Answered step by step

Verified Expert Solution

Question

1 Approved Answer

how to use the effective tax rate here . 1. Projects of differing length (Relatively easy but contains one fish-hook) Shoppex Ltd has to decide

how to use the effective tax rate here .

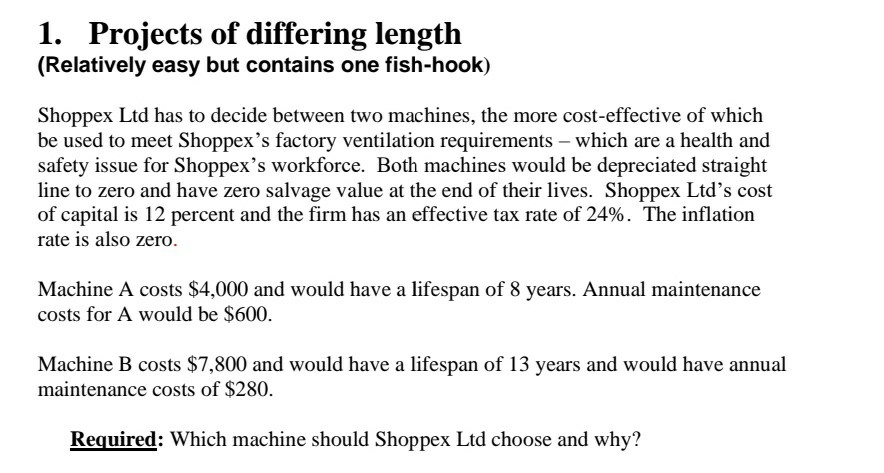

1. Projects of differing length (Relatively easy but contains one fish-hook) Shoppex Ltd has to decide between two machines, the more cost-effective of which be used to meet Shoppex's factory ventilation requirements - which are a health and safety issue for Shoppex's workforce. Both machines would be depreciated straight line to zero and have zero salvage value at the end of their lives. Shoppex Ltd's cost of capital is 12 percent and the firm has an effective tax rate of 24%. The inflation rate is also zero. Machine A costs $4,000 and would have a lifespan of 8 years. Annual maintenance costs for A would be $600. Machine B costs $7,800 and would have a lifespan of 13 years and would have annual maintenance costs of $280. Required: Which machine should Shoppex Ltd choose and whyStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started