Question

How would I enter this information into any tax software? On March 1, Paige took advantage of low interest rates and refinanced her $75,000 home

| How would I enter this information into any tax software? |

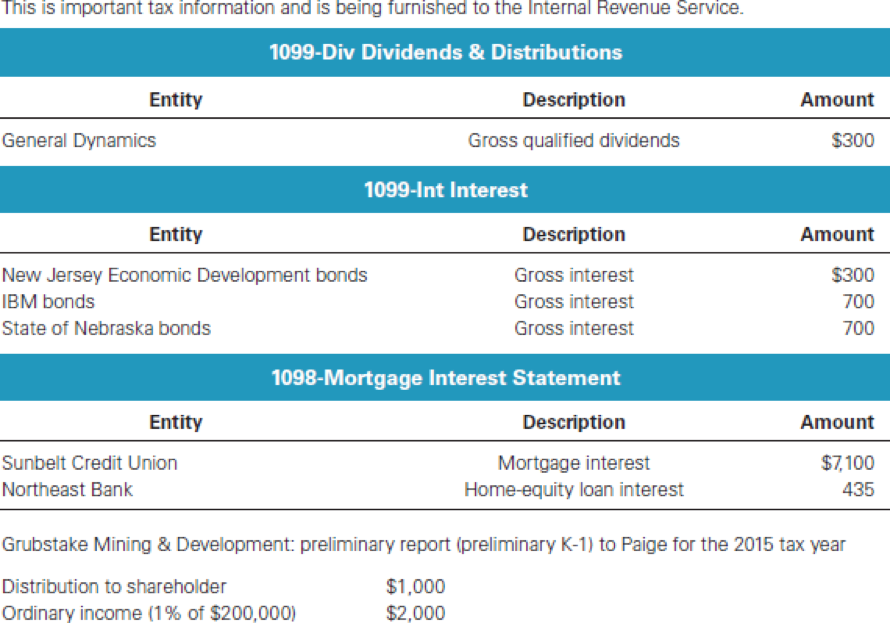

On March 1, Paige took advantage of low interest rates and refinanced her $75,000 home mortgage with her original lender. The new home loan is for 15 years. She paid $215 in closing costs and $1,500 in discount points (prepaid interest) to obtain the loan. The house is worth $155,000, and Paige's basis in the house is $90,000. As part of the refinancing arrangement, she also obtained a $10,000 home-equity loan. She used the proceeds from the home-equity loan to reduce the balance due on her credit cards. Paige received several Form 1098 statements from her bank for interest paid by her in 2015. Details appear below. (See also Exhibit A)

| Primary home mortgage | $7,100 |

| Home-equity loan | 435 |

| Credit cards | 498 |

| Car loan | 390 |

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started