Year 3 ? ( note 3 years of investing, unequal amounts) 2. JMP Industries just signed a sales contract with a new customer, and will receive annual customer payments in the amount of $62,000,$108,000,$135,000, and $150,000 at the end of Years 1 to 4 , respectively. What is this contract worth at the end of Year 4 if the firm earns 4.3 percent on its savings? (note: unequal amounts, determine future value) 3. STP Trucking just signed a $3.8 million contract. The contract calls for a payment of $1.1 million today, $1.3 million one year from today, and $1.4 million two years from today. What is this contract worth today at a discount rate of 8.7 percent? 4. Eric and Jan are considering an investment that will pay $8,200 a year for five years, starting one year from today. What is the maximum amount he should pay for this investment if he desires a rate of return of 11.2 percent? 5. How much money does Suzie need to have in her retirement savings account today if she wishes to withdraw $42,000 a year for 25 years? She expects to earn an average rate of return of 9.75 percent. (you are solving for the present value of an annuity) 1) Samantha plans to save $600 at the end of Year 1, $800 at the end of Year 2, and $1,000 at the end of Year 3. If she earns 3.4 percent on her savings, how much money will she have saved at the end of Year 3 ? ( note 3 years of investing, unequal amounts) 2. JMP Industries just signed a sales contract with a new customer, and will receive annual customer payments in the amount of $62,000,$108,000,$135,000, and $150,000 at the end of Years 1 to 4 , respectively. What is this contract worth at the end of Year 4 if the firm earns 4.3 percent on its savings? (note: unequal amounts, determine future value) 3. STP Trucking just signed a $3.8 million contract. The contract calls for a payment of $1.1 million today, $1.3 million one year from today, and $1.4 million two years from today. What is this contract worth today at a discount rate of 8.7 percent? 4. Eric and Jan are considering an investment that will pay $8,200 a year for five years, starting one year from today. What is the maximum amount he should pay for this investment if he desires a rate of return of 11.2 percent? 5. How much money does Suzie need to have in her retirement savings account today if she wishes to withdraw $42,000 a year for 25 years? She expects to earn an average rate of return of 9.75 percent. (you are solving for the present value of an annuity)

How to solve these problems using PRESENT VALUE (pv) function in excel?

How to solve these problems using PRESENT VALUE (pv) function in excel?