How would you fill out the following chart?

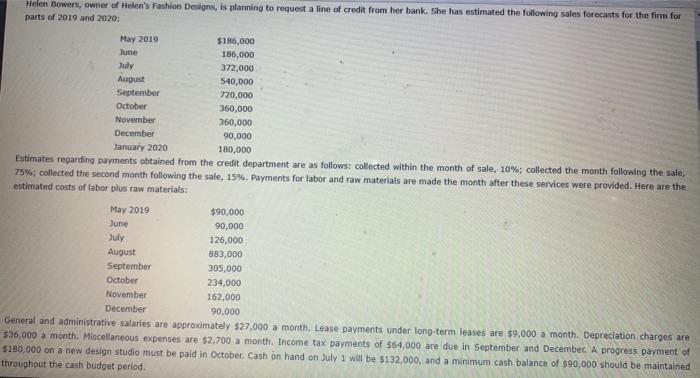

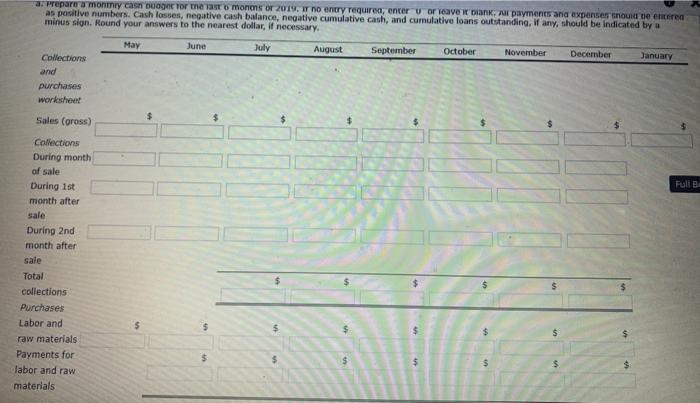

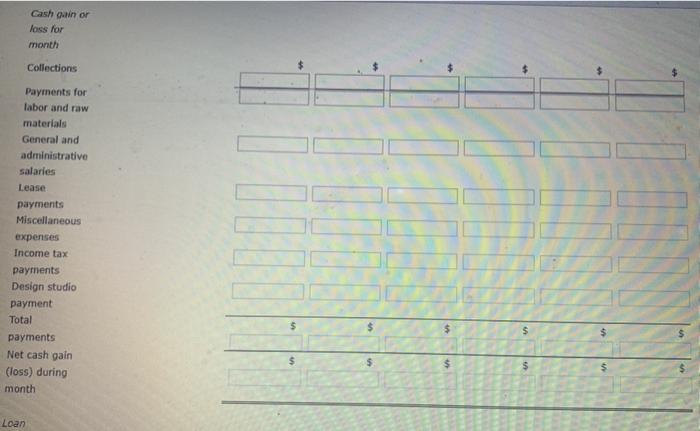

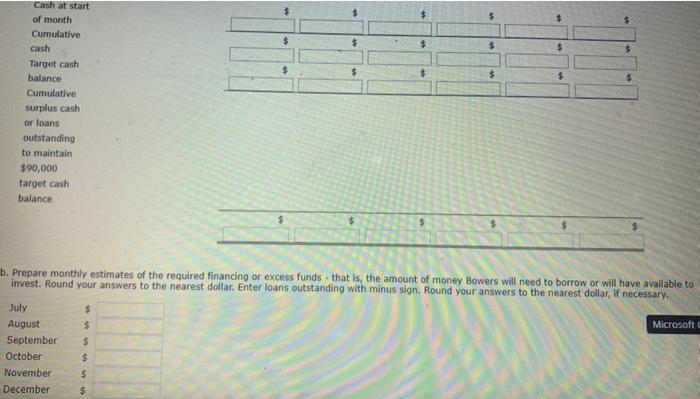

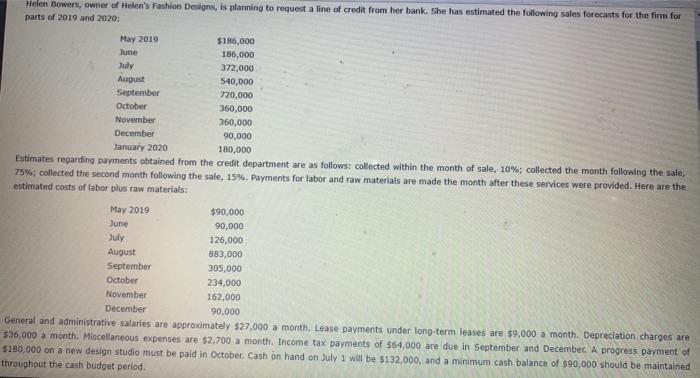

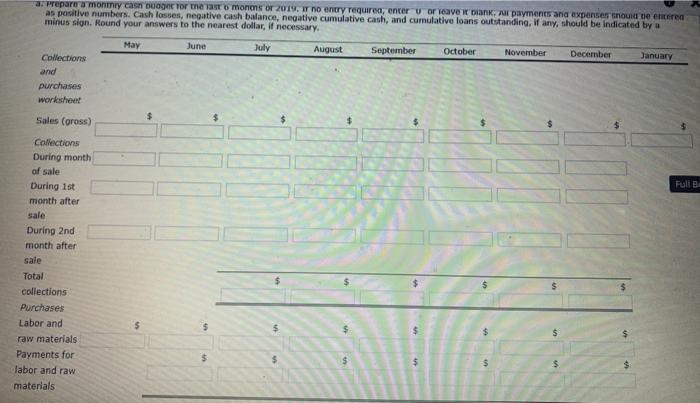

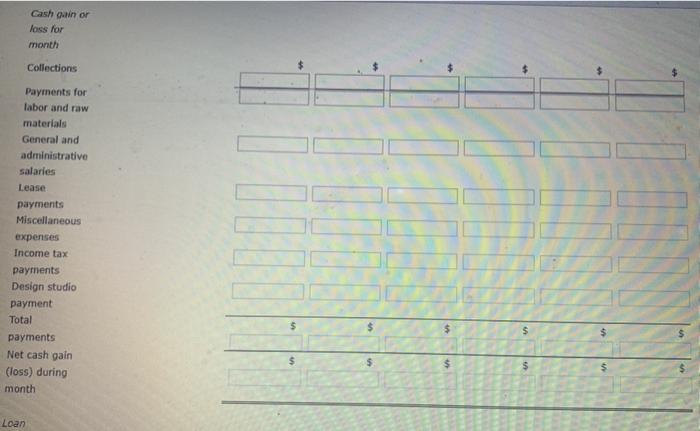

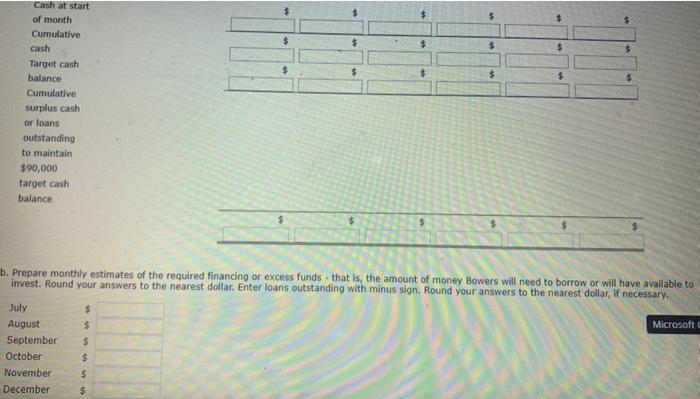

Helen Bowers, owner of Helen's Fashion Designs, is planning to request a line of credit from her bank. She has estimated the following sales forecasts for the firm for parts of 2019 and 2020: May 2019 $186,000 June 186,000 July 372,000 August 540,000 September 720,000 October 360,000 November 360,000 December 90,000 January 2020 180,000 Estimates regarding payments obtained from the credit department are as follows: collected within the month of sale, 10%; collected the month following the sale, 75% collected the second month following the sale, 15%. Payments for labor and raw materials are made the month after these services were provided. Here are the estimated costs of labor plus raw materials: July May 2019 $90,000 June 90,000 126,000 August 883,000 September 305,000 October 234,000 November 162,000 December 90,000 General and administrative salaries are approximately $27,000 a month. Lease payments under long-term leases are $9,000 a month. Depreciation charges are 536.000 a month. Miscellaneous expenses are $2,700 a month. Income tax payments of $64,000 are due in September and December A progress payment of $180,000 on a new design studio must be paid in October. Cash on hand on July 1 will be $132,000, and a minimum cash balance of $90,000 should be maintained throughout the cash budget period. a. Prepare a moniny casn uge for the last omonosor 2014. IT no entry required, enter u or leave it bank, payments and expenses should be enteren as positive numbers. Cash losses, negative cash balance, negative cumulative cash, and cumulative loans outstanding, if any, should be indicated by a minus sign. Round your answers to the nearest dollar, if necessary. May June July August September October November December January Collections and purchases worksheet $ Sales (grass) $ $ $ Full Collections During month of sale During 1st month after sale During 2nd month after sale Total collections Purchases Labor and raw materials Payments for labor and raw materials 5 $ $ $ $ $ $ $ $ $ Cash gain or loss for month Collections Payments for labor and raw materials General and administrative salaries Lease payments Miscellaneous expenses Income tax payments Design studio payment Total payments Net cash gain (loss) during month $ $ $ $ $ Loan $ $ $ $ $ $ $ $ $ $ Cash at start of month Cumulative cash Target cash balance Cumulative surplus cash or loans outstanding to maintain $90,000 target cash balance b. Prepare monthly estimates of the required financing or excess funds that is, the amount of money Bowers will need to borrow or will have available to invest. Round your answers to the nearest dollar. Enter loans outstanding with minus sign. Round your answers to the nearest dollar, if necessary. $ $ Microsoft July August September October November December $ $ $ $