Answered step by step

Verified Expert Solution

Question

1 Approved Answer

how would I write these journal entries TaiRamaj, a sole-proprietor, created Juicy Lemonade on December 1, 2018. Juicy Lemonade isa wholesaler that specializes in selling

how would I write these journal entries

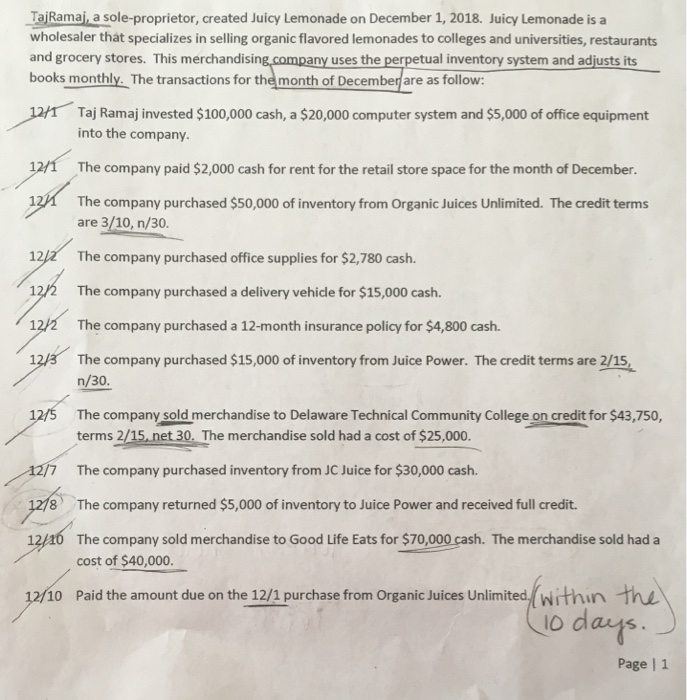

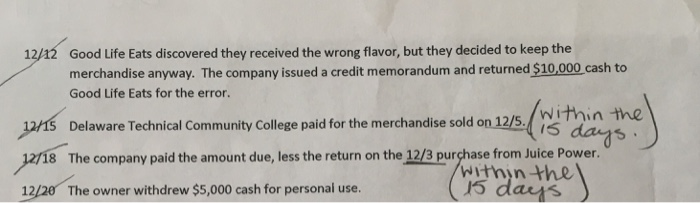

TaiRamaj, a sole-proprietor, created Juicy Lemonade on December 1, 2018. Juicy Lemonade isa wholesaler that specializes in selling organic flavored lemonades to colleges and universities, restaurants and grocery stores. This merchandising company books monthly. The transactions for any uses the perpetual inventory system and adjusts its the month of Decemberare as follow: Taj Ramaj invested $100,000 cash, a $20,000 computer system and $5,000 of office equipment into the company. The company paid $2,000 cash for rent for the retail store space for the month of December. The company purchased $50,000 of inventory from Organic Juices Unlimited. The credit terms are 3/10, n/30 12/2 The company purchased office supplies for $2,780 cash. 12/2 The company purchased a delivery vehicle for $15,000 cash. 12/2 The company purchased a 12-month insurance policy for $4,800 cash. 12/3 The company purchased $15,000 of inventory from Juice Power. The credit terms are 2/15, n/30. 12/5 The company sold merchandise to Delaware Technical Community College on credit for $43,750, /7 8' 12/a0 terms 2/15,net 30. The merchandise sold had a cost of $25,000. The company purchased inventory from JC Juice for $30,000 cash. The company returned $5,000 of inventory to Juice Power and received full credit. The company sold merchandise to Good Life Eats for $70,000 cash. The merchandise sold had a cost of $40,000. Paid the amount due on the 12/1 purchase from Organic Juices Unlimited/(within thu 10 o days Page | 1 12 Good Life Eats discovered they received the wrong flavor, but they decided to keep the merchandise anyway. The company issued a credit memorandum and returned $10,000 cash to Good Life Eats for the error. Delaware Technical Community College paid for the merchandise sold on 12/5 The company paid the amount due, less the return on the 12/3 purhase from Juice Power. Within the iS 8 12/20 The owner withdrew $5,000 cash for personal use withinthe 5 dauns

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started