Answered step by step

Verified Expert Solution

Question

1 Approved Answer

How would I prepare the journal entry's using only part B? Tack, Inc., reported a Retained earnings balance of $150,000 at December 31, 2016. In

How would I prepare the journal entry's using only part B?

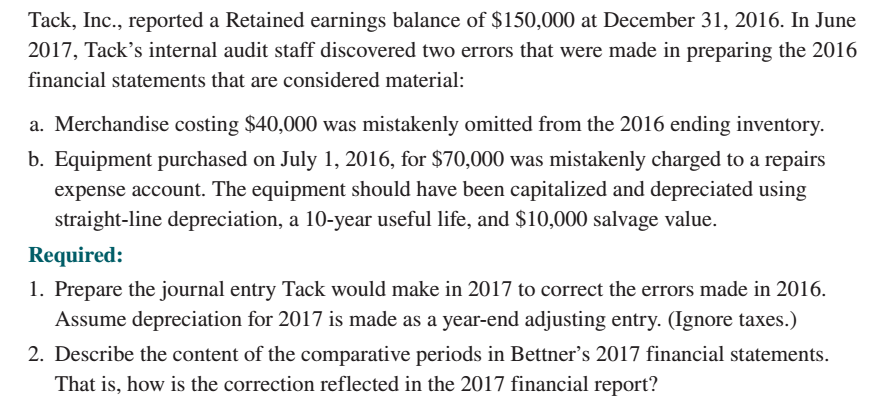

Tack, Inc., reported a Retained earnings balance of $150,000 at December 31, 2016. In June 2017, Tack's internal audit staff discovered two errors that were made in preparing the 2016 financial statements that are considered material: a. Merchandise costing $40,000 was mistakenly omitted from the 2016 ending inventory. b. Equipment purchased on July 1, 2016, for $70,000 was mistakenly charged to a repairs expense account. The equipment should have been capitalized and depreciated using straight-line depreciation, a 10-year useful life, and $10,000 salvage value. Required: 1. Prepare the journal entry Tack would make in 2017 to correct the errors made in 2016. Assume depreciation for 2017 is made as a year-end adjusting entry. (Ignore taxes.) 2. Describe the content of the comparative periods in Bettner's 2017 financial statements. That is, how is the correction reflected in the 2017 financial reportStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started