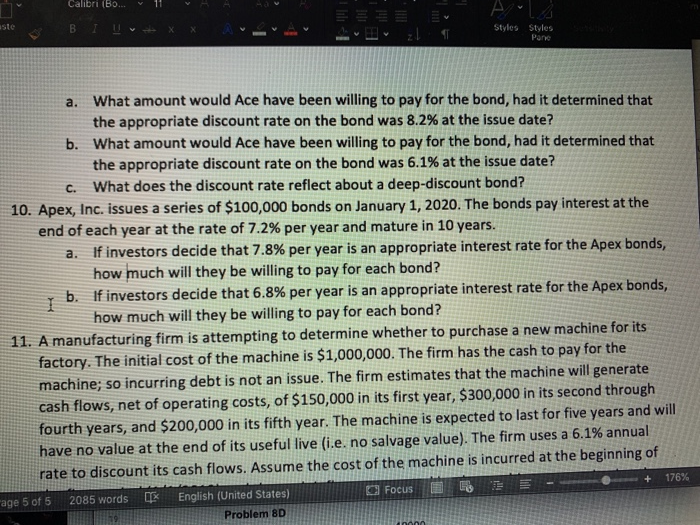

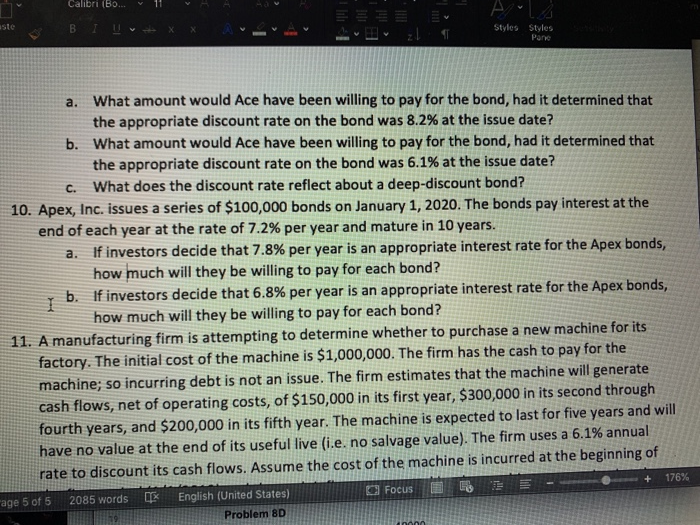

How would I do #10a and 10b

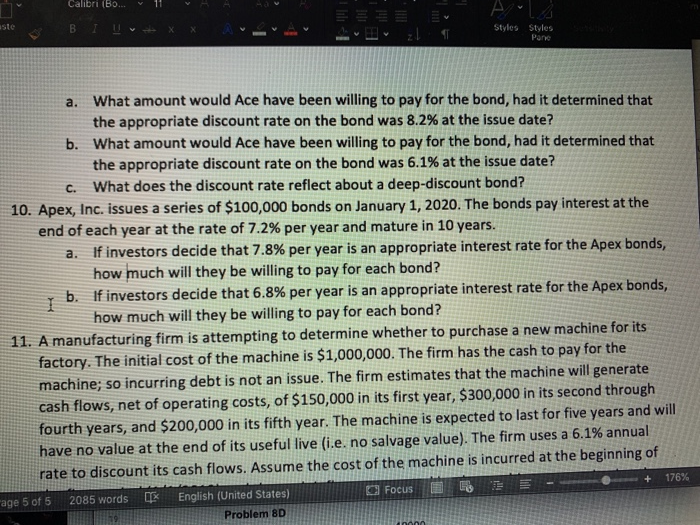

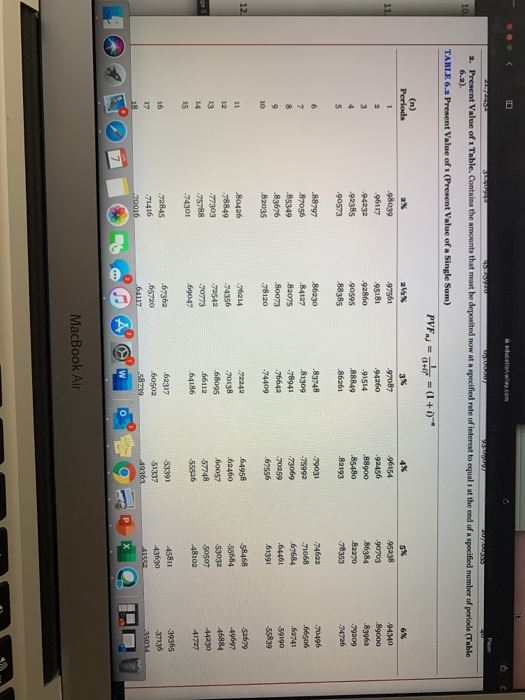

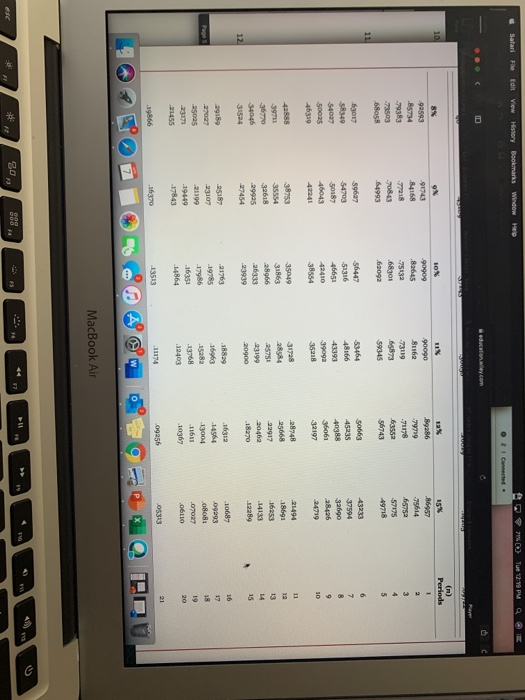

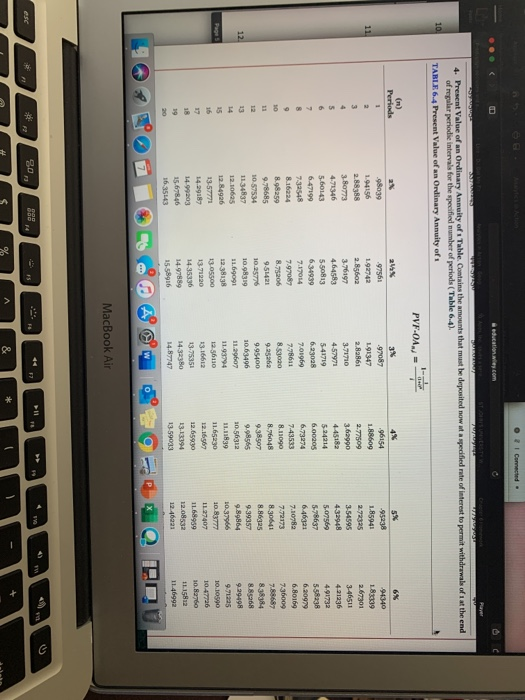

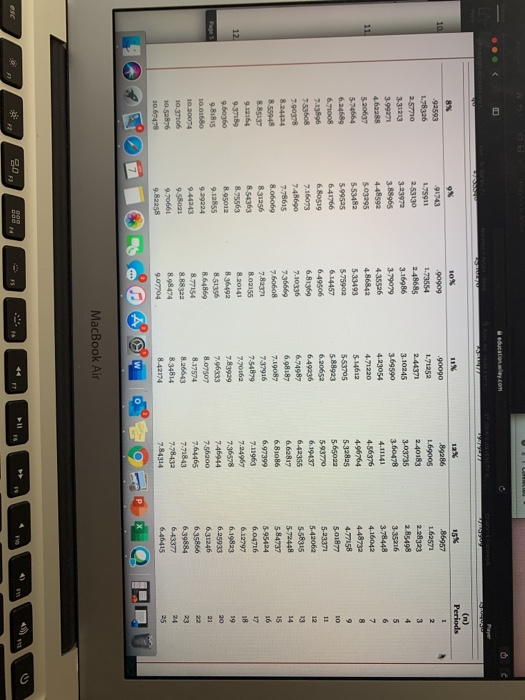

Calibri (Bo... 11 uste & B I w x x Styles Styles Pane a. What amount would Ace have been willing to pay for the bond, had it determined that the appropriate discount rate on the bond was 8.2% at the issue date? b. What amount would Ace have been willing to pay for the bond, had it determined that the appropriate discount rate on the bond was 6.1% at the issue date? C. What does the discount rate reflect about a deep-discount bond? 10. Apex, Inc. issues a series of $100,000 bonds on January 1, 2020. The bonds pay interest at the end of each year at the rate of 7.2% per year and mature in 10 years. a. If investors decide that 7.8% per year is an appropriate interest rate for the Apex bonds, how much will they be willing to pay for each bond? b. If investors decide that 6.8% per year is an appropriate interest rate for the Apex bonds, how much will they be willing to pay for each bond? 11. A manufacturing firm is attempting to determine whether to purchase a new machine for its factory. The initial cost of the machine is $1,000,000. The firm has the cash to pay for the machine; so incurring debt is not an issue. The firm estimates that the machine will generate cash flows, net of operating costs, of $150,000 in its first year, $300,000 in its second through fourth years, and $200,000 in its fifth year. The machine is expected to last for five years and will have no value at the end of its useful live (.e. no salvage value). The firm uses a 6.1% annual rate to discount its cash flows. Assume the cost of the machine is incurred at the beginning of + 176% rage 5 of 5 Focus EEE 2085 words English (United States) Problem 8D 2. Present Value of Table Contains the amounts that must be deposited now at a specified rate of interest to qualist the end of specified number of periode Table TARLE 6.a Present Value of (Present Value of a Single Sum) PVF., = = (1+1)** Periods 96154 98039 96117 -94232 -92385 -90573 -97561 -95181 92860 90595 88385 -97087 94260 -91514 88849 .86261 95238 90703 86384 82270 78353 94140 000 8396a 88900 85480 89193 79209 74726 .88797 87056 85349 .83676 82035 86230 84127 82075 80073 .78120 .83748 81309 -78941 -76642 -74409 -79031 -75992 73069 70259 67556 74622 -71068 .67684 .64461 .61391 70496 66506 .62741 -59190 55839 -72242 -70138 80426 78849 77303 75788 74301 -76214 74356 -72542 70773 69047 64958 .69460 60057 57748 32679 49697 46884 -44230 58468 -55684 -5303a 50507 48102 68095 66112 64186 39365 37136 72845 -71416 70016 43630 53391 51337 49363 .67362 65720 60117 62317 60502 58729 w A MacBook Air Safari Flie di View History Bookmarks Window Help X Tue 12:19 PM Q E I Connected educany.com 12% B9286 .90090 81162 91743 84168 7218 79719 75614 -92593 85734 -79363 731503 68058 10% 90909 82645 -75132 .08301 .62092 -71178 73119 6152 65673 59345 57175 49718 56993 56743 56447 -51316 48166 .63017 S8349 54027 50025 46319 5967 54703 50187 46043 50663 45235 40388 36061 -32197 43233 37594 32690 28426 24719 42410 39092 35218 38753 35049 28584 39711 31863 28966 28948 25668 22917 20462 .21494 .18691 16253 14133 12289 32618 .29925 27454 26333 34045 31524 23199 20900 18270 18829 16312 29169 25167 .23107 21199 .19449 .10687 09293 Boa 25025 21763 19785 17986 .36351 14864 .19768 .12403 13004 11611 10367 01190 21455 09256 -.11174 16370 .19866 13513 MacBook Air 7*?3022982 ". . . 2 I Connected education. Me.com 4. Present Value of an Ordinary Annuity of Table Contains the amounts that must be deposited now at a specified rate of interest to permit withdrawals of at the end of regular periodie intervals for the specified number of periods (Table 6.4) TABLE 6.4 Present Value of an ordinary Annuity of PVF-OA, (n) Periods -98039 1.94156 2.88388 3.80773 4.74346 5.60143 6.47199 249% 97561 1.92742 2.85602 3.76197 4.64583 5.50813 634939 7.17014 7-97087 8.75206 9.51421 10.25776 10.98319 11.69091 12 3838 13.05500 1371220 14-35330 14-97689 15.58916 8.16124 8.98259 9.78685 10-57534 1134837 12.10625 12 84926 13-57771 14.29187 14.99203 15.67846 16.35143 -97087 1.91347 2.82861 3-71710 4-57971 5-41719 6.23028 7.01969 7.78611 85.000 9.25262 9.95400 10.63496 11.29607 11.93794 12-36110 13.16612 13.75351 14.32380 14.87747 .96154 1.88609 2.77509 3.62990 44518 5.24214 6.00205 6.73274 7.43533 8.11090 8.76048 9.38507 9.98565 30-56312 11.11839 11.65230 12.16567 12.65930 13.13394 13-59033 -95236 1.8594 272325 3-54595 432948 5.07569 5-78637 6.46321 7.10782 7-72173 8.3061 8.86325 9-39357 9.89864 10.37966 108777 1127407 -94340 183339 2.67301 3-46511 421236 491732 5.58238 0.220979 6.80169 7-30009 7.88667 838384 885268 9.99498 9.71235 10.10590 1047726 10.86 11.15812 11.46992 12.08532 12.46921 40 PO 110* _069&c X MacBook Air % SI & * towy.com () Periods 9 10% 8 92593 1.78326 2-57710 3-31213 3-99271 4.69288 5.20637 5-74664 6.24689 6.71008 7.13596 759608 7.90378 8.24424 8.55945 1.75911 2.53130 323972 3.88965 448592 5.03295 S-53482 5.99525 6.41766 6.80519 7.16073 7-48690 7.78615 8.06069 8.31256 8-54303 8.75563 8.9012 9.12855 9.29224 9.44243 9-58021 9.70661 9.82258 .90909 1.73554 2.48685 3.16986 3-79079 4.35526 4.86842 5-33493 5-75902 6.14457 6.49506 6.81369 7.10336 736669 7.60608 7.82371 8.02155 8.2014 8.36492 8.51356 8.64869 8.77154 8.88322 8.98474 9.07704 90090 1.71252 2.44371 3.10245 3.69590 4.23054 4.71220 5.14612 553705 5.88923 6.20652 6.49436 6.74987 6.98187 7.19087 737916 7.54879 7.70162 7.83929 7.96333 8.07507 8.17574 12 .89286 1.69005 2.40183 3.03735 3.60478 4.11141 4-56376 4.96764 5-32825 5.65022 5-93770 6.19437 6.42355 6.62817 6.81086 6.97399 7.11963 7.94967 7.36578 7.46944 7-50200 7.64465 7.71843 7.78432 7.84314 86957 1.62571 2.2323 2.85498 3-35216 3.78448 4.16042 4.48732 4.77158 5.01877 5.23371 5-42062 558315 5-72448 5.84737 5-95424 6,04716 6.19797 6.19823 6.25933 6.31246 6.35866 6.39884 6.43377 6.46415 9.12164 9.37189 &qu 9.81815 10.01680 10.20074 10.37106 10.52876 10.67478 8.34814 842174 9 PX MacBook Air