Answered step by step

Verified Expert Solution

Question

1 Approved Answer

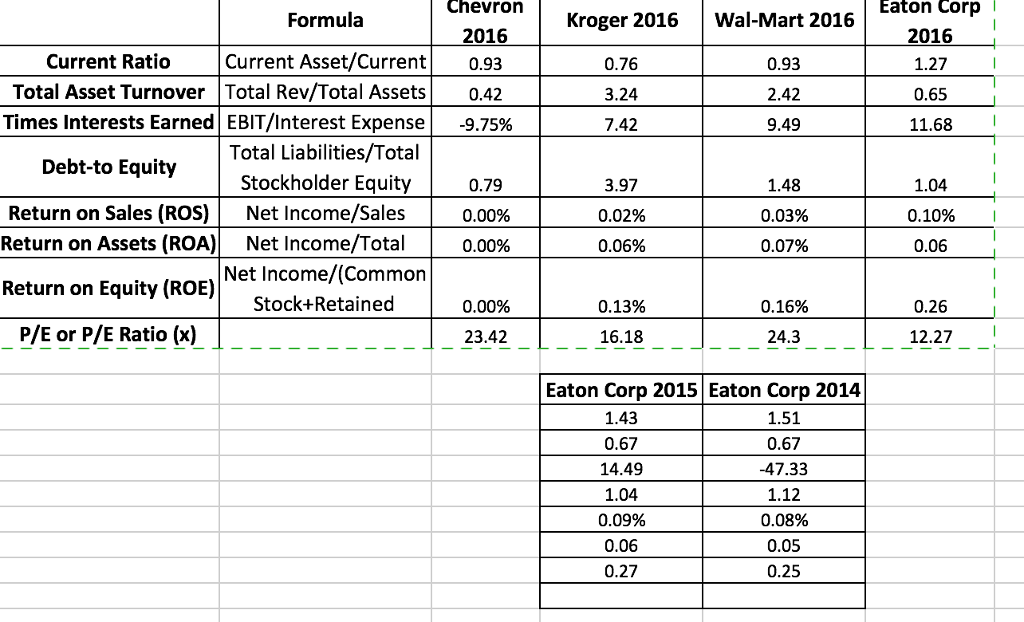

How would you rank the four firms in terms of financial performance? Why might their financial performances differ? What economic or market factors might account

How would you rank the four firms in terms of financial performance?

Why might their financial performances differ?

What economic or market factors might account for big differences in P/E ratios?

Is Eaton's firm performance improving, declining, stable, or is something strange going on?

Who are the firm's competitors? Does the selection of competitors make sense to you?

How is your selected company performing against its competition? (Don't just say better or worse on particular ratios - try to think of and offer reasons why).

Chevron Eaton Corp 2016 1.27 0.65 11.68 Formula Kroger 2016Wal-Mart 2016 2016 Current Ratio Current Asset/Current0.93 Total Asset Turnover Total Rev/Total Assets0.42 Times interests Earned| EBIT/Interest Expense -9.75% 0.76 3.24 7.42 0.93 2.42 9.49 Total Liabilities/Total Stockholder Equity Net Income/Sales Net Income/Total Net Income/(Common Stock+Retained Debt-to Equity 0.79 0.00% 0.00% 3.97 0.02% 0.06% 1.48 0.03% 0.07% 1.04 Return on Sales (ROS) | 0.10% I Return on Assets (ROA) Return on Equity (ROE) P/E or P/E atio(x) 0.06 0.00% 0.13% 0.16% 0.26 23.42 16.18 24.3 -L__12.27 Eaton Corp 2015 Eaton Corp 2014 1.43 0.67 14.49 1.04 0.09% 0.06 0.27 1.51 0.67 47.33 1.12 0.08% 0.05 0.25Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started