Answered step by step

Verified Expert Solution

Question

1 Approved Answer

How were these numbers calculated? Please show all work! pacity producing 9,500 The River Ouer Corporation is working at full production cap units of a

How were these numbers calculated? Please show all work!

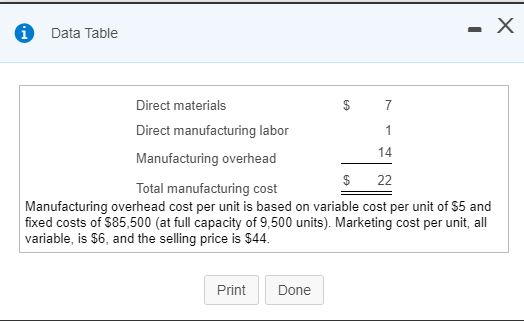

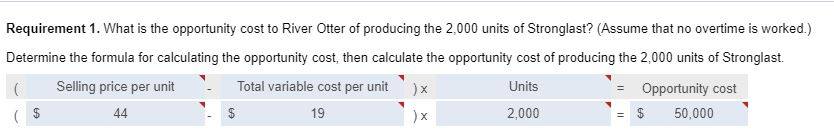

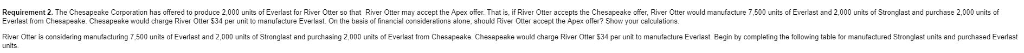

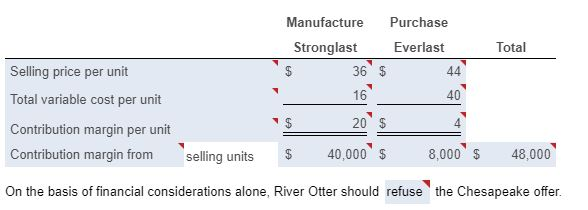

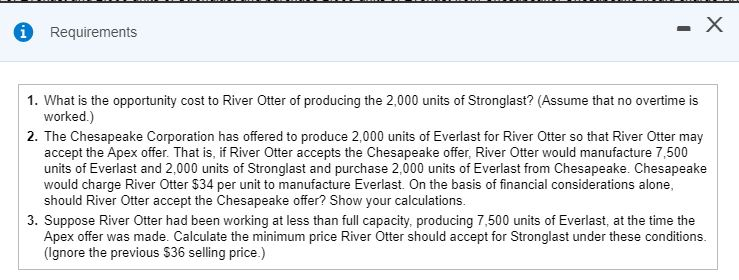

pacity producing 9,500 The River Ouer Corporation is working at full production cap units of a unique product, Evelast Manufacturing coet per unil for Evelast i EEB (Click the icon to view the cost per unit informalion.) A customer, the Apex Company, has asked River Otter to produce 2,000 units of Stronglast, a modification af Everlast Stronglast wauld require the same manufacturing processes as Everlast. Apex has ofered to pay River Otber $36 for a unit of Stronglast plus half of the marketing cost per unit Read the reouitementa Data Table Direct materials Direct manufacturing labor Manufacturing overhead Total manufacturing cost 14 $ 22 Manufacturing overhead cost per unit is based on variable cost per unit of $5 and fixed costs of $85,500 (at full capacity of 9,500 units). Marketing cost per unit, all variable, is $6, and the selling price is $44. PrintDone Requirement 1. What is the opportunity cost to River Otter of producing the 2,000 units of Stronglast? (Assume that no overtime is worked.) Determine the formula for calculating the opportunity cost, then calculate the opportunity cost of producing the 2,000 units of Stronglast. - Opportunity cost $ 50,000 Units - Total variable cost perunit x 19 Selling price per unit 2,000 Requirement 2. The Chesapeake Corporat on has offered to produce 2000 units of Everlast for River Otter so that River Otter may accept the Apex offer. That is, if River Otter accepts the Chesapeake offer, River Otter would maufacture 7,500 units of Everiast and 2,000 unts of Stronglast and purchase 2,000 urits cf Rha Otw o naid ring mand during 7500 u its of Everlast and 2 on rit8 of Str ngle t a and purchasing 2 00D units of Ev"lest tr m Chesapeaka Ch eapa ke ou d chaija River Otte $34 pa unt to manite turs Fe asi Ba in Eusrisst o n plei g tha t lowing table to manufactred manufached Strongast tre t units and punt ed Fvailast Manufacture Purchase Stronglast Everlast Total Selling price per unit Total variable cost per unit Contribution margin per unit Contribution margin from selling units 40,000 On the basis of financial considerations alone, River Otter should refuse the Chesapeake offer. 36 $ 16 40 20 $ 4 8,000's 48,000 Requirement 3. Suppose River Otter had been working at less than full capacity, producing 7,500 units of Everlast, at the tima the Apex offer was made. Calculate the minimum price River Ottar should accept for Stronglast under these conditions. (Ignora the pravious $36 salling price) The minimum selling price would be S i Requirements 1. What is the opportunity cost to River Otter of producing the 2.000 units of Stronglast? (Assume that no overtime is 2. The Chesapeake Corporation has offered to produce 2,000 units of Everlast for River Otter so that River Otter may worked.) accept the Apex offer. That is, if River Otter accepts the Chesapeake offer, River Otter would manufacture 7,500 units of Everlast and 2,000 units of Stronglast and purchase 2,000 units of Everlast from Chesapeake. Chesapeake would charge River Otter $34 per unit to manufacture Everlast. On the basis of financial considerations alone, should River Otter accept the Chesapeake offer? Show your calculations. 3. Suppose River Otter had been working at less than full capacity, producing 7,500 units of Everlast, at the time the Apex offer was made. Calculate the minimum price River Otter should accept for Stronglast under these conditions. (Ignore the previous $36 selling price.)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started