Answered step by step

Verified Expert Solution

Question

1 Approved Answer

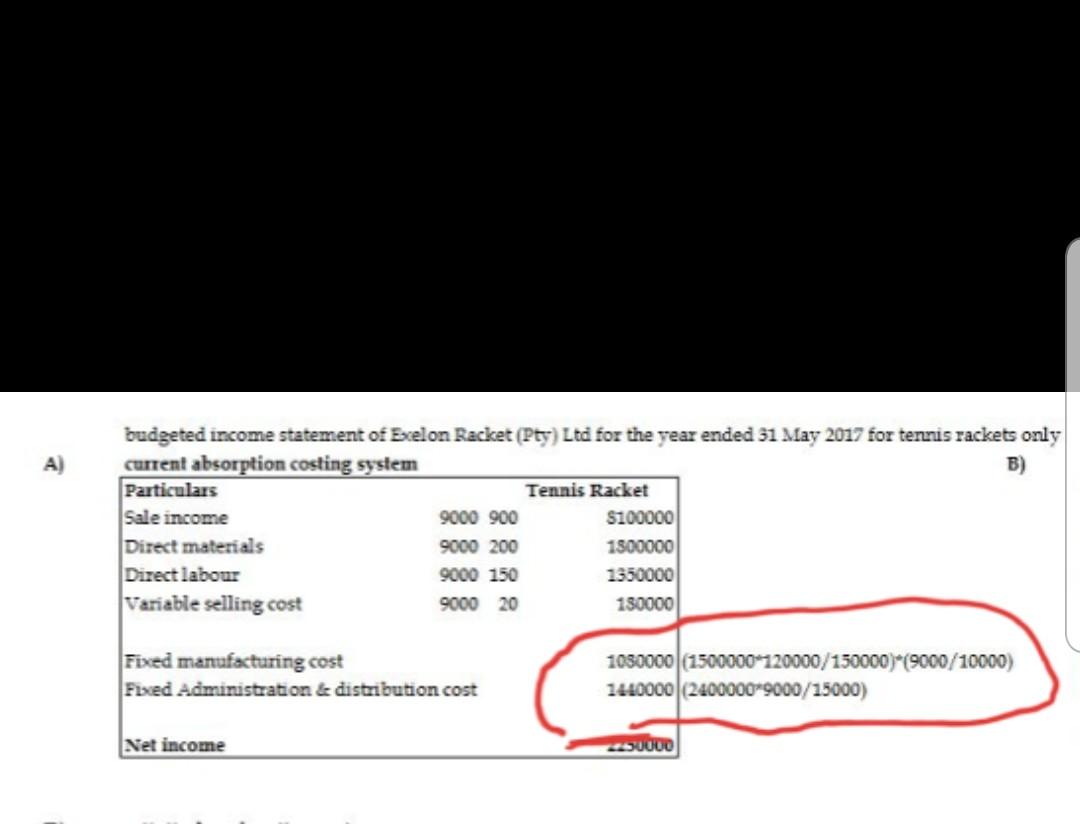

How was the fix manufacturing overhead calculated n where does the 150000 come from. How was the fix administration and distribution calculated. Where does the

How was the fix manufacturing overhead calculated n where does the 150000 come from. How was the fix administration and distribution calculated. Where does the 15000 come from. Full information with questions are below.

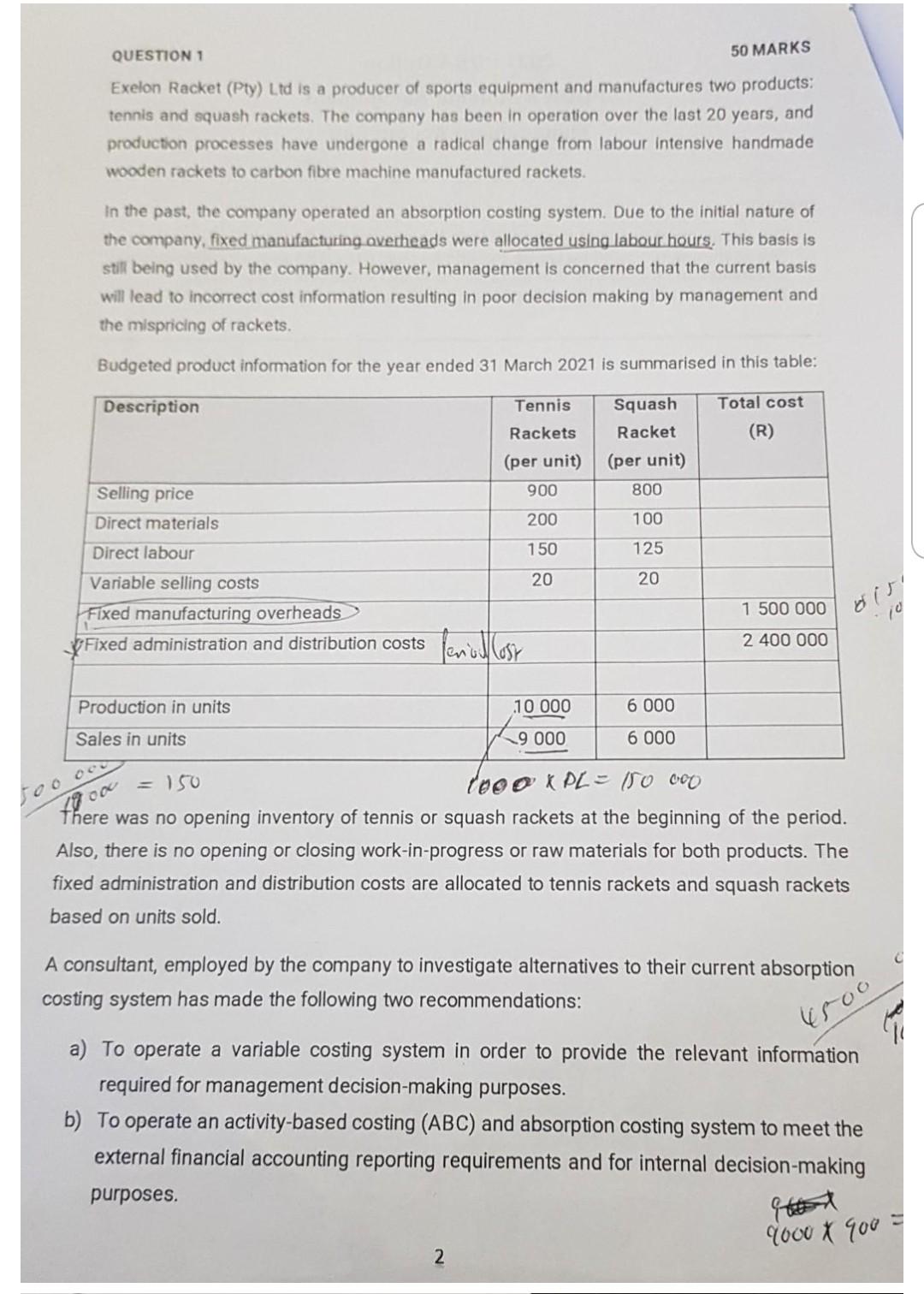

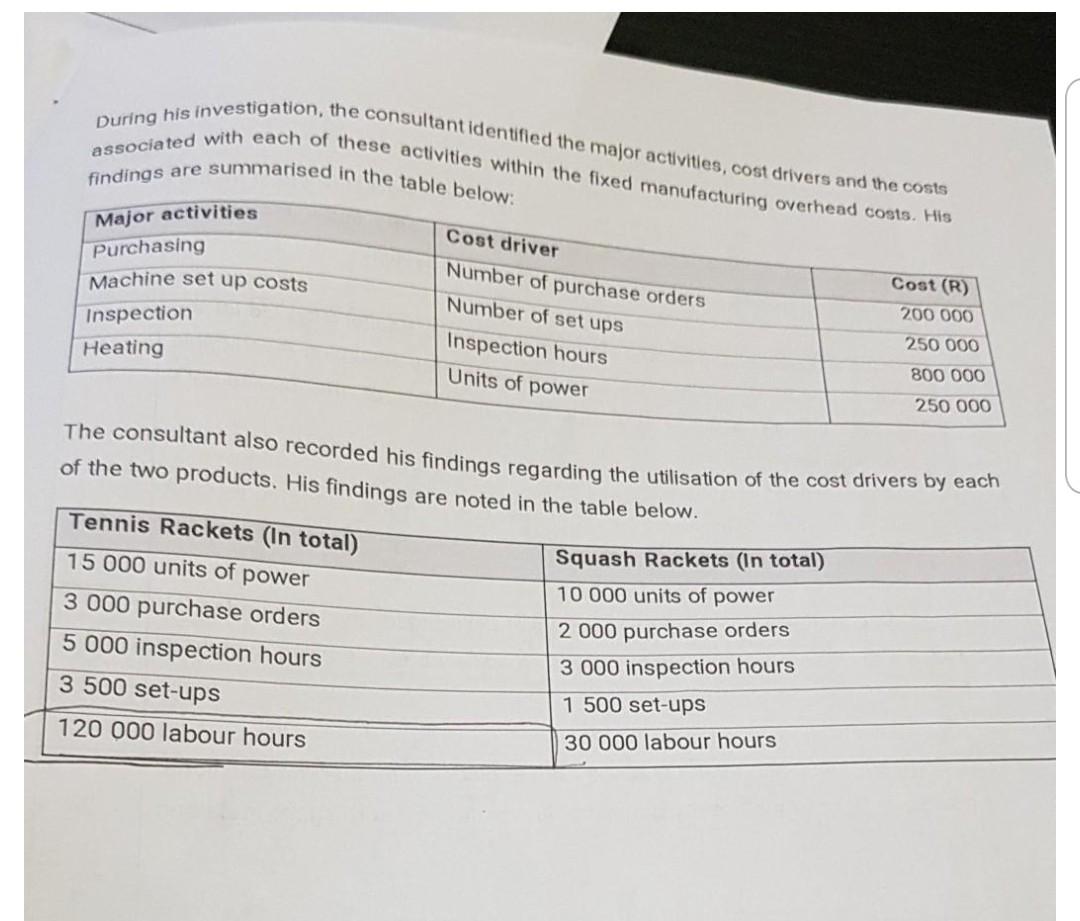

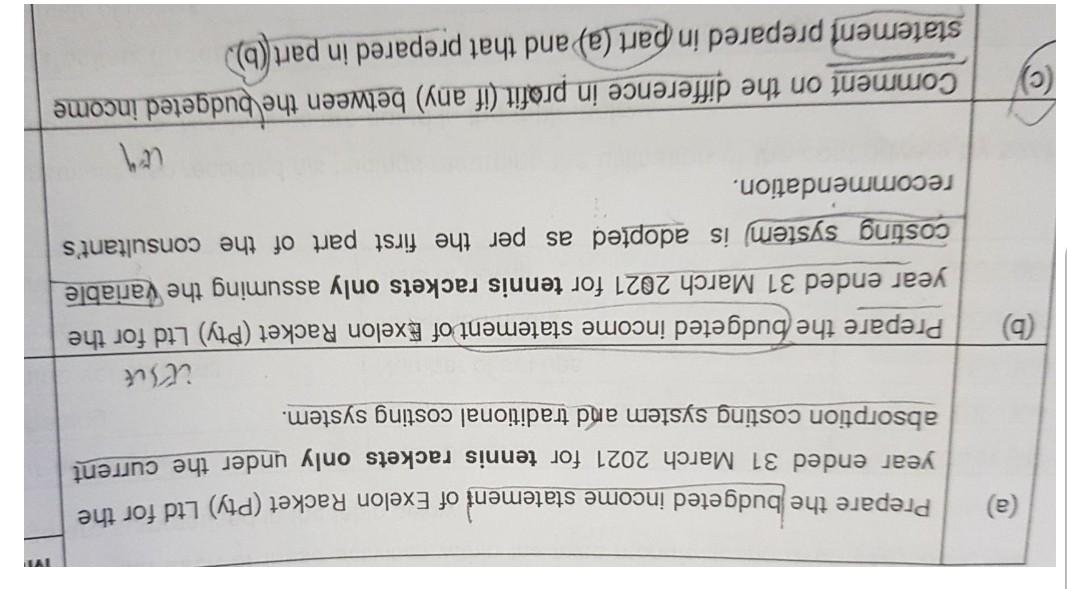

A) budgeted income statement of Estelon Racket (Pty) Ltd for the year ended 31 May 2017 for tennis rackets only current absorption costing system B) Particulars Tennis Racket sale income 9000 900 $100000 Direct materials 9000 200 1800000 Direct labour 9000 150 1350000 Variable selling cost 9000 20 150000 Fixed manufacturing cost Fixed Administration & distribution cost 1050000 (1500000~120000/150000)*(9000/10000) 1440000(2400000-9000/15000) Net income 50000 50 MARKS QUESTION 1 Exelon Racket (Pty) Ltd is a producer of sports equipment and manufactures two products: tennis and squash rackets. The company has been in operation over the last 20 years, and production processes have undergone a radical change from labour intensive handmade wooden rackets to carbon fibre machine manufactured rackets. In the past, the company operated an absorption costing system. Due to the initial nature of the company, fixed manufacturing overheads were allocated using labour hours. This basis is still being used by the company. However, management is concerned that the current basis will lead to incorrect cost information resulting in poor decision making by management and the mispricing of rackets. Budgeted product information for the year ended 31 March 2021 is summarised in this table: Description Tennis Squash Racket (per unit) Total cost (R) Rackets (per unit) 900 800 Selling price Direct materials 200 100 Direct labour 150 125 20 20 Variable selling costs Fixed manufacturing overheads 500 000 Fixed administration and distribution costs Penul loss 2 400 000 Production in units 10 000 6 000 Sales in units 9 000 6 000 = 150 19 000 ooo KPL = 150 000 There was no opening inventory of tennis or squash rackets at the beginning of the period. Also, there is no opening or closing work-in-progress or raw materials for both products. The fixed administration and distribution costs are allocated to tennis rackets and squash rackets based on units sold. A consultant, employed by the company to investigate alternatives to their current absorption costing system has made the following two recommendations: a) To operate a variable costing system in order to provide the relevant information required for management decision-making purposes. b) To operate an activity-based costing (ABC) and absorption costing system to meet the external financial accounting reporting requirements and for internal decision-making purposes. 9000 900 2 During his investigation, the consultant identified the major activities, cost drivers and the costs associated with each of these activities within the fixed manufacturing overhead costs. His findings are summarised in the table below: Major activities Purchasing Machine set up costs Inspection Heating Cost driver Number of purchase orders Number of set ups Inspection hours Units of power Cost (R) 200 000 250 000 800 000 250 000 The consultant also recorded his findings regarding the utilisation of the cost drivers by each of the two products. His findings are noted in the table below. Tennis Rackets (In total) 15 000 units of power 3 000 purchase orders 5 000 inspection hours 3 500 set-ups Squash Rackets (In total) 10 000 units of power 2 000 purchase orders 3 000 inspection hours 1 500 set-ups 30 000 labour hours 120 000 labour hours Prepare the budgeted income statement of Exelon Racket (Pty) Ltd for the year ended 31 March 2021 for tennis rackets only under the current absorption costing system and traditional costing system. itsit Prepare the budgeted income statement of Exelon Racket (Pty) Ltd for the year ended 31 March 2021 for tennis rackets only assuming the variable costing system is adopted as per the first part of the consultant's recommendation Comment on the difference in profit (if any) between the budgeted income statement prepared in part (a) and that prepared in part(b)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started