Answered step by step

Verified Expert Solution

Question

1 Approved Answer

How was it calculated bonus 44000 How was it calculated bonus 1:32 ill 60% + Expert Q&A + 0 Expert Answer Anonymous about 1 hour

How was it calculated bonus 44000

How was it calculated bonus

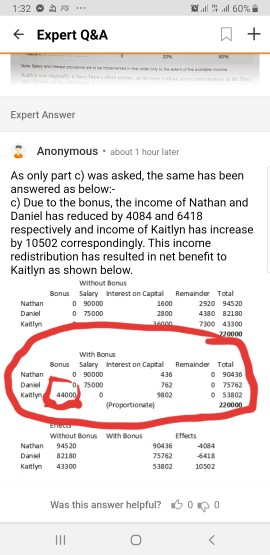

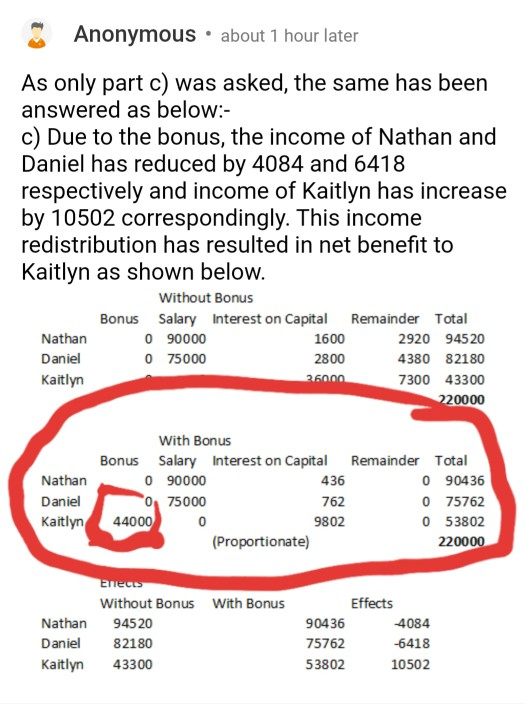

1:32 ill 60% + Expert Q&A + 0 Expert Answer Anonymous about 1 hour later As only part c) was asked the same has been answered as below:- c) Due to the bonus, the income of Nathan and Daniel has reduced by 4084 and 6418 respectively and income of Kaitlyn has increase by 10502 correspondingly. This income redistribution has resulted in net benefit to Kaitlyn as shown below. Without Bonus Bonus Salary interest on Capital Remainder Total Nathan 090000 1600 2920 94520 Daniel 0 75000 2000 4380 82180 Kaitlyn 7300 43300 20000 436 Nathan Daniel Kaitlyn With Bonus Bonus Salary interest on Capital Remainder Total 090000 090436 75000 762 075762 44000 9002 053802 (Proportionate 220000 Nathan Daniel Kaitlyn Without Bonus with Bonus 94520 82180 43300 Effects 90436 4084 75762 53802 10502 Was this answer helpful? DOPO III Anonymous about 1 hour later As only part c) was asked, the same has been answered as below:- c) Due to the bonus, the income of Nathan and Daniel has reduced by 4084 and 6418 respectively and income of Kaitlyn has increase by 10502 correspondingly. This income redistribution has resulted in net benefit to Kaitlyn as shown below. Without Bonus Bonus Salary Interest on Capital Remainder Total Nathan 090000 1600 2920 94520 Daniel 075000 2800 4380 82180 Kaitlyn 26000 7300 43300 220000 Nathan Daniel Kaitlyn With Bonus Bonus Salary Interest on Capital Remainder Total 090000 436 090436 075000 762 075762 44000 0 9802 053802 (Proportionate) 220000 Nathan Daniel Kaitlyn enec Without Bonus With Bonus 94520 82180 43300 Effects 90436 4084 75762 -6418 53802 10502 1:32 ill 60% + Expert Q&A + 0 Expert Answer Anonymous about 1 hour later As only part c) was asked the same has been answered as below:- c) Due to the bonus, the income of Nathan and Daniel has reduced by 4084 and 6418 respectively and income of Kaitlyn has increase by 10502 correspondingly. This income redistribution has resulted in net benefit to Kaitlyn as shown below. Without Bonus Bonus Salary interest on Capital Remainder Total Nathan 090000 1600 2920 94520 Daniel 0 75000 2000 4380 82180 Kaitlyn 7300 43300 20000 436 Nathan Daniel Kaitlyn With Bonus Bonus Salary interest on Capital Remainder Total 090000 090436 75000 762 075762 44000 9002 053802 (Proportionate 220000 Nathan Daniel Kaitlyn Without Bonus with Bonus 94520 82180 43300 Effects 90436 4084 75762 53802 10502 Was this answer helpful? DOPO III Anonymous about 1 hour later As only part c) was asked, the same has been answered as below:- c) Due to the bonus, the income of Nathan and Daniel has reduced by 4084 and 6418 respectively and income of Kaitlyn has increase by 10502 correspondingly. This income redistribution has resulted in net benefit to Kaitlyn as shown below. Without Bonus Bonus Salary Interest on Capital Remainder Total Nathan 090000 1600 2920 94520 Daniel 075000 2800 4380 82180 Kaitlyn 26000 7300 43300 220000 Nathan Daniel Kaitlyn With Bonus Bonus Salary Interest on Capital Remainder Total 090000 436 090436 075000 762 075762 44000 0 9802 053802 (Proportionate) 220000 Nathan Daniel Kaitlyn enec Without Bonus With Bonus 94520 82180 43300 Effects 90436 4084 75762 -6418 53802 10502Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started