Answered step by step

Verified Expert Solution

Question

1 Approved Answer

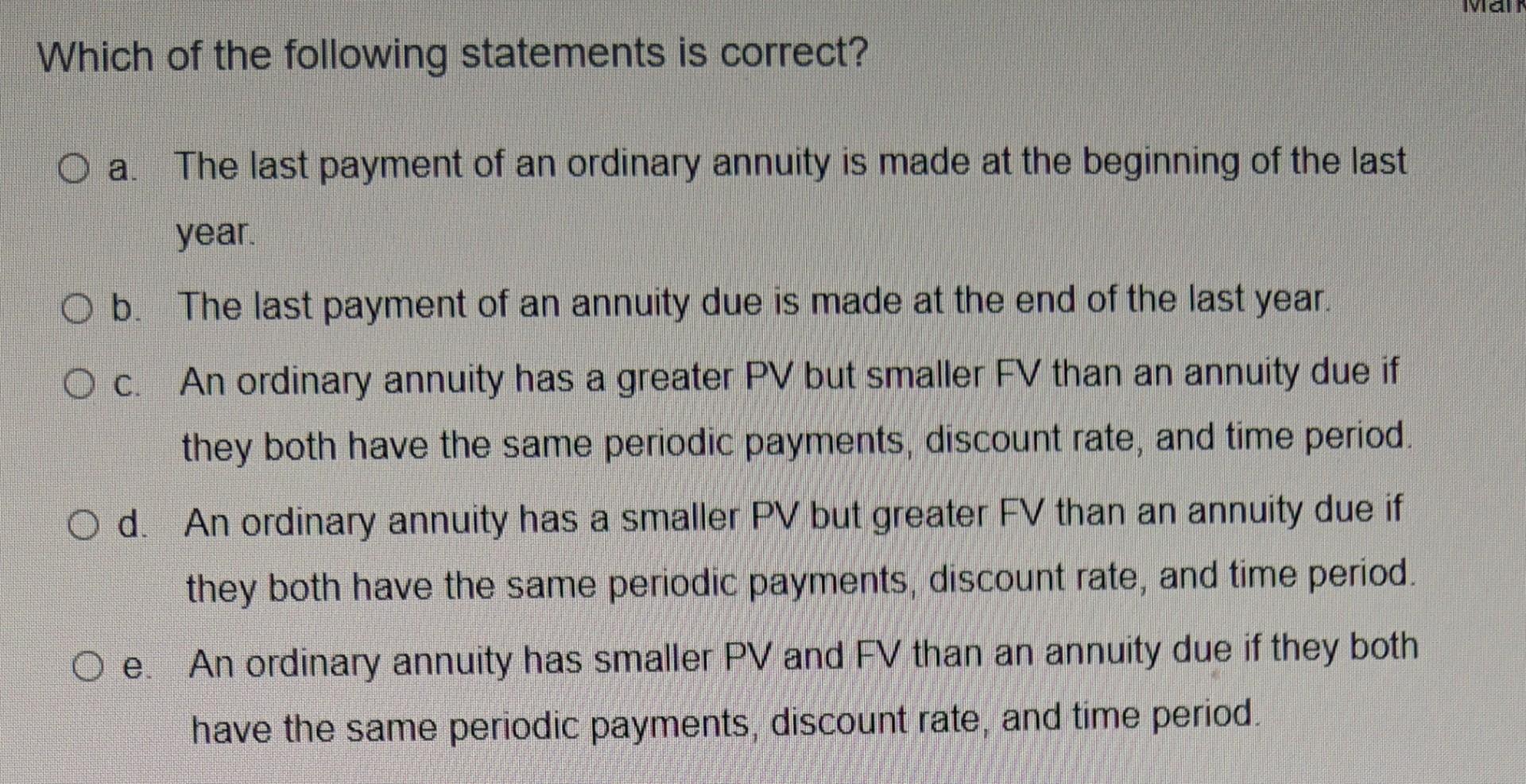

ICIN Which of the following statements is correct? O a. The last payment of an ordinary annuity is made at the beginning of the last

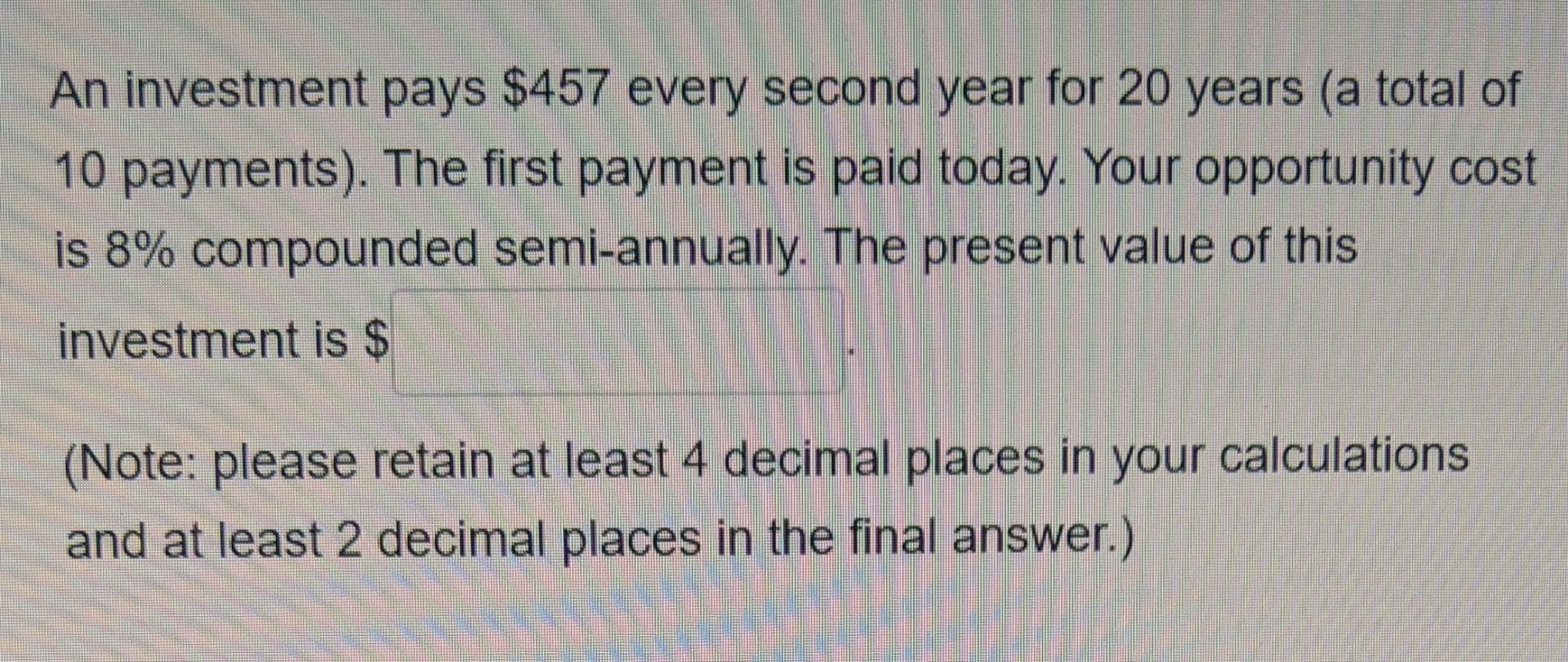

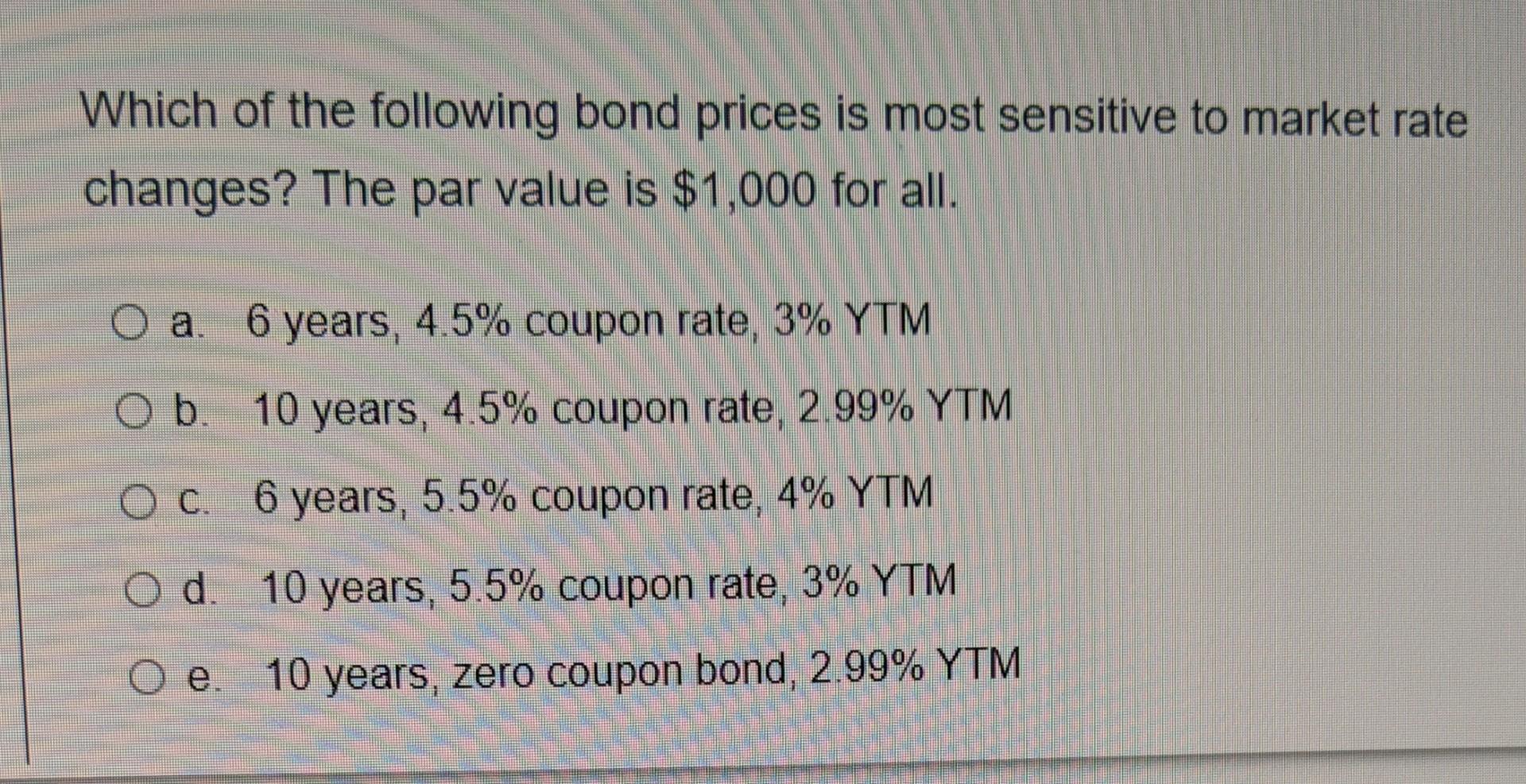

ICIN Which of the following statements is correct? O a. The last payment of an ordinary annuity is made at the beginning of the last year. O b. The last payment of an annuity due is made at the end of the last year. O c. An ordinary annuity has a greater PV but smaller FV than an annuity due if they both have the same periodic payments, discount rate, and time period Od An ordinary annuity has a smaller PV but greater FV than an annuity due if they both have the same periodic payments, discount rate, and time period. e An ordinary annuity has smaller PV and FV than an annuity due if they both have the same periodic payments, discount rate, and time period. An investment pays $457 every second year for 20 years (a total of 10 payments). The first payment is paid today. Your opportunity cost is 8% compounded semi-annually. The present value of this investment is $ (Note: please retain at least 4 decimal places in your calculations and at least 2 decimal places in the final answer.) Which of the following bond prices is most sensitive to market rate changes? The par value is $1,000 for all. O a. 6 years, 4.5% coupon rate, 3% YTM O b. 10 years, 4.5% coupon rate, 2.99% YTM O c. 6 years, 5.5% coupon rate, 4% YTM O d. d. 10 years, 5.5% coupon rate, 3% YTM O e. 10 years, zero coupon bond, 2.99% YTM ICIN Which of the following statements is correct? O a. The last payment of an ordinary annuity is made at the beginning of the last year. O b. The last payment of an annuity due is made at the end of the last year. O c. An ordinary annuity has a greater PV but smaller FV than an annuity due if they both have the same periodic payments, discount rate, and time period Od An ordinary annuity has a smaller PV but greater FV than an annuity due if they both have the same periodic payments, discount rate, and time period. e An ordinary annuity has smaller PV and FV than an annuity due if they both have the same periodic payments, discount rate, and time period. An investment pays $457 every second year for 20 years (a total of 10 payments). The first payment is paid today. Your opportunity cost is 8% compounded semi-annually. The present value of this investment is $ (Note: please retain at least 4 decimal places in your calculations and at least 2 decimal places in the final answer.) Which of the following bond prices is most sensitive to market rate changes? The par value is $1,000 for all. O a. 6 years, 4.5% coupon rate, 3% YTM O b. 10 years, 4.5% coupon rate, 2.99% YTM O c. 6 years, 5.5% coupon rate, 4% YTM O d. d. 10 years, 5.5% coupon rate, 3% YTM O e. 10 years, zero coupon bond, 2.99% YTM

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started