Answered step by step

Verified Expert Solution

Question

1 Approved Answer

How to solve When Serena Saver owns an asset ( such as a share of stock ) that rises in value, she has an accrued

How to solve

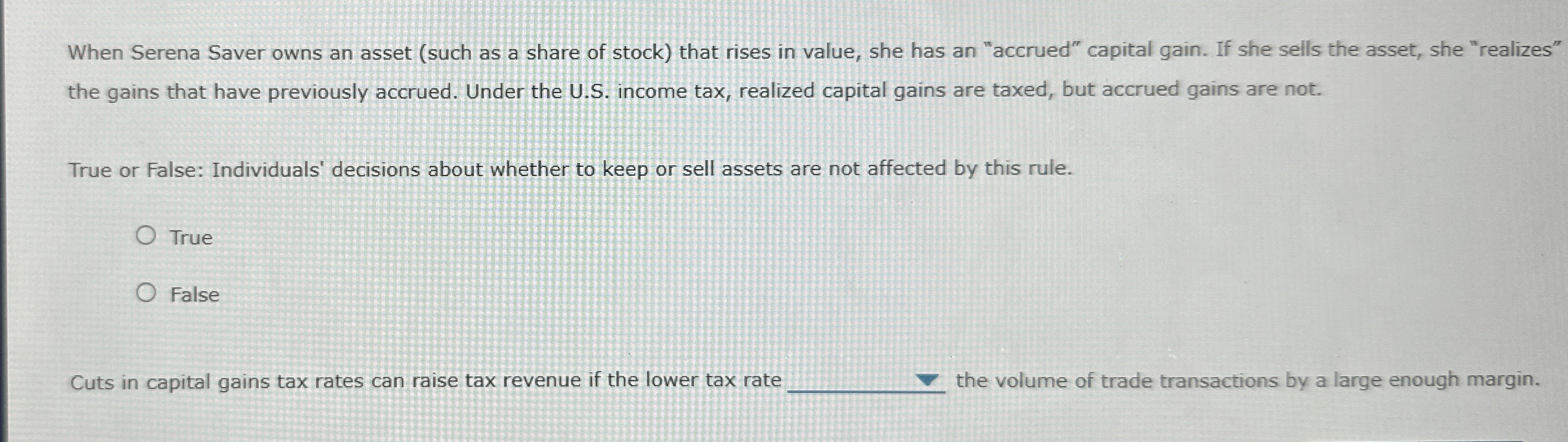

When Serena Saver owns an asset such as a share of stock that rises in value, she has an "accrued" capital gain. If she sells the asset, she "realizes" the gains that have previously accrued. Under the US income tax, realized capital gains are taxed, but accrued gains are not.

True or False: Individuals' decisions about whether to keep or sell assets are not affected by this rule.

True

False

Cuts in capital gains tax rates can raise tax revenue if the lower tax rate the volume of trade transactions by a large enough margin.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started