How would you analyze the consolidated balance sheets of this company and the numbers presented ? 6. CASH, CASH EQUIVALENTS, AND SHORT-TERM INVESTMENTS Cash and

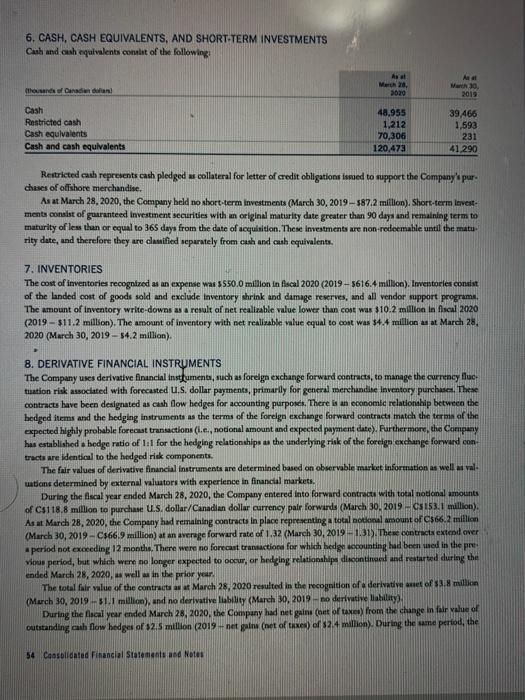

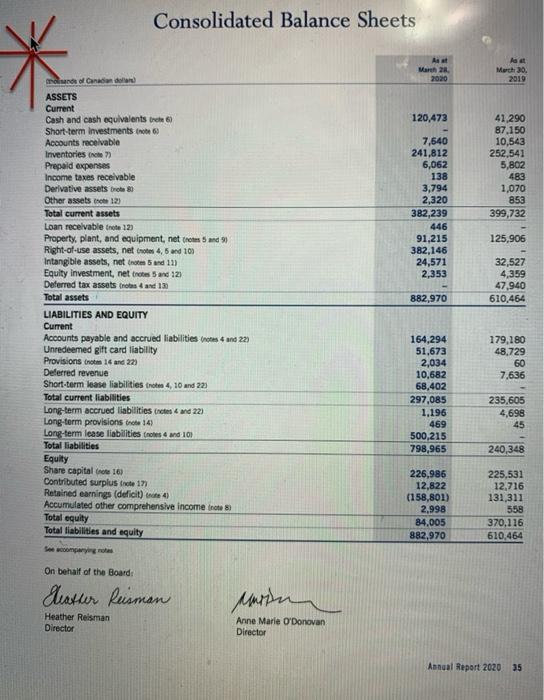

6. CASH, CASH EQUIVALENTS, AND SHORT-TERM INVESTMENTS Cash and cash equivalents consist of the following: (thousands of Canadian dolan) Cash Restricted cash Cash equivalents Cash and cash equivalents Avat March 20, 2020 48,955 1,212 70,306 120,473 Anat March 30 2019 > 39,466 1,593 231 41,290 Restricted cash represents cash pledged as collateral for letter of credit obligations issued to support the Company's pur- chases of offshore merchandise. As at March 28, 2020, the Company held no short-term investments (March 30, 2019-$87.2 million). Short-term invest- ments consist of guaranteed investment securities with an original maturity date greater than 90 days and remaining term to maturity of less than or equal to 365 days from the date of acquisition. These investments are non-redeemable until the matu rity date, and therefore they are classified separately from cash and cash equivalents. 7. INVENTORIES The cost of inventories recognized as an expense was $550.0 million in fiscal 2020 (2019-5616.4 million). Inventories consist of the landed cost of goods sold and exclude inventory shrink and damage reserves, and all vendor support programs. The amount of inventory write-downs as a result of net realizable value lower than cost was $10.2 million in fiscal 2020 (2019-$11.2 million). The amount of inventory with net realizable value equal to cost was $4.4 million as at March 28, 2020 (March 30, 2019-54.2 million). 8. DERIVATIVE FINANCIAL INSTRUMENTS The Company uses derivative financial instruments, such as foreign exchange forward contracts, to manage the currency fluc tuation risk associated with forecasted U.S. dollar payments, primarily for general merchandise Inventory purchases. These contracts have been designated as cash flow hedges for accounting purposes. There is an economic relationship between the hedged items and the hedging instruments as the terms of the foreign exchange forward contracts match the terms of the expected highly probable forecast transactions (i.e., notional amount and expected payment date). Furthermore, the Company has established a hedge ratio of 1:1 for the hedging relationships as the underlying risk of the foreign exchange forward con tracts are identical to the hedged risk components. The fair values of derivative financial instruments are determined based on observable market information as well as val- uations determined by external valuators with experience in financial markets. During the fiscal year ended March 28, 2020, the Company entered into forward contracts with total notional amounts of C$118.8 million to purchase U.S. dollar/Canadian dollar currency pair forwards (March 30, 2019-C$153.1 million). As at March 28, 2020, the Company had remaining contracts in place representing a total notional amount of C$66.2 million (March 30, 2019-C$66.9 million) at an average forward rate of 1.32 (March 30, 2019-1.31). These contracts extend over a period not exceeding 12 months. There were no forecast transactions for which hedge accounting had been used in the pre- vious period, but which were no longer expected to occur, or hedging relationships discontinued and restarted during the ended March 28, 2020, as well as in the prior year. The total fair value of the contracts as at March 28, 2020 resulted in the recognition of a derivative asset of $3.8 million (March 30, 2019-51.1 million), and no derivative liability (March 30, 2019-no derivative liability). During the fiscal year ended March 28, 2020, the Company had net gains (net of taxes) from the change in fair value of outstanding cash flow hedges of $2.5 million (2019-net gains (net of taxes) of $2.4 million). During the same period, the 54 Consolidated Financial Statements and Notes

Step by Step Solution

3.49 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

Analyzing the consolidated balance sheets of the company requires understanding the various components of the balance sheet and their implications for ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started