Answered step by step

Verified Expert Solution

Question

1 Approved Answer

how to solve this? especially the transaction on 10 march. is it 4.100 or 1.600? thanks Matcha a Instructions Prepare a correct trial balance. (Hint:

how to solve this? especially the transaction on 10 march. is it 4.100 or 1.600? thanks

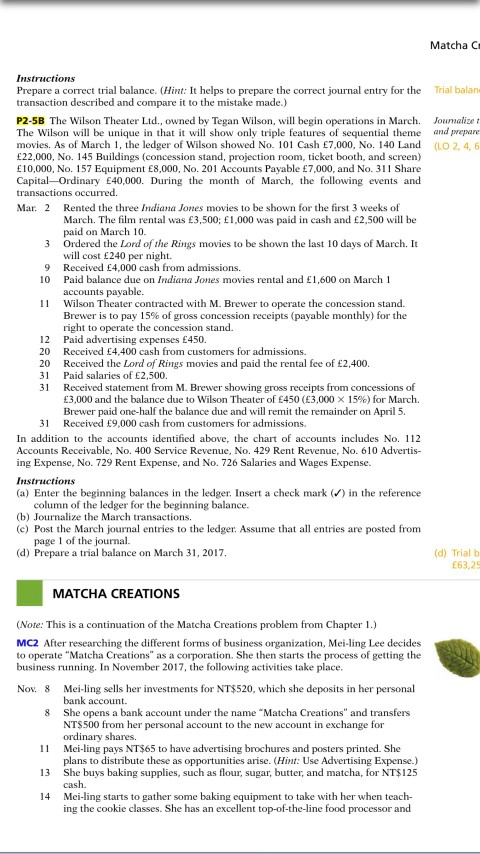

Matcha a Instructions Prepare a correct trial balance. (Hint: It helps to prepare the correct journal entry for the Trial balan transaction described and compare it to the mistake made.) P2-5B The Wilson Theater Ltd., owned by Tegan Wilson, will begin operations in March Journalist The Wilson will be unique in that it will show only triple features of sequential theme and prepare movies. As of March 1, the ledger of Wilson showed No. 101 Cash 7,000, No. 140 Land (LO 2,4,6 22,000, No. 145 Buildings (concession stand, projection room, ticket booth, and screen) 10,000, No. 157 Equipment 8,000, No. 201 Accounts Payable 7,000, and No. 311 Share Capital-Ordinary 40,000. During the month of March, the following events and transactions occurred. Mar. 2 Rented the three Indiana Jones movies to be shown for the first 3 weeks of March. The film rental was 3,500: 1,000 was paid in cash and 2,500 will be paid on March 10. 3 Ordered the Lord of the Rings movies to be shown the last 10 days of March. It will cost 240 per night. 9 Received 4,000 cash from admissions. 10 Paid balance due on Indiana Jones movies rental and 1,600 on March 1 accounts payable. 11 Wilson Theater contracted with M. Brewer to operate the concession stand. Brewer is to pay 15% of gross concession receipts (payable monthly) for the right to operate the concession stand. 12 Paid advertising expenses 450. 20 Received 4,400 cash from customers for admissions 20 Received the Lord of Rings movies and paid the rental fee of 2,400. 31 Paid salaries of 2,500. 31 Received statement from M. Brewer showing gross receipts from concessions of 3,000 and the balance due to Wilson Theater of 450 (3,000 X 15%) for March Brewer paid one-half the balance due and will remit the remainder on April 5. 31 Received 9,000 cash from customers for admissions. In addition to the accounts identified above, the chart of accounts includes No. 112 Accounts Receivable, No. 400 Service Revenue, No. 429 Rent Revenue, No. 610 Advertis- ing Expense, No. 729 Rent Expense, and No. 726 Salaries and Wages Expense. Instructions (a) Enter the beginning balances in the ledger. Insert a check mark in the reference column of the ledger for the beginning balance. (b) Journalize the March transactions, (c) Post the March journal entries to the ledger. Assume that all entries are posted from page 1 of the journal. (d) Prepare a trial balance on March 31, 2017 (d) Trial 63,2 MATCHA CREATIONS (Note: This is a continuation of the Matcha Creations problem from Chapter 1.) MC2 After researching the different forms of business organization, Meiling Lee decides to operate "Matcha Creations as a corporation. She then starts the process of getting the business running. In November 2017, the following activities take place. Nov. 8 8 11 Mei-ling sells her investments for NT$520, which she deposits in her personal bank account. She opens a bank account under the name "Matcha Creations and transfers NT$500 from her personal account to the new account in exchange for ordinary shares. Mei-ling pays NT$65 to have advertising brochures and posters printed. She plans to distribute these as opportunities arise. (Hint: Use Advertising Expense.) She buys baking supplies, such as flour, sugar, butter, and matcha, for NT$125 cash Mei-ling starts to gather some baking equipment to take with her when teach- ing the cookie classes. She has an excellent top-of-the-line food processor and 13 14Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started