Answered step by step

Verified Expert Solution

Question

1 Approved Answer

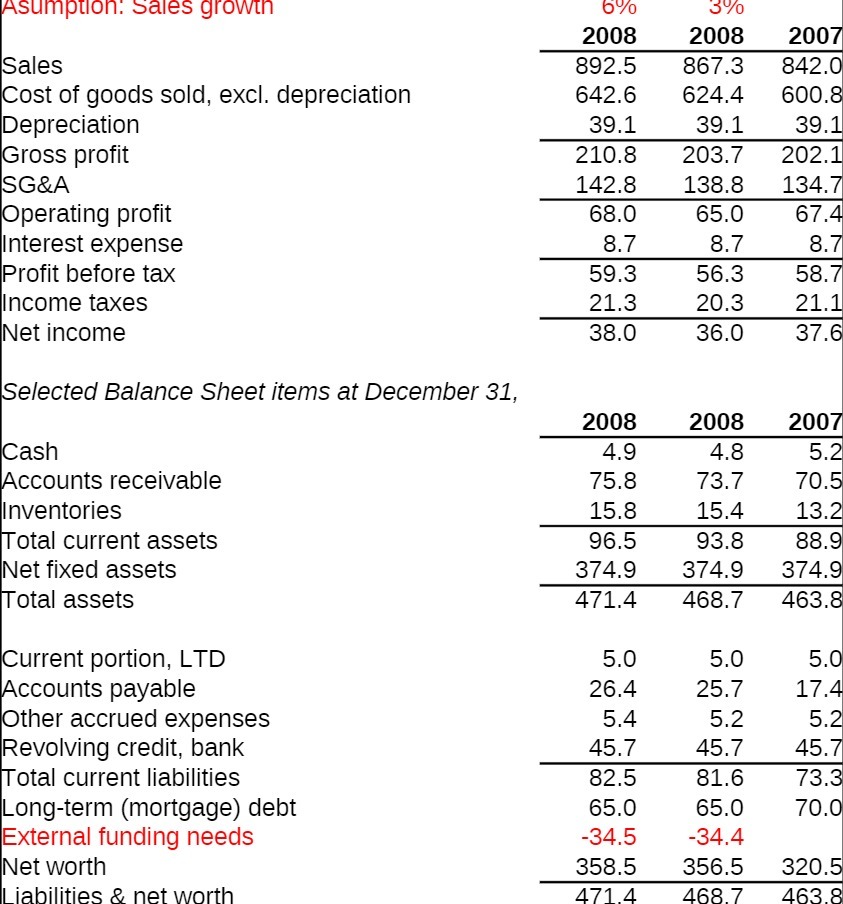

How was external funding needed calculated? Asumption: Sales growth 6% 2008 2008 2007 Sales 892.5 867.3 842.0 Cost of goods sold, excl. depreciation 642.6 624.4

How was external funding needed calculated?

Asumption: Sales growth 6% 2008 2008 2007 Sales 892.5 867.3 842.0 Cost of goods sold, excl. depreciation 642.6 624.4 600.8 Depreciation 39.1 39.1 39.1 Gross profit 210.8 203.7 202.1 SG&A 142.8 138.8 134.7 Operating profit 68.0 65.0 67.4 Interest expense 8.7 8.7 8.7 Profit before tax 59.3 56.3 58.7 Income taxes 21.3 20.3 21.1 Net income 38.0 36.0 37.6 Selected Balance Sheet items at December 31, 2008 2008 2007 Cash 4.9 4.8 5.2 Accounts receivable 75.8 73.7 70.5 Inventories 15.8 15.4 13.2 Total current assets 96.5 93.8 88.9 Net fixed assets 374.9 374.9 374.9 Total assets 471.4 468.7 463.8 Current portion, LTD 5.0 5.0 5.0 Accounts payable 26.4 25.7 17.4 Other accrued expenses 5.4 5.2 5.2 Revolving credit, bank 45.7 45.7 45.7 Total current liabilities 82.5 81.6 73.3 Long-term (mortgage) debt 65.0 65.0 70.0 External funding needs -34.5 -34.4 Net worth 358.5 356.5 320.5 Liabilities & net worth 471.4 468.7 463.8

Step by Step Solution

★★★★★

3.55 Rating (173 Votes )

There are 3 Steps involved in it

Step: 1

Step1 Introduction Maintaining liquidity and making enlargement plans require an attention of a agen...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started