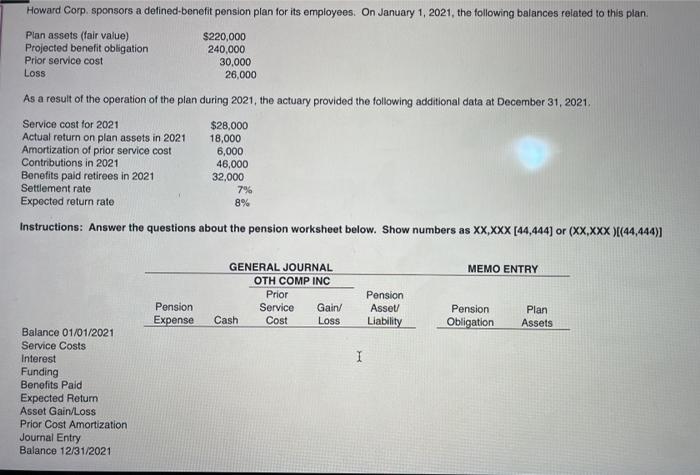

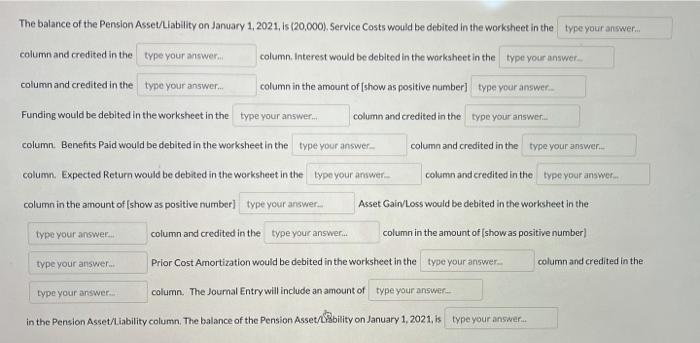

Howard Corp. sponsors a detined-benefit pension plan for its employees. On January 1, 2021, the following balances related to this plan Plan assets (fair value) $220,000 Projected benefit obligation 240,000 Prior service cost 30,000 Loss 26,000 As a result of the operation of the plan during 2021, the actuary provided the following additional data at December 31, 2021. Service cost for 2021 $28,000 Actual return on plan assets in 2021 18,000 Amortization of prior service cost 6,000 Contributions in 2021 46,000 Benefits paid retirees in 2021 32,000 Settlement rate 7% Expected return rate 8% Instructions: Answer the questions about the pension worksheet below. Show numbers as XX,XXX [44,444) or (XX.XXX (44,444) MEMO ENTRY GENERAL JOURNAL OTH COMP INC Prior Service Gain/ Cash Cost LOSS Pension Expense Pension Asset Liability Pension Obligation Plan Assets I Balance 01/01/2021 Service Costs Interest Funding Benefits Paid Expected Return Asset Gain/Loss Prior Cost Amortization Journal Entry Balance 12/31/2021 The balance of the Pension Asset/Liability on January 1, 2021, is (20,000), Service Costs would be debited in the worksheet in the type your answer.. column and credited in the type your answer. column. Interest would be debited in the worksheet in the type your answer column and credited in the type your answer... column in the amount of (show as positive number] type your answer. Funding would be debited in the worksheet in the type your answer. column and credited in the type your answer column. Benefits Paid would be debited in the worksheet in the type your answer column and credited in the type your answer... column. Expected Return would be debited in the worksheet in the type your answer.. column and credited in the type your answer column in the amount of [show as positive number] type your answer... Asset Gain Loss would be debited in the worksheet in the type your answer column and credited in the type your answer column in the amount of Ishow as positive number type your answer... Prior Cost Amortization would be debited in the worksheet in the type your answer.. column and credited in the type your answer column. The Journal Entry will include an amount of type your answer in the Pension Asset/Liability column. The balance of the Pension Asset ability on January 1, 2021. is type your