Answered step by step

Verified Expert Solution

Question

1 Approved Answer

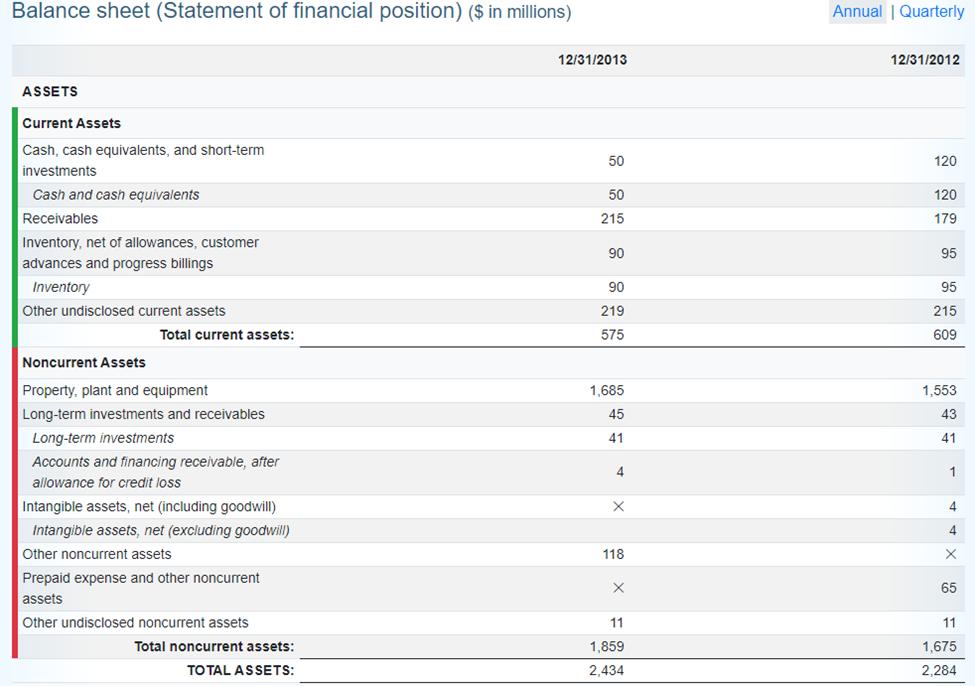

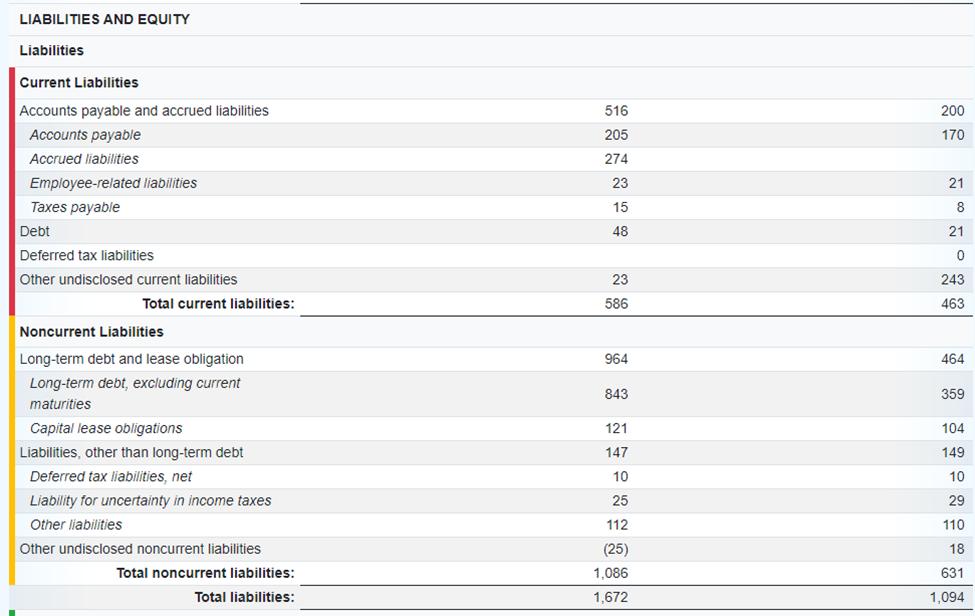

How would you complete a fundamental analysis of stock pricing for Tim Horton's based on the information below? Compare the fundamental value as measured using

How would you complete a fundamental analysis of stock pricing for Tim Horton's based on the information below? Compare the fundamental value as measured using a textbook method to the current price of the stock.

Would you rate the stock a buy, hold, or sell? Explain your reasoning

Balance sheet (Statement of financial position) ($ in millions) ASSETS Current Assets Cash, cash equivalents, and short-term investments Cash and cash equivalents Receivables Inventory, net of allowances, customer. advances and progress billings Inventory Other undisclosed current assets Total current assets: Noncurrent Assets Property, plant and equipment Long-term investments and receivables Long-term investments Accounts and ancing receivable, after allowance for credit loss Intangible assets, net (including goodwill) Intangible assets, net (excluding goodwill) Other noncurrent assets Prepaid expense and other noncurrent assets Other undisclosed noncurrent assets Total noncurrent assets: TOTAL ASSETS: 12/31/2013 50 50 215 90 90 219 575 1,685 45 41 4 X 118 X 11 1,859 2,434 Annual | Quarterly 12/31/2012 120 120 179 95 95 215 609 1,553 43 41 1 4 4 X 65 11 1,675 2,284

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Question Description To conduct a fundamental analysis of Tim Hortons stock pricing we need to consider additional information beyond the balance shee...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started