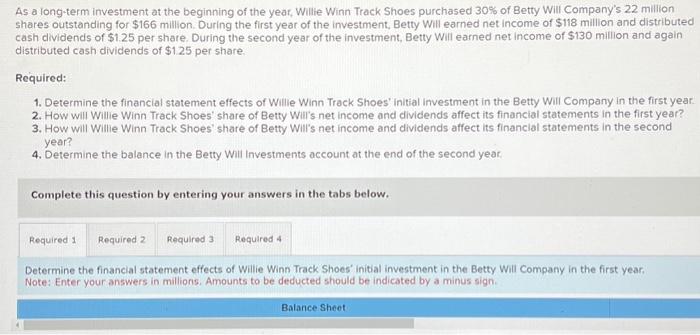

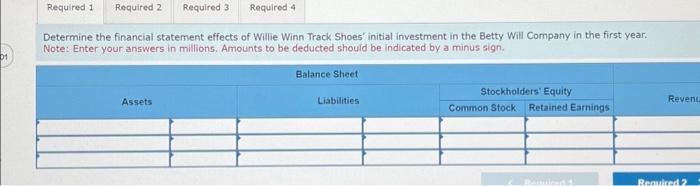

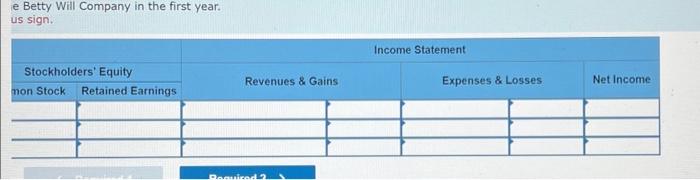

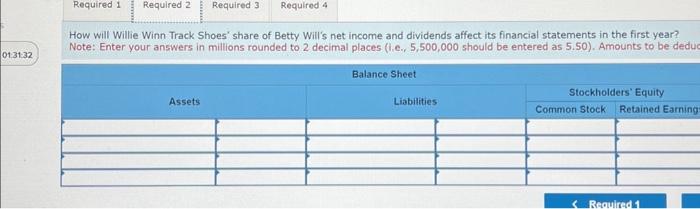

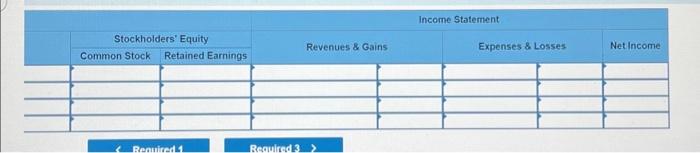

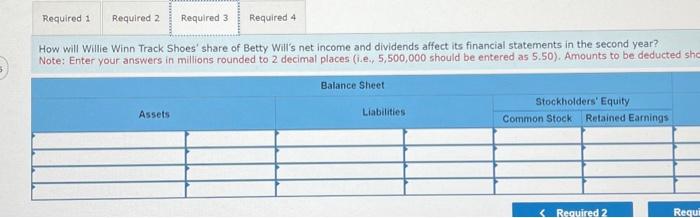

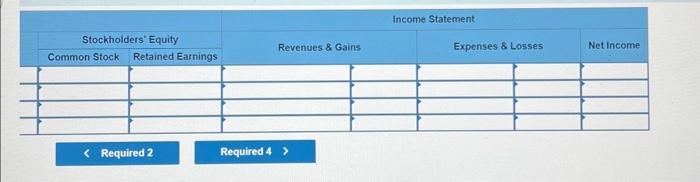

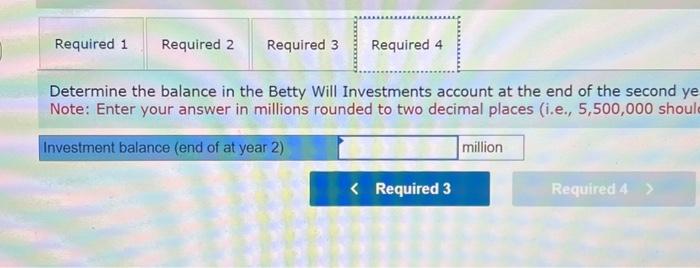

How will Willie Winn Track Shoes' share of Betty Will's net income and dividends affect its financial statements in the second year? Note: Enter your answers in millions rounded to 2 decimal places (i.e., 5,500,000 should be entered as 5.50 ). Amounts to be deducted sh How will Willie Winn Track Shoes' share of Betty Will's net income and dividends affect its financial statements in the first year? Note: Enter your answers in millions rounded to 2 decimal places (i.e., 5,500,000 should be entered as 5.50 ). Amounts to be ded Determine the balance in the Betty Will Investments account at the end of the second ye Note: Enter your answer in millions rounded to two decimal places (i.e., 5, 500,000 shoul \begin{tabular}{|l|l|l|l|l|l|} \hline \multicolumn{2}{|c|}{ Stockholders' Equity } & Net Income \\ \hline Common Stock & Retained Earnings & & \\ \hline \end{tabular} Determine the financial statement effects of Willie Winn Track Shoes' initial investment in the Betty Will Company in the first year. Note: Enter your answers in millions, Amounts to be deducted should be indicated by a minus sign. \begin{tabular}{|c|c|c|c|c|} \hline & & \multicolumn{3}{|c|}{ Income Statement } \\ \hline \multicolumn{2}{|c|}{ Stockholders' Equity } & \multirow{2}{*}{ Revenues \& Gains } & \multirow{2}{*}{ Expenses \& Losse } & \multirow{2}{*}{ Net Income } \\ \hline Common Stock & Retained Earnings & & & \\ \hline & & & & \\ \hline & & & & \\ \hline & & & & \\ \hline & & & & \\ \hline \end{tabular} e Betty Will Company in the first year. us sign. As a long-term investment at the beginning of the year, Willie Winn Track Shoes purchased 30% of Betty Will Company's 22 million shares outstanding for $166 million. During the first year of the investment, Betty Will earned net income of $118 million and distributed cash dividends of \$1.25 per share. During the second year of the investment, Betty Will earned net income of $130 million and again distributed cash dividends of $125 per share. Required: 1. Determine the financial statement effects of Wille Winn Track Shoes' initial investment in the Betty Will Company in the first year. 2. How will Willie Winn Track Shoes' share of Betty Wil's net income and dividends affect its financial statements in the first year? 3. How will Willie Winn Track Shoes' share of Betty Will's net income and dividends affect its financial statements in the second year? 4. Determine the balance in the Betty Wili Investments account at the end of the second year. Complete this question by entering your answers in the tabs below. Determine the financial statement effects of Willie Winn Track Shoes' initial investment in the Betty Will Company in the first year. Note: Enter your answers in milions. Amounts to be deducted should be indicated by a minus sign