Answered step by step

Verified Expert Solution

Question

1 Approved Answer

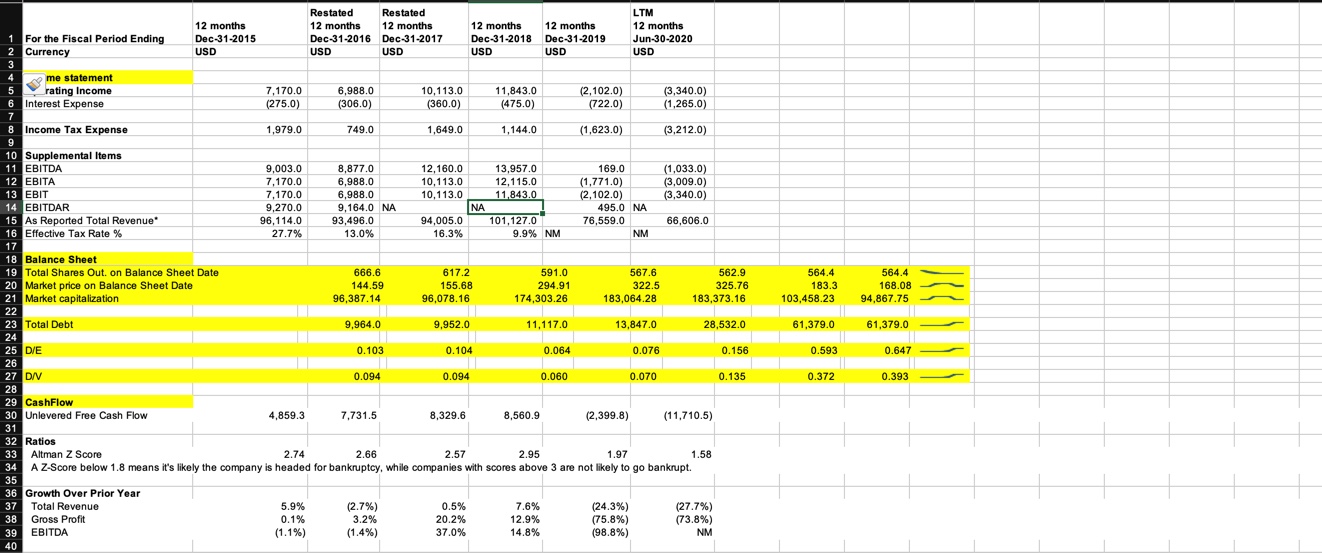

How would you explain Boeing's capital structure (financing policy) changes (see D/E and D/V ratios in Balance Sheet section during the time data is available

How would you explain Boeing's capital structure (financing policy) changes (see D/E and D/V ratios in "Balance Sheet" section during the time data is available using all the relevant factors/theories listed below.

A.Modigliani and Miller Proposition I and II

B.Taxes

C.The Trade-off Theory

D.The pecking order theory

1 For the Fiscal Period Ending 2 Currency 4 me statement S 5 rating Income 6 Interest Expense 12 months Dec-31-2015 USD 8 Income Tax Expense 9 10 Supplemental Items 11 EBITDA 12 EBITA 13 EBIT 14 EBITDAR 15 As Reported Total Revenue* 16 Effective Tax Rate % 17 18 Balance Sheet 19 Total Shares Out. on Balance Sheet Date 20 Market price on Balance Sheet Date 21 Market capitalization 22 23 Total Debt 24 25 D/E 7,170.0 (275.0) 1,979.0 9,003.0 7,170.0 7,170.0 9,270.0 96,114.0 27.7% P L Restated 12 months Dec-31-2016 4,859.3 USD 5.9% 0.1% (1.1%) 6,988.0 (306.0) 749.0 8,877.0 6,988.0 6,988.0 9,164.0 NA 93,496.0 13.0% 666.6 144.59 96,387.14 9,964.0 Restated 12 months Dec-31-2017 USD 0.103 0.094 7,731.5 (2.7%) 3.2% (1.4%) 10,113.0 (360.0) 1,649.0 12,160.0 10,113.0 10,113.0 94,005.0 16.3% 0.094 12 months Dec-31-2018 617.2 155.68 96,078.16 9,952.0 0.104 8,329.6 USD 0.5% 20.2% 37.0% 11,843.0 (475.0) 1,144.0 13,957.0 12,115.0 11,843.0 101,127.0 9.9% NM 12 months Dec-31-2019 USD 591.0 294.91 174,303.26 11,117.0 8,560.9 26 27 D/V 28 29 CashFlow 30 Unlevered Free Cash Flow 31 32 Ratios 33 Altman Z Score 2.74 2.66 2.57 2.95 1.97 34 A Z-Score below 1.8 means it's likely the company is headed for bankruptcy, while companies with scores above 3 are not likely to go bankrupt. 35 36 Growth Over Prior Year 37 Total Revenue 38 Gross Profit 39 EBITDA 40 0.064 7.6% 12.9% 14.8% 0.060 (2,102.0) (722.0) (1,623.0) 169.0 (1,771.0) (2,102.0) 495.0 NA 76,559.0 LTM 12 months Jun-30-2020 USD 567.6 322.5 183,064.28 13,847.0 (2,399.8) NM (24.3%) (75.8%) (98.8%) 0.076 0.070 (3,340.0) (1,265.0) (3,212.0) (1,033.0) (3,009.0) (3,340.0) 66,606.0 562.9 325.76 183,373.16 28,532.0 (11,710.5) 1.58 (27.7%) (73.8%) NM 0.156 0.135 564.4 183.3 103,458.23 61,379.0 0.593 0.372 564.4 168.08 94,867.75 61,379.0 0.647 0.393

Step by Step Solution

★★★★★

3.50 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

To analyze Boeings capital structure changes and financing policy we can consider the relevant factors and theories listed below A Modigliani and Mill...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started