Question

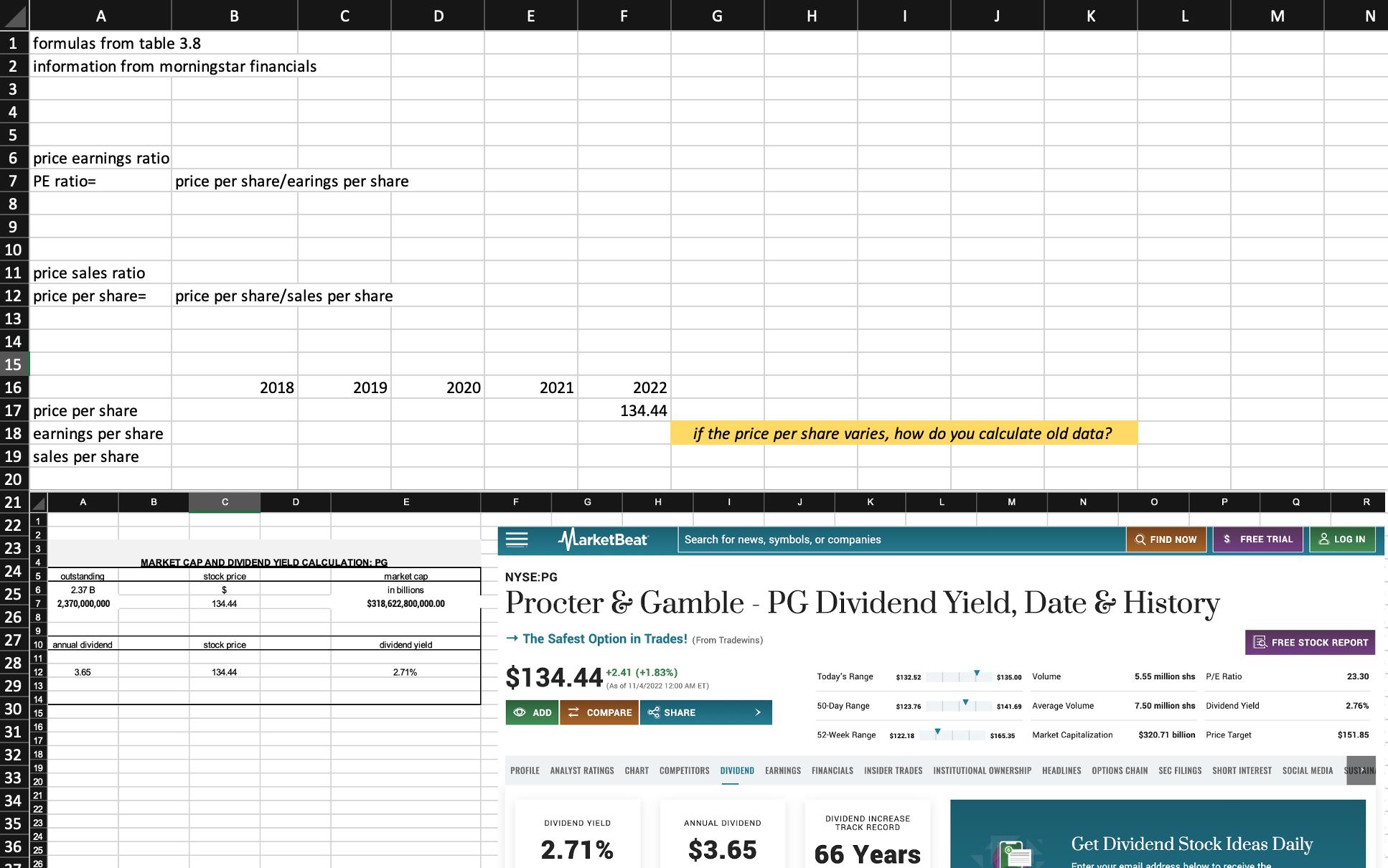

Company: PG years: 2022, 2021, 2020 (unless it has to be starting 2021, 2020, 2019). problem: 1) Using an Excel spreadsheet, you will create a

Company: PG

years: 2022, 2021, 2020 (unless it has to be starting 2021, 2020, 2019).

problem:

1) Using an Excel spreadsheet, you will create a three-year ratio trend analysis from the financial statements for your assigned corporation. The trend will consist of the following ratios:

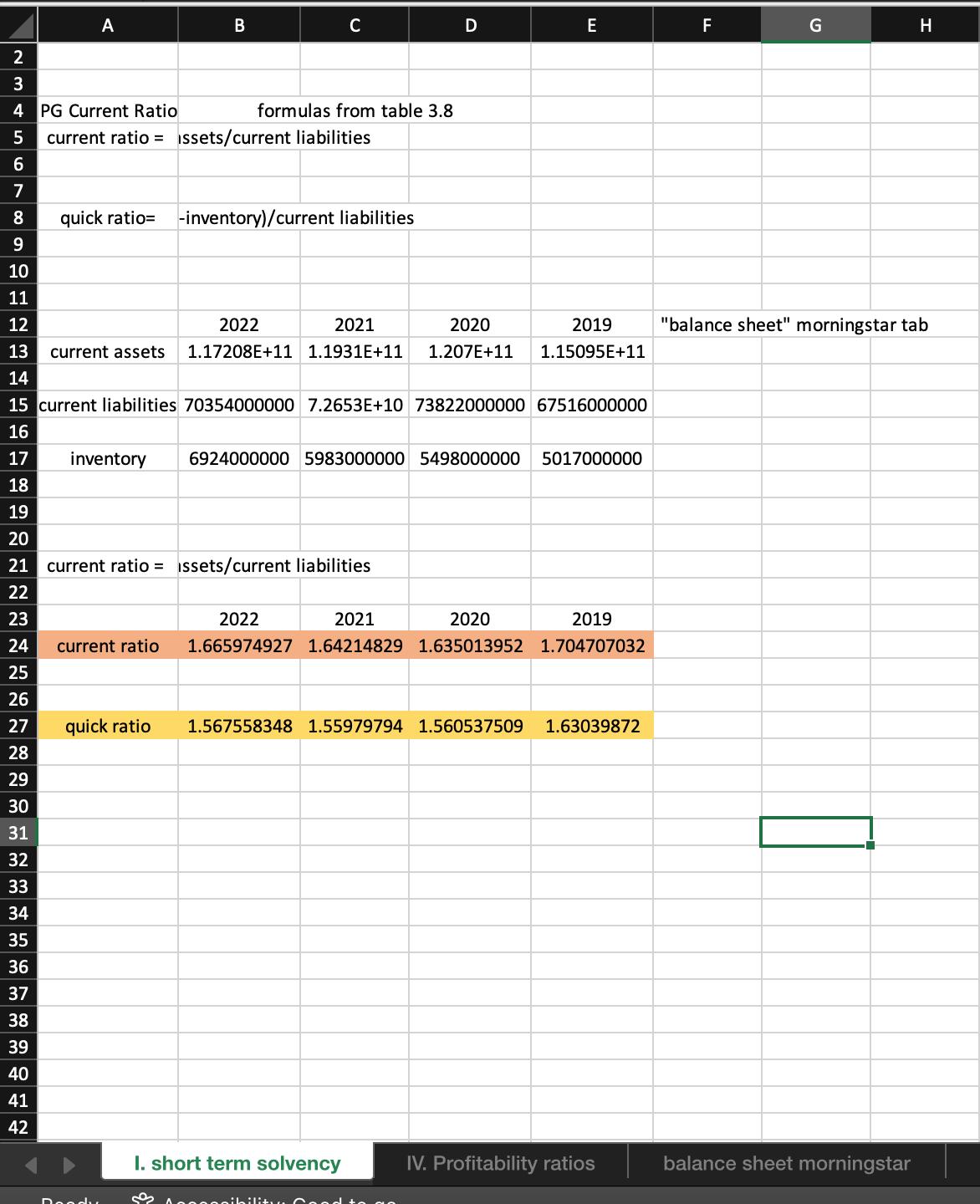

Current Ratio and the Quick Ratio from the “I. Short term solvency, or liquidity, ratios” category

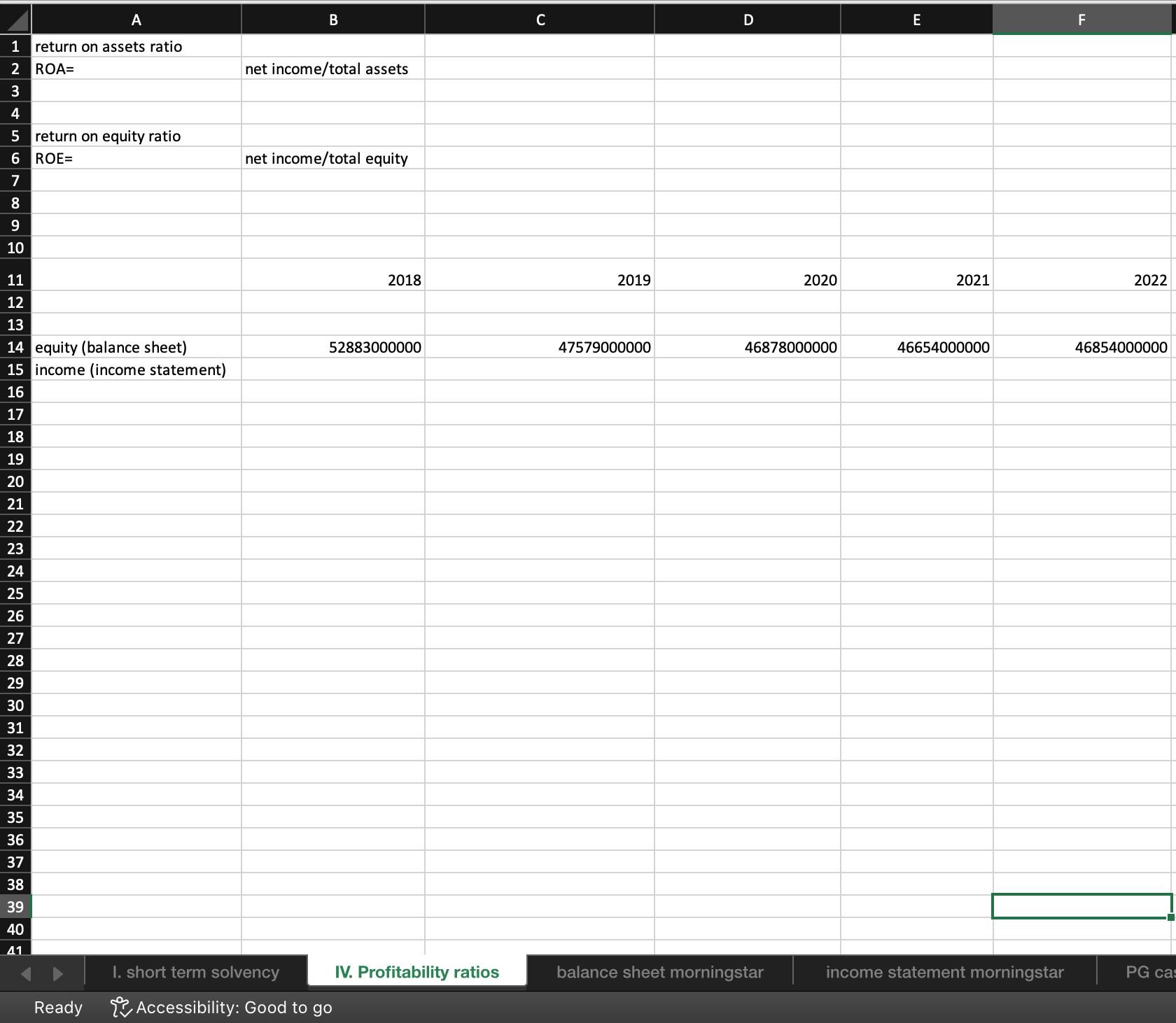

Return on Assets Ratio and the Return on Equity Ratio from the “IV. Profitability ratios” category

Price Earnings Ratio and the Price Sales Ratio from the “V. Market value ratios” category.

Then provide a one-page (minimum) discussion about what each trend indicates for your assigned corporation. Is the trend good or bad, why?

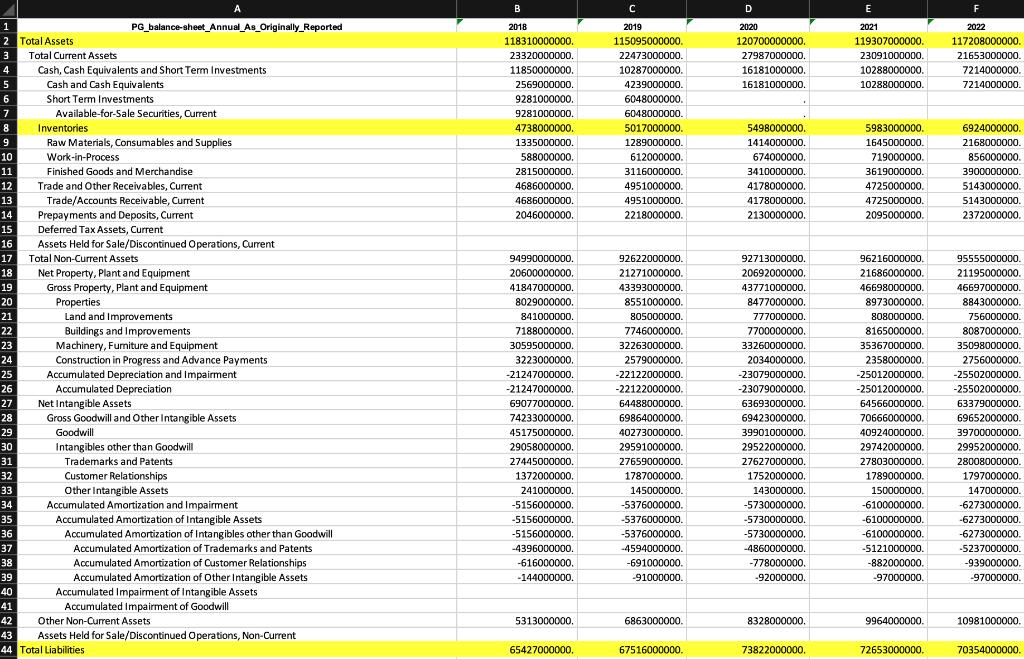

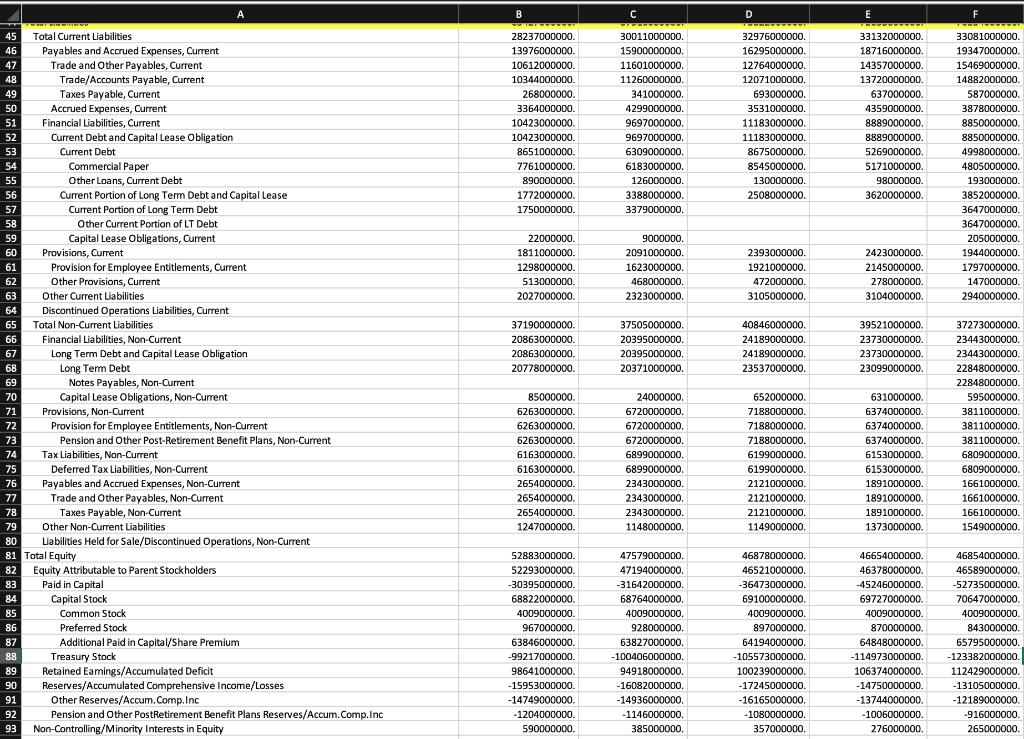

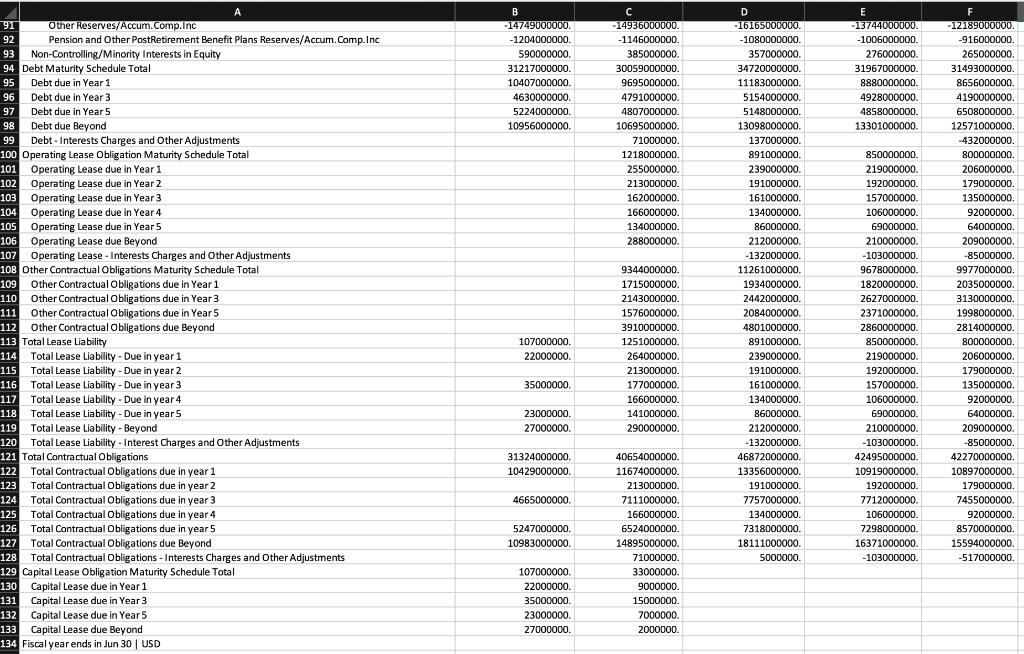

PG balance sheet from morningstar

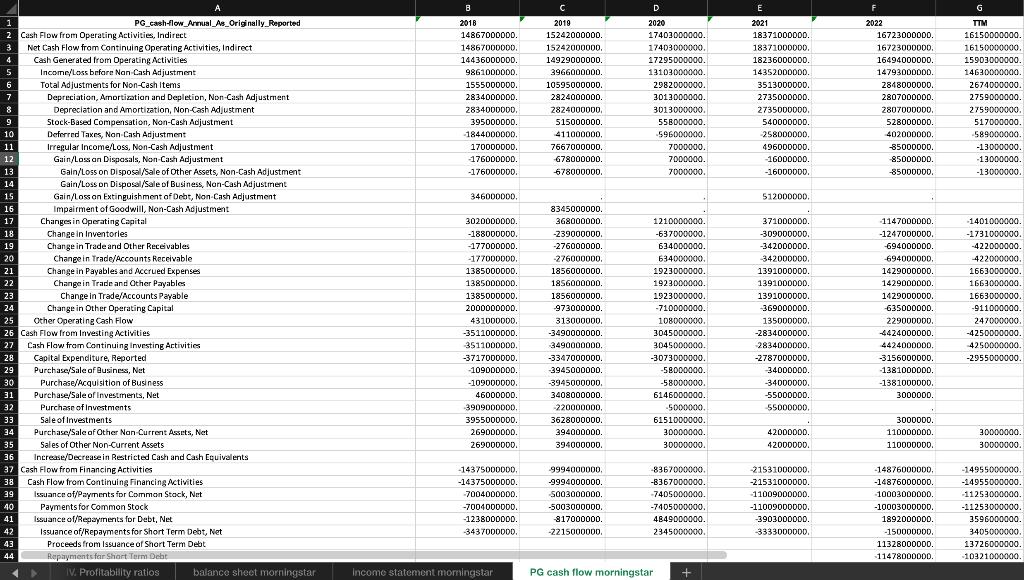

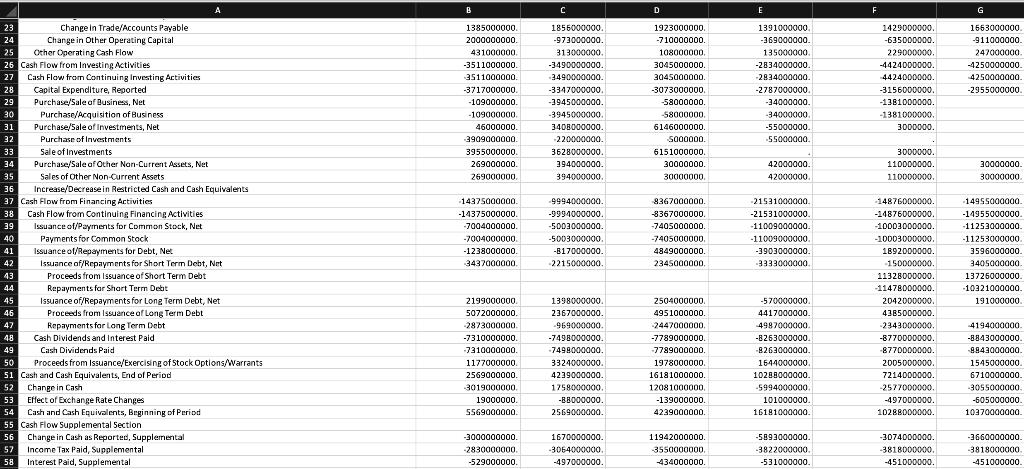

PG cash flow annual from morningstar

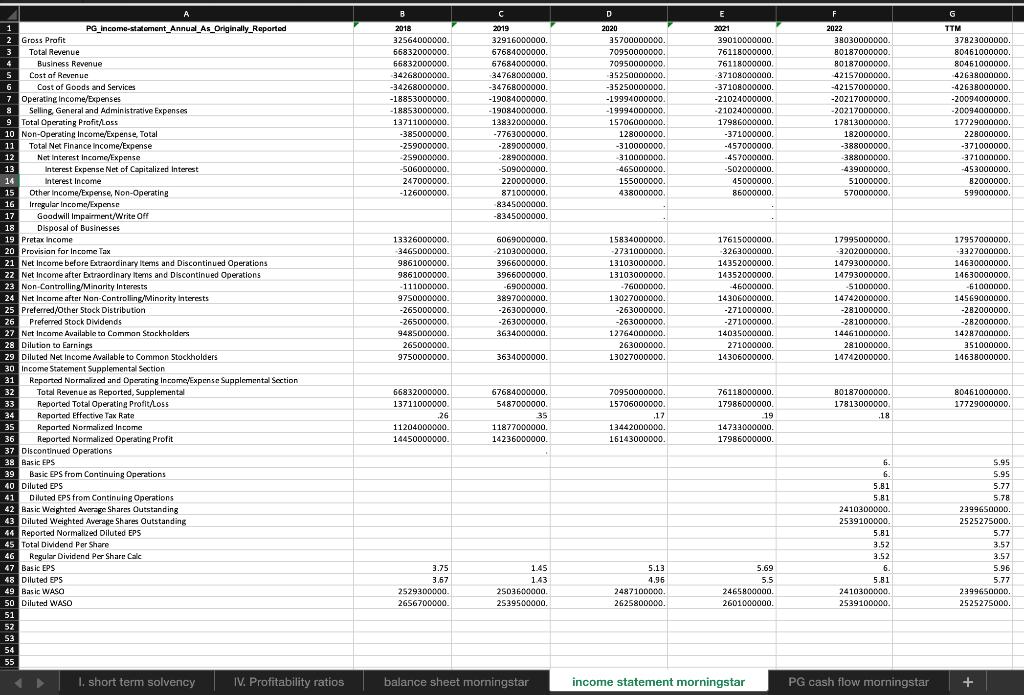

PG income statement from morningstar

Work:

I believe this is right above

I believe this is right above

this part I'm not sure about

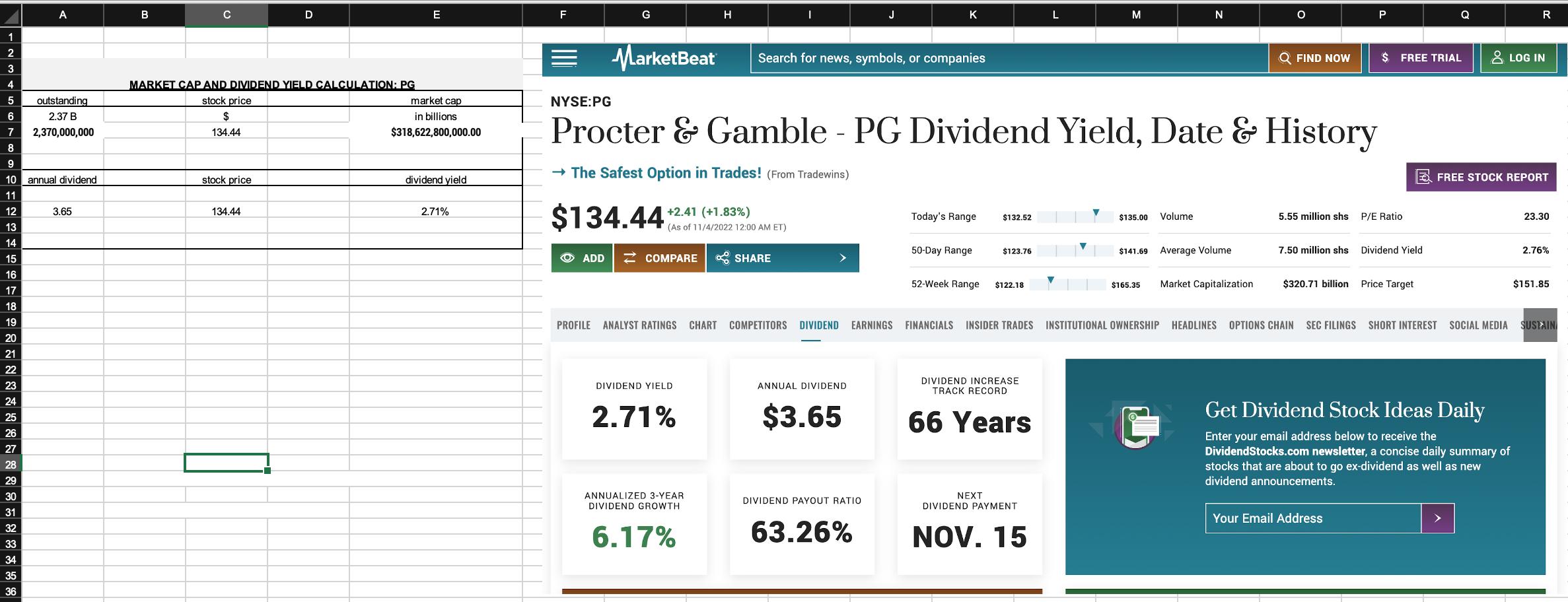

this part I'm not sure. How would you calculate the price per share since the 134.44 isn't accurate for 2021,2020 or any other year?( i included it for the stock price from market beat)

thanks! I can repost additionally if needed. Just wanted to make sure I'm on the right track with short term solvency tab.the two problems below it I'm not sure about.

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 PG_balance-sheet_Annual_As_Originally_Reported Total Assets Total Current Assets Cash, Cash Equivalents and Short Term Investments Cash and Cash Equivalents Short Term Investments Available-for-Sale Securities, Current 16 17 Total Non-Current Assets 18 19 Inventories Raw Materials, Consumables and Supplies Work-in-Process Finished Goods and Merchandise Trade and Other Receivables, Current Trade/Accounts Receivable, Current Prepayments and Deposits, Current Deferred Tax Assets, Current Assets Held for Sale/Discontinued Operations, Current Net Property, Plant and Equipment Gross Property, Plant and Equipment Properties Land and Improvements Buildings and Improvements Machinery, Furniture and Equipment Construction in Progress and Advance Payments Accumulated Depreciation and Impairment Accumulated Depreciation. Net Intangible Assets Gross Goodwill and Other Intangible Assets Goodwill Intangibles other than Goodwill Trademarks and Patents Customer Relationships Other Intangible Assets Accumulated Amortization and Impairment. Accumulated Amortization of Intangible Assets. Accumulated Amortization of Intangibles other than Goodwill Accumulated Amortization of Trademarks and Patents Accumulated Amortization of Customer Relationships Accumulated Amortization of Other Intangible Assets Accumulated Impairment of Intangible Assets Accumulated Impairment of Goodwill Other Non-Current Assets Assets Held for Sale/Discontinued Operations, Non-Current 43 44 Total Liabilities B 2018 118310000000. 23320000000, 11850000000. 2569000000. 9281000000. 9281000000. 4738000000. 1335000000. 588000000. 2815000000. 4686000000. 4686000000. 2046000000. 94990000000. 20600000000. 41847000000. 8029000000. 841000000. 7188000000. 30595000000. 3223000000. -21247000000. -21247000000 69077000000. 74233000000. 45175000000. 29058000000. 27445000000. 1372000000. 241000000. -5156000000. -5156000000. -5156000000. -4396000000. -616000000. -144000000. 5313000000. 65427000000. 2019 115095000000. 22473000000. 10287000000. 4239000000 6048000000. 6048000000. 5017000000. 1289000000. 612000000. 3116000000. 4951000000. 4951000000. 2218000000. 92622000000 21271000000. 43393000000. 8551000000. 805000000. 7746000000. 32263000000. 2579000000. -22122000000 -22122000000. 64488000000 69864000000. 40273000000. 29591000000. 27659000000. 1787000000. 145000000. -5376000000. -5376000000. -5376000000. -4594000000. -691000000. -91000000. 6863000000. 67516000000. D 2020 120700000000. 27987000000. 16181000000. 16181000000. 5498000000. 1414000000. 674000000. 3410000000. 4178000000. 4178000000. 2130000000. 92713000000. 20692000000. 43771000000. 8477000000. 777000000. 7700000000. 33260000000. 2034000000. -23079000000. -23079000000, 63693000000. 69423000000. 39901000000. 29522000000. 27627000000. 1752000000 143000000. -5730000000. -5730000000. -5730000000. -4860000000. -778000000. -92000000. 8328000000. 73822000000. E 2021 119307000000. 23091000000. 10288000000. 10288000000. 5983000000. 1645000000. 719000000. 3619000000 4725000000. 4725000000. 2095000000. 96216000000. 21686000000. 46698000000. 8973000000. 808000000. 8165000000. 35367000000. 2358000000. -25012000000. -25012000000. 64566000000 70666000000. 40924000000. 29742000000. 27803000000. 1789000000. 150000000. -6100000000. -6100000000. -6100000000. -5121000000. -882000000. -97000000. 9964000000. 72653000000. F 2022 117208000000. 21653000000. 7214000000. 7214000000. 6924000000. 2168000000. 856000000. 3900000000. 5143000000 5143000000. 2372000000 95555000000. 21195000000. 46697000000. 8843000000. 756000000. 8087000000. 35098000000. 2756000000. -25502000000. -25502000000. 63379000000. 69652000000. 39700000000. 29952000000. 28008000000. 1797000000. 147000000. -6273000000. -6273000000. -6273000000. -5237000000. -939000000. -97000000. 10981000000. 70354000000.

Step by Step Solution

3.54 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

ANSWER TREND function is a builtin function in excel which comes under the category of Statistical f...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started