How to summary the "management discussion and analysis" on tax?

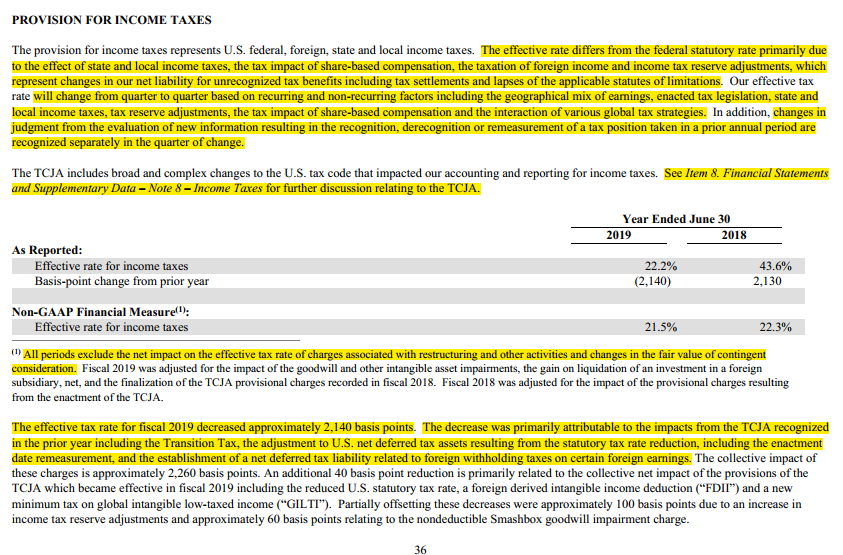

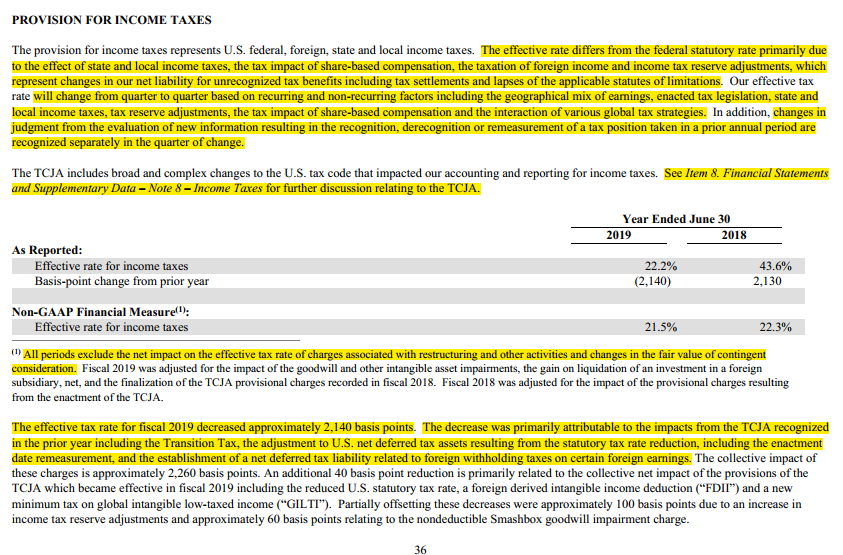

PROVISION FOR INCOME TAXES The provision for income taxes represents U.S. federal, foreign, state and local income taxes. The effective rate differs from the federal statutory rate primarily due to the effect of state and local income taxes, the tax impact of share-based compensation, the taxation of foreign income and income tax reserve adjustments, which represent changes in our net liability for unrecognized tax benefits including tax settlements and lapses of the applicable statutes of limitations. Our effective tax rate will change from quarter to quarter based on recurring and non-recurring factors including the geographical mix of earnings, enacted tax legislation, state and local income taxes, tax reserve adjustments, the tax impact of share-based compensation and the interaction of various global tax strategies. In addition, changes in judgment from the evaluation of new information resulting in the recognition, derecognition or remeasurement of a tax position taken in a prior annual period are recognized separately in the quarter of change. The TCJA includes broad and complex changes to the U.S. tax code that impacted our accounting and reporting for income taxes. See Item 8. Financial Statements and Supplementary Data - Note 8 - Income Taxes for further discussion relating to the TCJA. Year Ended June 30 2019 2018 As Reported: Effective rate for income taxes Basis-point change from prior year 22.2% (2,140) 43.6% 2,130 Non-GAAP Financial Measurell), Effective rate for income taxes 21.5% 22.3% (1) All periods exclude the net impact on the effective tax rate of charges associated with restructuring and other activities and changes in the fair value of contingent consideration. Fiscal 2019 was adjusted for the impact of the goodwill and other intangible asset impairments, the gain on liquidation of an investment in a foreign subsidiary, net, and the finalization of the TCJA provisional charges recorded in fiscal 2018. Fiscal 2018 was adjusted for the impact of the provisional charges resulting from the enactment of the TCJA. The effective tax rate for fiscal 2019 decreased approximately 2,140 basis points. The decrease was primarily attributable to the impacts from the TCJA recognized in the prior year including the Transition Tax, the adjustment to U.S. net deferred tax assets resulting from the statutory tax rate reduction, including the enactment date remeasurement, and the establishment of a net deferred tax liability related to foreign withholding taxes on certain foreign earnings. The collective impact of these charges is approximately 2,260 basis points. An additional 40 basis point reduction is primarily related to the collective net impact of the provisions of the TCJA which became effective in fiscal 2019 including the reduced U.S. statutory tax rate, a foreign derived intangible income deduction ("FDII") and a new minimum tax on global intangible low-taxed income ("GILTI"). Partially offsetting these decreases were approximately 100 basis points due to an increase in income tax reserve adjustments and approximately 60 basis points relating to the nondeductible Smashbox 36