Answered step by step

Verified Expert Solution

Question

1 Approved Answer

how to solve this Wonder Widemess Company's Anna Walace is continuing hor analysis of the compary's postion and belove the company will need to borrow

how to solve this

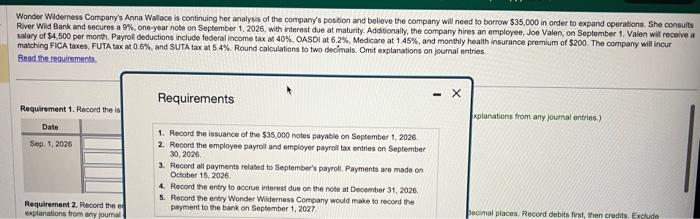

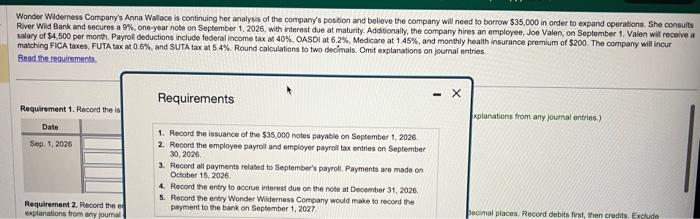

Wonder Widemess Company's Anna Walace is continuing hor analysis of the compary's postion and belove the company will need to borrow $35,000 in ordet to expand cperatons. She consults Fiver Wild Bank and secures a 9\%, one-year note on September 1, 2026, with interest due at maturity. Additionally, the company hires an empleyee, Joe Valen, on September 1 , Valen will receive a salary of $4,500 per month. Payrol deductions include foderal income tax at 40%, OASOI at 6.2%. Medicare at 1.45%, and monthly health insurance premium of $200. The company will incur matching FICA taxes. FUTA tax at 0.6%, and SUTA tax at 5.4%. Round calculations to two decimals. Omit explanations on journal entries. Read the requimemes. Requirement 1. Record the is 1. Record the issuance of the $35,000 notes payable on September 1,2026 2. Record the employee payrol and employer payroi tax entries on September 30,2026. 3. Recerd all payments related to September's payroll. Payments aco made on October 15, 2026. 4. Record the entry to accrue interest due on the note at December 31,2026. Requirement 2. Plecord the of explanations from eny journal Requirements 5. Record the entry Wonder Widerness Company would mabe to record the payment to the bank on September 1,2027 xplanations from any joumal ontries.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started