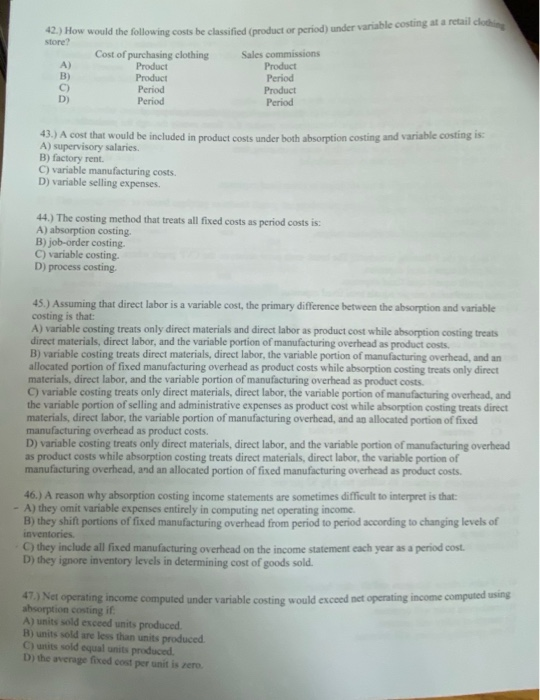

. How would the following costs be classified reductor cried under variable costing at a retail cloth store? Cost of purchasing clothing Sales commissions A) Product Product Product Period Period Product Period Period 43.) A cost that would be included in product casts under heuth absorption costing and variable costing is A) supervisory salaries. B) factory rent. C) variable manufacturing costs. D) variable selling expenses. 44.) The costing method that treats all fixed costs as period costs is: A) absorption costing. B) job-order costing. C) variable costing. D) process costing 45.) Assuming that direct labor is a variable cost, the primary difference between the absorption and variable costing is that: A) variable costing treats only direct materials and direct labor as product cost while absorption costing treats direct materials, direct labor, and the variable portion of manufacturing overhead as product costs B) variable costing treats direct materials, direct labor, the variable portion of manufacturing overhead, and an allocated portion of fixed manufacturing overhead as product costs while absorption costing treats only direct materials, direct labor, and the variable portion of manufacturing overhead as product costs. C) variable costing treats only direct materials, direct labor, the variable portion of manufacturing overhead, and the variable portion of selling and administrative expenses as product cost while absorption costing treats direct materials, direct labor, the variable portion of manufacturing overhead, and an allocated portion of fixed manufacturing overhead as product costs. D) variable costing treats only direct materials, direct labor, and the variable portion of manufacturing overhead as product costs while absorption costing treats direct materials, direct labor, the variable portion of manufacturing overhead, and an allocated portion of fixed manufacturing overhead as product costs. 46.) A reason why absorption costing income statements are sometimes difficult to interpret is that: - A) they omit variable expenses entirely in computing net operating income. B) they shift portions of fixed manufacturing overhead from period to period according to changing levels of inventories they include all fixed manufacturing overhead on the income statement each year as a penodol D) they ignore inventory levels in determining cost of goods sold. cl operating income computed under variable costing would exceed net operating income computed using absorption costing if A) units sold exceed units produced B) units sold are less than units produced C) untits sold equal units produced D) the average fixed cost per unit is zero