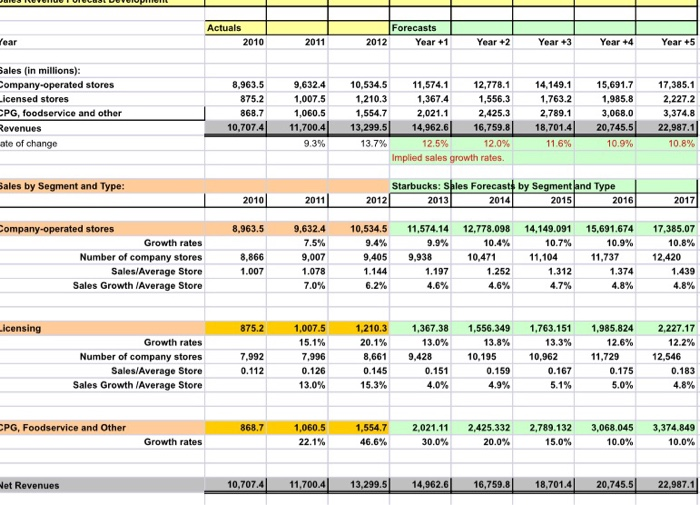

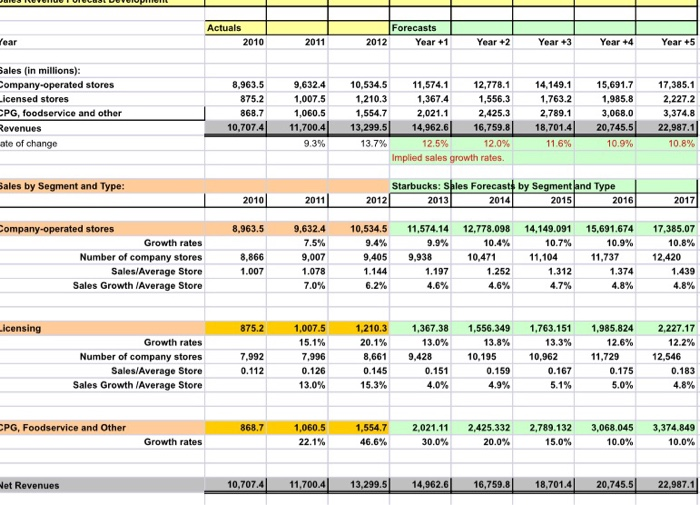

how would you analyze the sales growth projections of Starbucks? How many years into the future would you as an analyst be willing to commit to in the sales forecast? what are the external factors that could change (increase or decrease) the sales revenue forecasts of Starbucks?

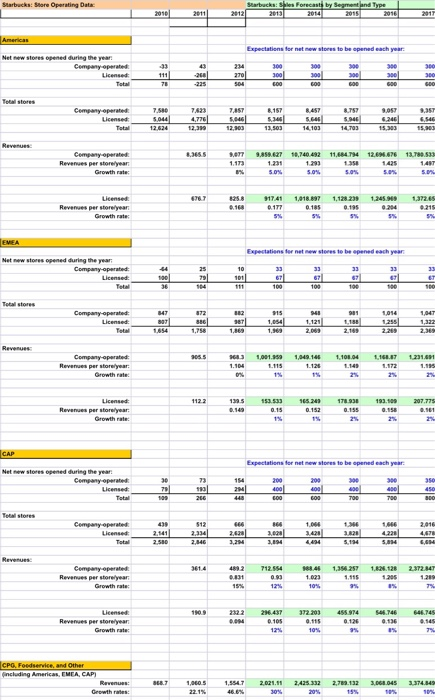

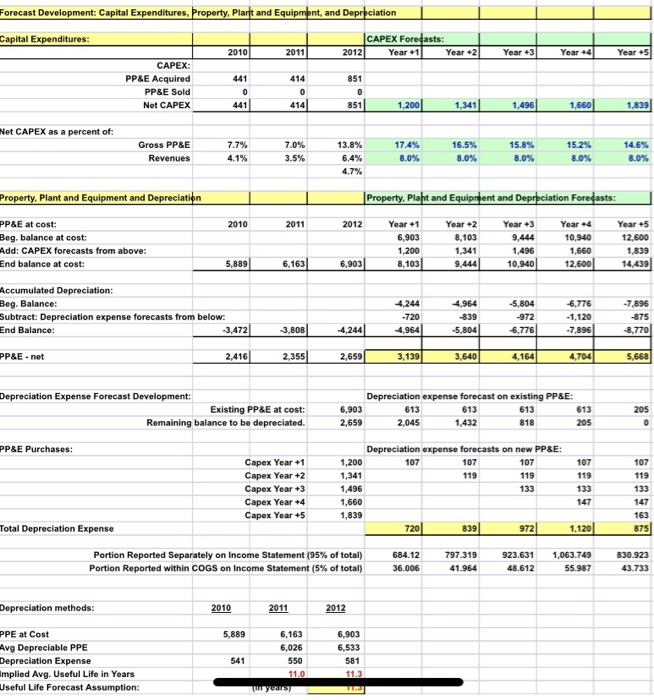

Actuals Forecasts Year 2010 2011 2012 Year+1 Year +2 Year +3 Year +4 Year +5 Sales (in millions): Company-operated stores 8,963.5 9,632.4 10,534.5 11,574.1 12,778.1 14,149.1 15,691.7 17,385.1 1,985.8 2,227.2 icensed stores 875.2 1,007.5 1,210.3 1,367.4 1,556.3 1,763.2 PG, foodservice and other 868.7 1,554.7 2,425.3 3,374.8 1,060.5 2,021.1 2,789.1 3,068.0 11,700.4 18,701.4 22,987.1 13,299.5 14,962.6 Revenues 10,707.4 16,759.8 20,745.5 13.7 % 10.9 % ate of change 12.0 % 10.8 % 9.3% 12.5% 11.6% Implied sales growth rates. Sales by Segment and Type: Starbucks: Sales Forecasts by Segment and Type 2010 2011 2012 2013 2014 2015 2016 2017 ompany-operated stores 8,963.5 9,632.4 10,534.5 11,574.14 12,778.098 14,149.091 15,691.674 17,385.07 Growth rates 7.5% 9.4% 9.9% 10.4% 10.7 % 10.9% 10.8% Number of company stores 8,866 9,007 9,405 9.938 10,471 11,104 11,737 12.420 1.197 1.312 Sales/Average Store 1.007 1.078 1.144 1.252 1.374 1.439 Sales Growth /Average Store 7,0% 6.2% 4.6% 4,6% 4.7% 4.8% 4.8% Licensing 875.2 1,210.3 1,367.38 1,556.349 1,763.151 1,985.824 2,227.17 1.007.5 13.0 % 12.6 % 20.1% Growth rates 15.1% 13.8% 13.3% 12.2% Number of company stores 7,992 7,996 8,661 9,428 10,195 10,962 11,729 12,546 Sales/Average Store 0.112 0.126 0.145 0.151 0.159 0.167 0.175 0.183 Sales Growth /Average Store 13.0% 15.3% 4.0% 4.9% 5.1% 5.0% 4.8% PG, Foodservice and Other 1,554.7 2,021.11 2,425.332 868.7 1,060.5 2,789.132 3,068.045 3,374.849 30.0 % 10.0 % Growth rates 22.1% 46.6% 20.0% 15.0% 10.0% Net Revenues 10,707.4 13,299.5 11,700.4 14,962.6 16,759.8 18,701.4 20,745.5 22,987.1 Starbucks: sles Forecasts by Segmentand Type 2014 Starbucks: Store Operating Data: 2013 2015 201 2010 2011 2012 2016 Americas Expectations for net mew stores to be opened each year Net new stores opened during the year Company operated 300 300 600 30m 33 234 300 300 300 300 300 Licensed 111 260 270 300 30m 600 -225 Total 504 Tetal stores Cempany operated: 7 580 7,623 745T 8157 8.457 8757 9.057 5,044 4,776 5046 5.946 Licensed: 5346 5646 6246 654m 12.903 Total 12.624 12.399 13.503 14.103 14.703 15.303 15.90 Revenues 12.696 676- 13.780 53 Company-operated 3655 9859627 10.740 492 11.684 794 1.358 1425 Revenues per storelyears 1.173 1.231 1293 141 Growth rate: 5.0 % 50 50% 50% 50% 1372.6m 021 Licensed 76.7 82580 17.41 1018.897 1.128 239 1.245.969 Revenues per storelyear Growth rate 168 0.177 0.185 9.195 0204 5% 5% 5% EMEA Expectations for net new stores to be opened each year Net new stores opened during the year: Company-operated 33 33 11 67 67 1011 Licensed 100 36 104 10m Tetal 111 100 100 100 Total stores 1,014 Company-operated 47 872 15 981 104 s07 1054 Licensed: 1.121 1.188 1,255 1.32 Tetal 2 269 2.36 1654 1758 1869 1.969 2.06 2 181 Revenues Company-oparated: Revenues per storelyear a05.5 s68 3 1,001.9598 1,049 14 1.108.04 1.158.17 1,231.9 1.115 1.172 1.104 1.12 1.14 1.19m Growth rate 0% 13% 2% 2% 29 165 243 170.930 Licensed 112.25 1395 193.100 207.77m Revenues per storelyear: 0.1498 0.15 0.152 0.155 9.16 Growth rate 1% 1% 2% 2 CAP Expectations for net mew stores to be opened each year Net new stores opened during the year Company operated 30 73 154 200 200 300 300 3sm 294 400 00 Licensed: 75 193 400 400 45m 600 Total 260 440 600 70 Tetal stores Company operated 1,666 21 435 $12 1.066 136 2,334 3421 32 Licensed 2,141 262 1028 422 4,67 Total 2.580 24 3.294 3894 4494 5.134 S84 Revenues 988.40 1824.128 1.205 Cempany-operated Revenues per storelyear 361.4 489 2 712.554 1356 257 237284 p831 0.93 1.023 1.115 1.28m 12 % % Growth rate: 15% 10% 7% 26 437 646 74m 372 203 455.974 s4746- Licensed 190 9 2322 0004 Revenues per storelyear 0.105 0.115 0.126 136 14m Growth rate 12% 10% I% 7% CPG, Foodservice, and Other Gncluding Americas, EMEA, CAP) 1,060 5 3068.0452 10 % Revenues 1.554-7 s68.7 2021.115 2425 332 2.789.132 3.37484 Growth rates 46.6% 30% 20% 15% 10% 22.1% Forecast Development: Capital Expenditures, Property, Plart and Equipment, and Deprbciation CAPEX Forecasts: Capital Expenditures: Year +3 Year +4 Year +5 2010 2011 2012 Year +1 Year +2 CAPEX: PP&E Acquired 441 414 851 PP&E Sold C 0 1,839 414 1,660 Net CAPEX 441 851 1,200 1,341 1,496 Net CAPEX as a percent of: Gross PP&E 7,7% 7,0% 13.8% 17.4% 16.5% 15.8% 15.2% 14.6% 8.0 % 6.4 % Revenues 4.1 % 3.5% 8.0% 8.0% 8.0% 8.0% 4.7% Property, Plant and Equipment and Depreciation Property, Plant and Equipment and Depreciation Forecasts: PP&E at cost: 2011 Year +5 2010 2012 Year+1 Year +2 Year +3 Year +4 Beg. balance at cost: 6,903 8,103 9.444 10,940 12,600 Add: CAPEX forecasts from above: 1,200 1,341 1,496 1,660 1,839 End balance at cost: 6,163 8,103 14,439 9,444 5,889 6,903 10,940 12,600 Accumulated Depreciation: Beg. Balance: 4,244 4,964 -5,804 -6.776 -7,896 Subtract: Depreciation expense forecasts from below: 3,472 -720 -839 972 1,120 875 3,808 4,244 -7,896 End Balance: 4,964 5,804 -6,776 8,770 2,355 3,139 3,640 4,164 5,668 PP&E-net 4,704 2,416 2,659 Depreciation Expense Forecast Development: Depreciation expense forecast on existing PP&E: 205 Existing PP&E at cost: 6,903 613 613 613 613 205 Remaining balance to be depreciated. 2,659 2,045 1,432 818 PP&E Purchases: Depreciation expense forecasts on new PP&E: Capex Year +1 1,200 107 107 107 107 107 Capex Year +2 1,341 119 119 119 119 Capex Year +3 1,496 133 133 133 Capex Year +4 1,660 147 147 Capex Year +5 1,839 163 1,120 875 Total Depreciation Expense 839 972 720 Portion Reported Separately on Income Statement (95 % of total) Portion Reported within COGS on Income Statement (5 % of total) 684.12 797.319 923.631 1,063.749 830.923 41.964 36.006 48.612 55.987 43.733 Depreciation methods: 2010 2011 2012 PPE at Cost 5,889 6,163 6,903 Avg Depreciable PPE Depreciation Expense Implied Avg. Useful Life in Years 6,026 6,533 541 550 581 11.0 11.3 Useful Life Forecast Assumption: Actuals Forecasts Year 2010 2011 2012 Year+1 Year +2 Year +3 Year +4 Year +5 Sales (in millions): Company-operated stores 8,963.5 9,632.4 10,534.5 11,574.1 12,778.1 14,149.1 15,691.7 17,385.1 1,985.8 2,227.2 icensed stores 875.2 1,007.5 1,210.3 1,367.4 1,556.3 1,763.2 PG, foodservice and other 868.7 1,554.7 2,425.3 3,374.8 1,060.5 2,021.1 2,789.1 3,068.0 11,700.4 18,701.4 22,987.1 13,299.5 14,962.6 Revenues 10,707.4 16,759.8 20,745.5 13.7 % 10.9 % ate of change 12.0 % 10.8 % 9.3% 12.5% 11.6% Implied sales growth rates. Sales by Segment and Type: Starbucks: Sales Forecasts by Segment and Type 2010 2011 2012 2013 2014 2015 2016 2017 ompany-operated stores 8,963.5 9,632.4 10,534.5 11,574.14 12,778.098 14,149.091 15,691.674 17,385.07 Growth rates 7.5% 9.4% 9.9% 10.4% 10.7 % 10.9% 10.8% Number of company stores 8,866 9,007 9,405 9.938 10,471 11,104 11,737 12.420 1.197 1.312 Sales/Average Store 1.007 1.078 1.144 1.252 1.374 1.439 Sales Growth /Average Store 7,0% 6.2% 4.6% 4,6% 4.7% 4.8% 4.8% Licensing 875.2 1,210.3 1,367.38 1,556.349 1,763.151 1,985.824 2,227.17 1.007.5 13.0 % 12.6 % 20.1% Growth rates 15.1% 13.8% 13.3% 12.2% Number of company stores 7,992 7,996 8,661 9,428 10,195 10,962 11,729 12,546 Sales/Average Store 0.112 0.126 0.145 0.151 0.159 0.167 0.175 0.183 Sales Growth /Average Store 13.0% 15.3% 4.0% 4.9% 5.1% 5.0% 4.8% PG, Foodservice and Other 1,554.7 2,021.11 2,425.332 868.7 1,060.5 2,789.132 3,068.045 3,374.849 30.0 % 10.0 % Growth rates 22.1% 46.6% 20.0% 15.0% 10.0% Net Revenues 10,707.4 13,299.5 11,700.4 14,962.6 16,759.8 18,701.4 20,745.5 22,987.1 Starbucks: sles Forecasts by Segmentand Type 2014 Starbucks: Store Operating Data: 2013 2015 201 2010 2011 2012 2016 Americas Expectations for net mew stores to be opened each year Net new stores opened during the year Company operated 300 300 600 30m 33 234 300 300 300 300 300 Licensed 111 260 270 300 30m 600 -225 Total 504 Tetal stores Cempany operated: 7 580 7,623 745T 8157 8.457 8757 9.057 5,044 4,776 5046 5.946 Licensed: 5346 5646 6246 654m 12.903 Total 12.624 12.399 13.503 14.103 14.703 15.303 15.90 Revenues 12.696 676- 13.780 53 Company-operated 3655 9859627 10.740 492 11.684 794 1.358 1425 Revenues per storelyears 1.173 1.231 1293 141 Growth rate: 5.0 % 50 50% 50% 50% 1372.6m 021 Licensed 76.7 82580 17.41 1018.897 1.128 239 1.245.969 Revenues per storelyear Growth rate 168 0.177 0.185 9.195 0204 5% 5% 5% EMEA Expectations for net new stores to be opened each year Net new stores opened during the year: Company-operated 33 33 11 67 67 1011 Licensed 100 36 104 10m Tetal 111 100 100 100 Total stores 1,014 Company-operated 47 872 15 981 104 s07 1054 Licensed: 1.121 1.188 1,255 1.32 Tetal 2 269 2.36 1654 1758 1869 1.969 2.06 2 181 Revenues Company-oparated: Revenues per storelyear a05.5 s68 3 1,001.9598 1,049 14 1.108.04 1.158.17 1,231.9 1.115 1.172 1.104 1.12 1.14 1.19m Growth rate 0% 13% 2% 2% 29 165 243 170.930 Licensed 112.25 1395 193.100 207.77m Revenues per storelyear: 0.1498 0.15 0.152 0.155 9.16 Growth rate 1% 1% 2% 2 CAP Expectations for net mew stores to be opened each year Net new stores opened during the year Company operated 30 73 154 200 200 300 300 3sm 294 400 00 Licensed: 75 193 400 400 45m 600 Total 260 440 600 70 Tetal stores Company operated 1,666 21 435 $12 1.066 136 2,334 3421 32 Licensed 2,141 262 1028 422 4,67 Total 2.580 24 3.294 3894 4494 5.134 S84 Revenues 988.40 1824.128 1.205 Cempany-operated Revenues per storelyear 361.4 489 2 712.554 1356 257 237284 p831 0.93 1.023 1.115 1.28m 12 % % Growth rate: 15% 10% 7% 26 437 646 74m 372 203 455.974 s4746- Licensed 190 9 2322 0004 Revenues per storelyear 0.105 0.115 0.126 136 14m Growth rate 12% 10% I% 7% CPG, Foodservice, and Other Gncluding Americas, EMEA, CAP) 1,060 5 3068.0452 10 % Revenues 1.554-7 s68.7 2021.115 2425 332 2.789.132 3.37484 Growth rates 46.6% 30% 20% 15% 10% 22.1% Forecast Development: Capital Expenditures, Property, Plart and Equipment, and Deprbciation CAPEX Forecasts: Capital Expenditures: Year +3 Year +4 Year +5 2010 2011 2012 Year +1 Year +2 CAPEX: PP&E Acquired 441 414 851 PP&E Sold C 0 1,839 414 1,660 Net CAPEX 441 851 1,200 1,341 1,496 Net CAPEX as a percent of: Gross PP&E 7,7% 7,0% 13.8% 17.4% 16.5% 15.8% 15.2% 14.6% 8.0 % 6.4 % Revenues 4.1 % 3.5% 8.0% 8.0% 8.0% 8.0% 4.7% Property, Plant and Equipment and Depreciation Property, Plant and Equipment and Depreciation Forecasts: PP&E at cost: 2011 Year +5 2010 2012 Year+1 Year +2 Year +3 Year +4 Beg. balance at cost: 6,903 8,103 9.444 10,940 12,600 Add: CAPEX forecasts from above: 1,200 1,341 1,496 1,660 1,839 End balance at cost: 6,163 8,103 14,439 9,444 5,889 6,903 10,940 12,600 Accumulated Depreciation: Beg. Balance: 4,244 4,964 -5,804 -6.776 -7,896 Subtract: Depreciation expense forecasts from below: 3,472 -720 -839 972 1,120 875 3,808 4,244 -7,896 End Balance: 4,964 5,804 -6,776 8,770 2,355 3,139 3,640 4,164 5,668 PP&E-net 4,704 2,416 2,659 Depreciation Expense Forecast Development: Depreciation expense forecast on existing PP&E: 205 Existing PP&E at cost: 6,903 613 613 613 613 205 Remaining balance to be depreciated. 2,659 2,045 1,432 818 PP&E Purchases: Depreciation expense forecasts on new PP&E: Capex Year +1 1,200 107 107 107 107 107 Capex Year +2 1,341 119 119 119 119 Capex Year +3 1,496 133 133 133 Capex Year +4 1,660 147 147 Capex Year +5 1,839 163 1,120 875 Total Depreciation Expense 839 972 720 Portion Reported Separately on Income Statement (95 % of total) Portion Reported within COGS on Income Statement (5 % of total) 684.12 797.319 923.631 1,063.749 830.923 41.964 36.006 48.612 55.987 43.733 Depreciation methods: 2010 2011 2012 PPE at Cost 5,889 6,163 6,903 Avg Depreciable PPE Depreciation Expense Implied Avg. Useful Life in Years 6,026 6,533 541 550 581 11.0 11.3 Useful Life Forecast Assumption