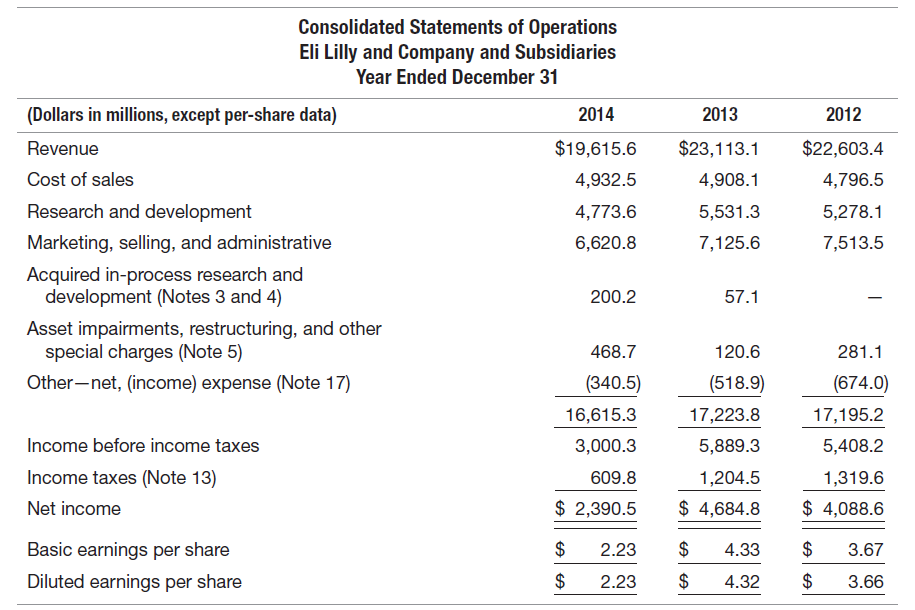

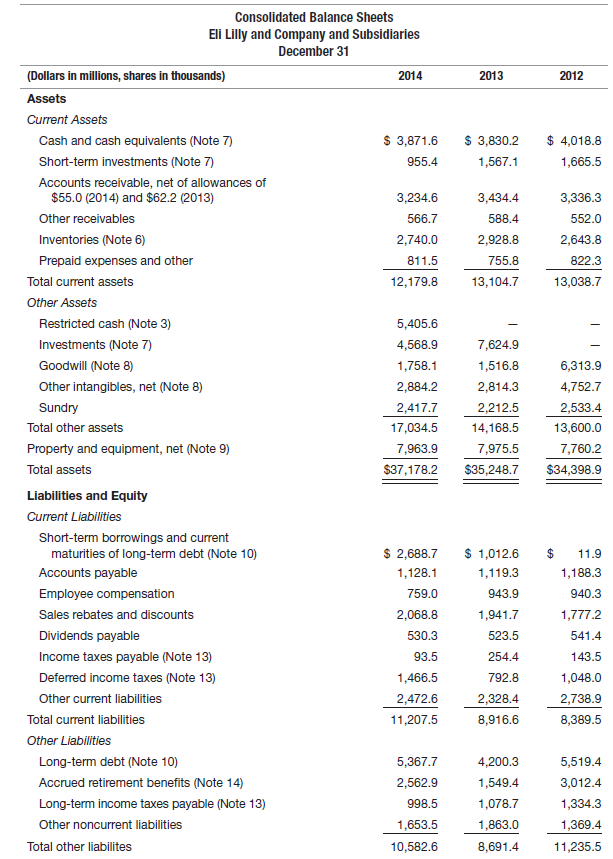

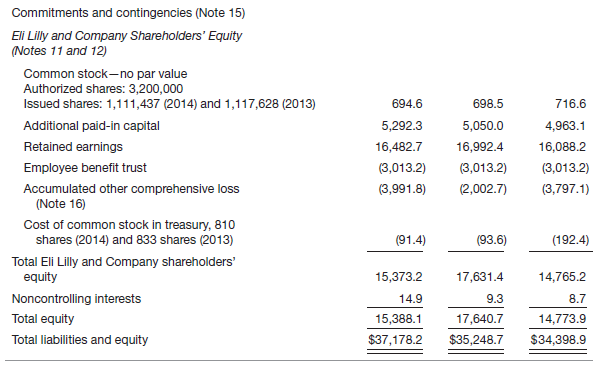

The following pages contain the consolidated balance sheets and statements of income and cash flows taken from

Question:

REQUIRED:

Analyze the statements by using the ROE model. Estimate whether Lilly created value for its shareholders and identify the company€™s primary value drivers.

Transcribed Image Text:

Consolidated Statements of Operations Eli Lilly and Company and Subsidiaries Year Ended December 31 2014 (Dollars in millions, except per-share data) 2013 2012 $19,615.6 $23,113.1 $22,603.4 Revenue Cost of sales 4,796.5 4,932.5 4,908.1 Research and development 5,531.3 4,773.6 5,278.1 Marketing, selling, and administrative 6,620.8 7,125.6 7,513.5 Acquired in-process research and development (Notes 3 and 4) 200.2 57.1 Asset impairments, restructuring, and other special charges (Note 5) 468.7 120.6 281.1 Other-net, (income) expense (Note 17) (340.5) (518.9) (674.0) 16,615.3 17,223.8 17,195.2 Income before income taxes 3,000.3 5,889.3 5,408.2 Income taxes (Note 13) 609.8 1,204.5 1,319.6 $ 2,390.5 $ 4,684.8 $ 4,088.6 Net income Basic earnings per share 2.23 4.33 3.67 Diluted earnings per share 2.23 4.32 3.66 Consolidated Balance Sheets Eli Lilly and Company and Subsidiaries December 31 (Dollars in millions, shares in thousands) 2014 2013 2012 Assets Current Assets Cash and cash equivalents (Note 7) $ 3,871.6 $ 3,830.2 $ 4,018.8 Short-term investments (Note 7) 955.4 1,567.1 1,665.5 Accounts receivable, net of allowances of $55.0 (2014) and $62.2 (2013) 3,234.6 3,434.4 3,336.3 Other receivables 566.7 588.4 552.0 Inventories (Note 6) 2,740.0 2,928.8 2,643.8 Prepaid expenses and other 811.5 755.8 822.3 Total current assets 12,179.8 13,104.7 13,038.7 Other Assets Restricted cash (Note 3) 5,405.6 Investments (Note 7) 4,568.9 7,624.9 Goodwill (Note 8) 1,758.1 1,516.8 6,313.9 Other intangibles, net (Note 8) 2,884.2 2,814.3 4,752.7 Sundry 2,417.7 2,212.5 2,533.4 Total other assets 17,034.5 14,168.5 13,600.0 Property and equipment, net (Note 9) 7,963.9 7,975.5 7,760.2 Total assets $37,178.2 $35,248.7 $34,398.9 Liabilities and Equity Current Liabilities Short-term borrowings and current maturities of long-term debt (Note 10) $ 2,688.7 $ 1,012.6 2$ 11.9 Accounts payable 1,128.1 1,119.3 1,188.3 Employee compensation 759.0 943.9 940.3 Sales rebates and discounts 2,068.8 1,941.7 1,777.2 Dividends payable 530.3 523.5 541.4 Income taxes payable (Note 13) 93.5 254.4 143.5 Deferred income taxes (Note 13) 1,466.5 792.8 1,048.0 Other current liabilities 2,472.6 2,328.4 2,738.9 Total current liabilities 11,207.5 8,916.6 8,389.5 Other Liabilities Long-term debt (Note 10) 5,367.7 4,200.3 5,519.4 Accrued retirement benefits (Note 14) 2,562.9 1,549.4 3,012.4 Long-term income taxes payable (Note 13) 998.5 1,078.7 1,334.3 Other noncurrent liabilities 1,653.5 1,863.0 1,369.4 Total other liabilites 10,582.6 8,691.4 11,235.5

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 88% (9 reviews)

The case asks you to assess Eli Lillys financial statements using the ROE model Relevant ratios for Lilly are calculated below tax rate equals 20 for ...View the full answer

Answered By

Antony Mutonga

I am a professional educator and writer with exceptional skills in assisting bloggers and other specializations that necessitate a fantastic writer. One of the most significant parts of being the best is that I have provided excellent service to a large number of clients. With my exceptional abilities, I have amassed a large number of references, allowing me to continue working as a respected and admired writer. As a skilled content writer, I am also a reputable IT writer with the necessary talents to turn papers into exceptional results.

4.50+

2+ Reviews

10+ Question Solved

Related Book For

Question Posted:

Related Video

The Dupont analysis is an expanded return on equity formula, calculated by multiplying the net profit margin by the asset turnover by the equity multiplier. The DuPont analysis is also known as the DuPont identity or DuPont model.This Video will guide on how to calculate return on Equity and estimate profitability of shareholders using DuPont Analysis.

Students also viewed these Business questions

-

Refer to the consolidated balance sheets and statements of income and retained earnings for Leon's Furniture Limited, which are presented in Exhibit 6-13. (Leon's sells furniture, appliances, and...

-

Using the following amounts (in thousands) reported in Agilysys, Inc. and Subsidiaries consolidated balance sheets and statements of income at March 31, 2007 and 2006, and the valuation schedule,...

-

High Liner Foods Incorporated processes and markets prepared frozen seafood throughout Canada, the United States, and Mexico under the High Liner and Fisher Boy brands. It also produces private label...

-

In 2020-21, a taxpayer makes a number of disposals, as listed below. Which of these disposals would be exempt from CGT? (a) An antique table sold for 5,000. (b) A watercolour painting sold at...

-

The Railway Labor Act and the National Labor Relations Act govern most all aspects of air transport collective bargaining. Identify the differences between these two acts as to: a) Contracts b)...

-

Public Radio station KXPR-FM in Sacramento broadcasts at 88.9MHz. The radio waves pass between two tall skyscrapers that are 15.0 m apart along their closest walls. (a) At what horizontal angles,...

-

Common Size Statements (LO3, 4) . Comparative balance sheets for Albany, Inc., follow for year-end 2012 and 2011. Its president is concerned about the decline in total assets and wants to know where...

-

Why might an analyst examining variances in the production area look beyond that business function for explanations of those variances?

-

What is the present value of a 30-year immediate annuity at 10% interest where the first payment is $100 and each payment thereafter is increased by 5%? Answer: $1,504.63

-

Find [a]-1 in Z1009 for (a) a = 17, (b) a = 100, and (c) a = 111

-

Morning star, a firm that evaluates and rates mutual fund performance, published an article on its website discussing a companys book value per share (shareholders equity/number of shares...

-

Information about PepsiCos six primary segments is provided on the next page (dollars in millions). The information was taken from the companys 2014 SEC Form 10-K. REQUIRED: Assume no interest...

-

For head of household filing status, which of the following costs are considered in determining whether the taxpayer has contributed more than one-half the cost of maintaining the household? a. Food...

-

Question 1 Consider the function g (x) = x-6x+1. The discriminant is [Select] [Select] and therefore the graph has x-intercepts.

-

Han Wu Manufacturing uses a job order cost system and applies overhead to production on the basisof direct labour hours. On January 1, 2023, Job no, 50 was the only job in process. The costs incurred...

-

Mr. A Background Mr. A is a 42-year-old divorced man assessed at intake to a crisis intervention unit. He was brought to the facility by the local law enforcement agency after his father complained...

-

QUESTION 1 The bank reconciliation statement of Honshu Ltd for February 2020 is set out below: 1) Bank reconciliation statement on 29 February 2020: < DR Balance as per bank statement Add:...

-

what do you think is the most important thing that adults can do to facilitate physical and motor development? Why?

-

What information can be obtained from reading the auditors report?

-

Organizations are increasing their use of personality tests to screen job applicants. What are some of the advantages and disadvantages of this approach? What can managers do to avoid some of the...

-

At the end of 2009 a fast-growing advertising agency had a negative balance of $596 million in its retained earnings accounts. Compute the missing amounts in the following table, and comment on the...

-

La-Z-Boy Incorporated included the following information in its 2009 annual report (dollars in millions). Define solvency and discuss how this information might be useful in assessing the company??s...

-

Suppose that La-Z-Boy in E2-7 signed a debt covenant specifying that current assets must exceed current liabilities by $200 million. Assume further that in early January 2010, the company planned to...

-

Estimate the intrinsic value of the stock company ABC. Dividends were just paid at $8 per share and are expected to grow by 5%. You require 20% on this stock given its volatile characteristics. If...

-

Crane, Inc., a resort management company, is refurbishing one of its hotels at a cost of $6,794,207. Management expects that this will lead to additional cash flows of $1,560,000 for the next six...

-

Match each of the following transactions with the applicable internal control principle that is being violated

Safety In Civil Aviation Monitoring Management Of Ecology 1st Edition - ISBN: 981196209X - Free Book

Study smarter with the SolutionInn App