Answered step by step

Verified Expert Solution

Question

1 Approved Answer

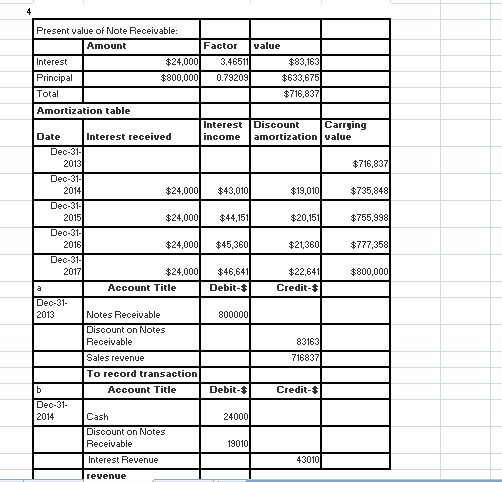

How were the factors computed in the first part? (both interest and principal) As well as discount amortization? I was able to work out everything

How were the factors computed in the first part? (both interest and principal) As well as discount amortization? I was able to work out everything else. Thank you

Present value of Note Receivable Amount Factor value Interest $24,000 3.46511 $83,163 Principal $800,000 0.79208 $633,675 Total $716,837 Amortization table Interest Discount Carrying Date Interest received income amortization value Dec-31-1 2013 $716,837 Dec-31- 2014 $24,000 $43,010 $19,010 $735,848 Dec-31- 2015 $24,000 $44,151 $20,151 $755,998 Deo-31. 2016 $24,000 $45,360 $21,360 $777,358 Deo-31 $24,000 $46,641 $22,641 $800,000 Account Title Debit-$ Credit-$ Dec-31. 2013 Notes Receivable 8000001 Discount on Notes Receivable 83163 Sales revenue 7168371 To record transaction Account Title Debit-$ Credit-$1 Dec 31- 2014 Cash 24000 Discount on Notes Receivable 19010 2017 Interest Revenue revenueStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started