Answered step by step

Verified Expert Solution

Question

1 Approved Answer

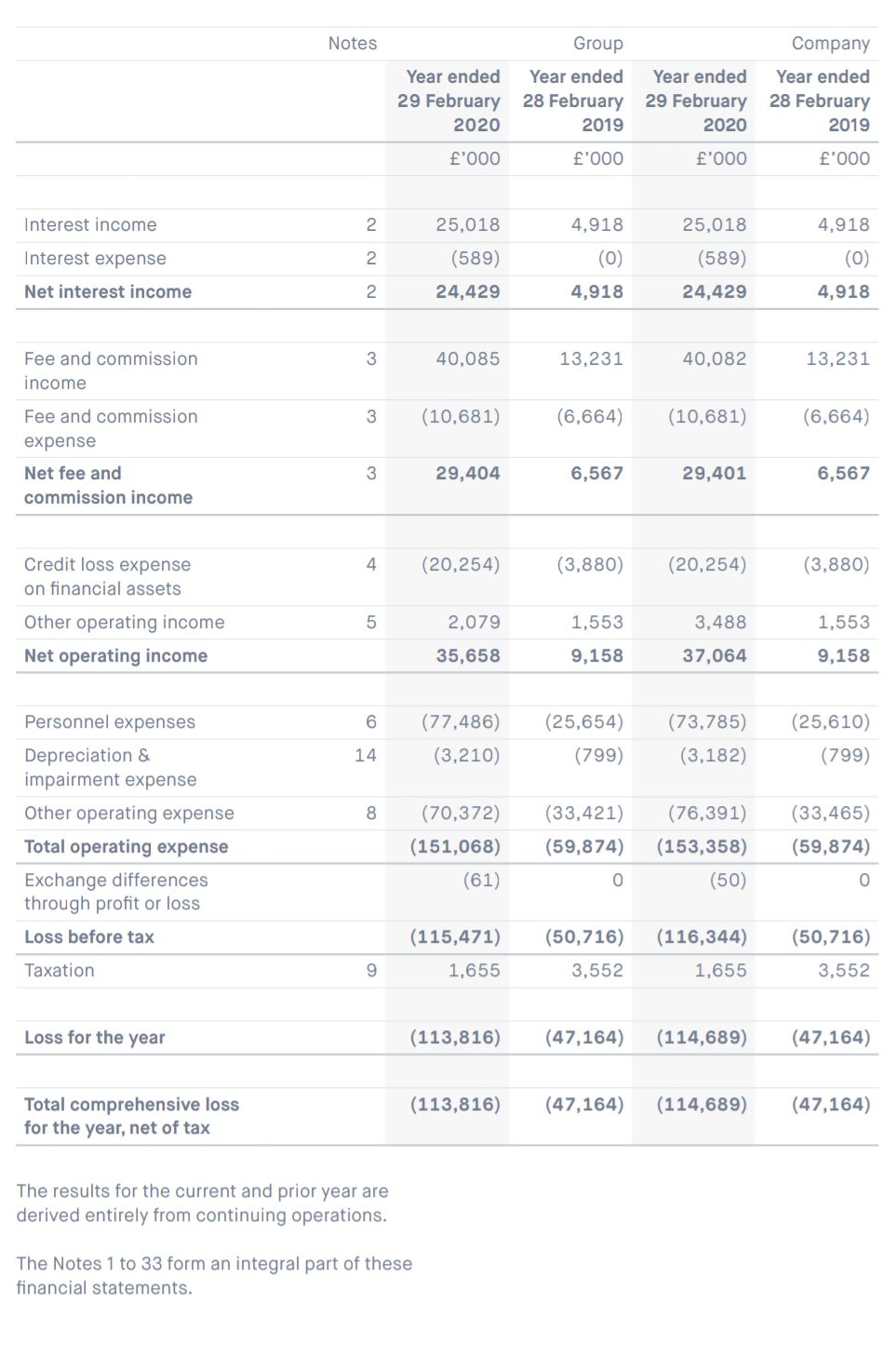

how would you analyze the income statement of this company and the numbers presented ? Analyze items on the income statement for the base company

how would you analyze the income statement of this company and the numbers presented ?

Analyze items on the income statement for the base company that would be important to an investor, and discuss whether the companys performance related to these items appeared to be improving, deteriorating, or remaining stable. Justify your answer

Notes Group Year ended Year ended Year ended 29 February 28 February 29 February 2020 2019 2020 Company Year ended 28 February 2019 f'000 f'000 '000 f'000 Interest income 2. 25,018 4,918 25,018 4,918 (0) Interest expense 2 (589) (589) (0) 4,918 Net interest income 2 24,429 24,429 4,918 3 40,085 13,231 40,082 13,231 Fee and commission income 3 (10,681) (6,664) (10,681) (6,664) Fee and commission expense Net fee and commission income 3 29,404 6,567 29,401 6,567 4 (20,254) (3,880) Credit loss expense on financial assets (20,254) (3,880) 5 2,079 1,553 3,488 1,553 Other operating income Net operating income 35,658 9,158 37,064 9,158 6 (77,486) (3,210) (25,654) (799) (73,785) (3,182) (25,610) (799) 14 8 Personnel expenses Depreciation & impairment expense Other operating expense Total operating expense Exchange differences through profit or loss Loss before tax (70,3 (151,068) (61) (33,421) (59,874) (76,391) (153,358) (50) (33,465) (59,874) 0 0 (50,716) (115,471) 1,655 (50,716) 3,552 (116,344) 1,655 Taxation 9 3,552 Loss for the year (113,816) (47,164) (114,689) (47,164) (113,816) (47,164) (114,689) (47,164) Total comprehensive loss for the year, net of tax The results for the current and prior year are derived entirely from continuing operations. The Notes 1 to 33 form an integral part of these financial statements. Notes Group Year ended Year ended Year ended 29 February 28 February 29 February 2020 2019 2020 Company Year ended 28 February 2019 f'000 f'000 '000 f'000 Interest income 2. 25,018 4,918 25,018 4,918 (0) Interest expense 2 (589) (589) (0) 4,918 Net interest income 2 24,429 24,429 4,918 3 40,085 13,231 40,082 13,231 Fee and commission income 3 (10,681) (6,664) (10,681) (6,664) Fee and commission expense Net fee and commission income 3 29,404 6,567 29,401 6,567 4 (20,254) (3,880) Credit loss expense on financial assets (20,254) (3,880) 5 2,079 1,553 3,488 1,553 Other operating income Net operating income 35,658 9,158 37,064 9,158 6 (77,486) (3,210) (25,654) (799) (73,785) (3,182) (25,610) (799) 14 8 Personnel expenses Depreciation & impairment expense Other operating expense Total operating expense Exchange differences through profit or loss Loss before tax (70,3 (151,068) (61) (33,421) (59,874) (76,391) (153,358) (50) (33,465) (59,874) 0 0 (50,716) (115,471) 1,655 (50,716) 3,552 (116,344) 1,655 Taxation 9 3,552 Loss for the year (113,816) (47,164) (114,689) (47,164) (113,816) (47,164) (114,689) (47,164) Total comprehensive loss for the year, net of tax The results for the current and prior year are derived entirely from continuing operations. The Notes 1 to 33 form an integral part of these financial statements

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started