Answered step by step

Verified Expert Solution

Question

1 Approved Answer

How would I do the - Jane sold her old computer for $1,000 on 1/1/2020 and purchased a new computer for $1,000 on the same

How would I do the -

Jane sold her old computer for $1,000 on 1/1/2020 and purchased a new computer for $1,000 on the same day

on pro connect?

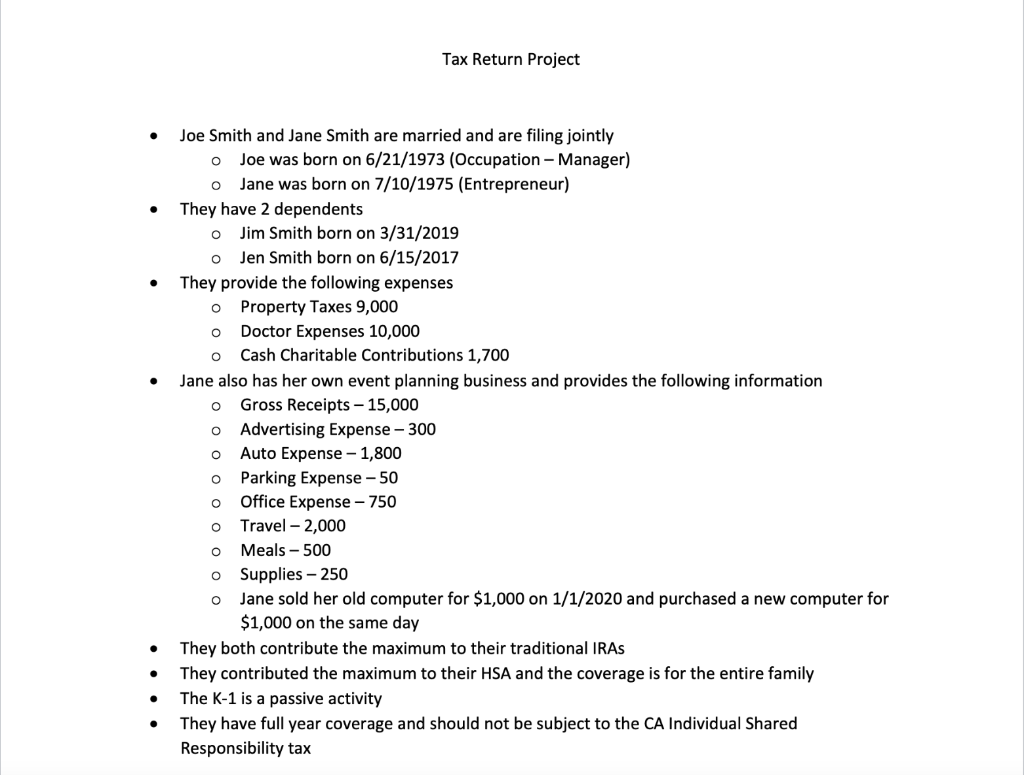

Tax Return Project . . O o O O O Joe Smith and Jane Smith are married and are filing jointly o Joe was born on 6/21/1973 (Occupation - Manager) o Jane was born on 7/10/1975 (Entrepreneur) They have 2 dependents Jim Smith born on 3/31/2019 Jen Smith born on 6/15/2017 They provide the following expenses o Property Taxes 9,000 Doctor Expenses 10,000 o Cash Charitable Contributions 1,700 Jane also has her own event planning business and provides the following information Gross Receipts - 15,000 Advertising Expense - 300 Auto Expense - 1,800 Parking Expense -50 Office Expense - 750 o Travel -2,000 Meals - 500 o Supplies - 250 Jane sold her old computer for $1,000 on 1/1/2020 and purchased a new computer for $1,000 on the same day They both contribute the maximum to their traditional IRAs They contributed the maximum to their HSA and the coverage is for the entire family The K-1 is a passive activity They have full year coverage and should not be subject to the CA Individual Shared Responsibility tax o o o o OStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started