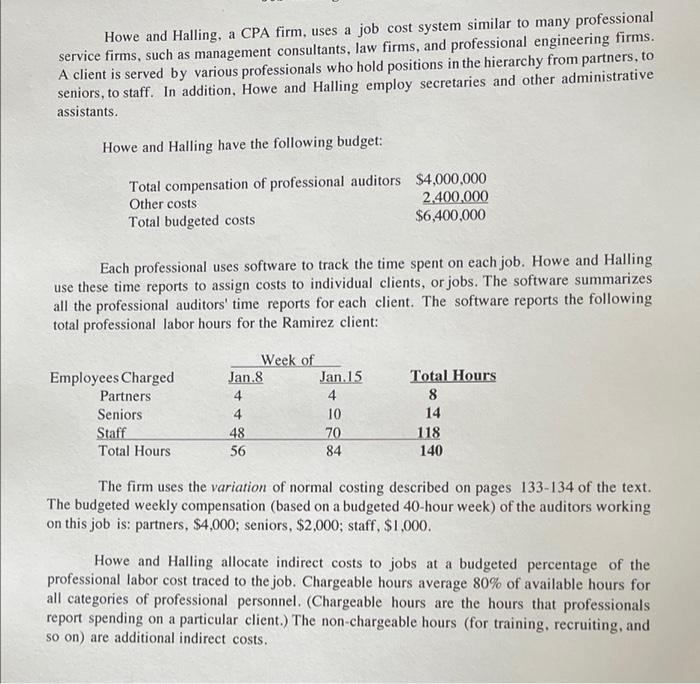

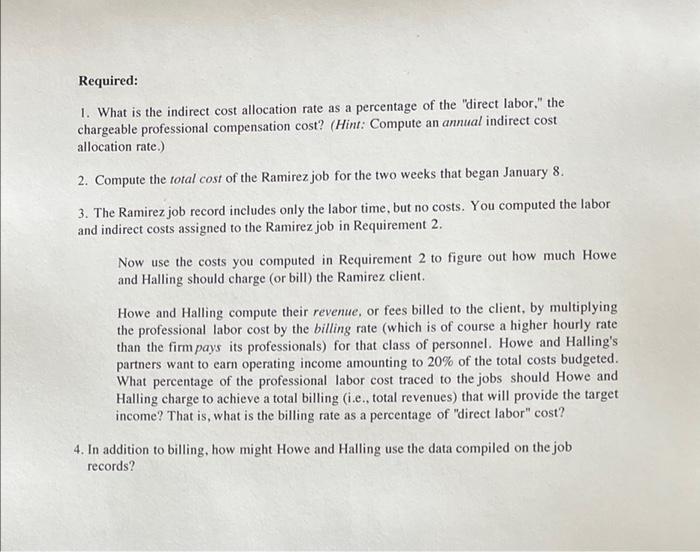

Howe and Halling, a CPA firm, uses a job cost system similar to many professional service firms, such as management consultants, law firms, and professional engineering firms. A client is served by various professionals who hold positions in the hierarchy from partners, to seniors, to staff. In addition, Howe and Halling employ secretaries and other administrative assistants. Howe and Halling have the following budget: Total compensation of professional auditors $4,000,000 Other costs 2.400.000 Total budgeted costs $6,400,000 Each professional uses software to track the time spent on each job. Howe and Halling use these time reports to assign costs to individual clients, or jobs. The software summarizes all the professional auditors' time reports for each client. The software reports the following total professional labor hours for the Ramirez client: Employees Charged Partners Seniors Staff Total Hours Week of Jan.8 Jan. 15 4 4 10 48 70 56 84 Total Hours 8 14 118 140 The firm uses the variation of normal costing described on pages 133-134 of the text. The budgeted weekly compensation (based on a budgeted 40-hour week) of the auditors working on this job is: partners, $4,000; seniors, $2,000; staff, $1.000. Howe and Halling allocate indirect costs to jobs at a budgeted percentage of the professional labor cost traced to the job. Chargeable hours average 80% of available hours for all categories of professional personnel. (Chargeable hours are the hours that professionals report spending on a particular client. The non-chargeable hours (for training, recruiting, and so on) are additional indirect costs. Required: 1. What is the indirect cost allocation rate as a percentage of the "direct labor," the chargeable professional compensation cost? (Hint: Compute an annual indirect cost allocation rate.) 2. Compute the total cost of the Ramirez job for the two weeks that began January 8. 3. The Ramirez job record includes only the labor time, but no costs. You computed the labor and indirect costs assigned to the Ramirez job in Requirement 2. Now use the costs you computed in Requirement 2 to figure out how much Howe and Halling should charge (or bill) the Ramirez client. Howe and Halling compute their revenue, or fees billed to the client, by multiplying the professional labor cost by the billing rate (which is of course a higher hourly rate than the firm pays its professionals) for that class of personnel. Howe and Halling's partners want to earn operating income amounting to 20% of the total costs budgeted. What percentage of the professional labor cost traced to the jobs should Howe and Halling charge to achieve a total billing (i.e., total revenues) that will provide the target income? That is, what is the billing rate as a percentage of "direct labor" cost? 4. In addition to billing, how might Howe and Halling use the data compiled on the job records? Howe and Halling, a CPA firm, uses a job cost system similar to many professional service firms, such as management consultants, law firms, and professional engineering firms. A client is served by various professionals who hold positions in the hierarchy from partners, to seniors, to staff. In addition, Howe and Halling employ secretaries and other administrative assistants. Howe and Halling have the following budget: Total compensation of professional auditors $4,000,000 Other costs 2.400.000 Total budgeted costs $6,400,000 Each professional uses software to track the time spent on each job. Howe and Halling use these time reports to assign costs to individual clients, or jobs. The software summarizes all the professional auditors' time reports for each client. The software reports the following total professional labor hours for the Ramirez client: Employees Charged Partners Seniors Staff Total Hours Week of Jan.8 Jan. 15 4 4 10 48 70 56 84 Total Hours 8 14 118 140 The firm uses the variation of normal costing described on pages 133-134 of the text. The budgeted weekly compensation (based on a budgeted 40-hour week) of the auditors working on this job is: partners, $4,000; seniors, $2,000; staff, $1.000. Howe and Halling allocate indirect costs to jobs at a budgeted percentage of the professional labor cost traced to the job. Chargeable hours average 80% of available hours for all categories of professional personnel. (Chargeable hours are the hours that professionals report spending on a particular client. The non-chargeable hours (for training, recruiting, and so on) are additional indirect costs. Required: 1. What is the indirect cost allocation rate as a percentage of the "direct labor," the chargeable professional compensation cost? (Hint: Compute an annual indirect cost allocation rate.) 2. Compute the total cost of the Ramirez job for the two weeks that began January 8. 3. The Ramirez job record includes only the labor time, but no costs. You computed the labor and indirect costs assigned to the Ramirez job in Requirement 2. Now use the costs you computed in Requirement 2 to figure out how much Howe and Halling should charge (or bill) the Ramirez client. Howe and Halling compute their revenue, or fees billed to the client, by multiplying the professional labor cost by the billing rate (which is of course a higher hourly rate than the firm pays its professionals) for that class of personnel. Howe and Halling's partners want to earn operating income amounting to 20% of the total costs budgeted. What percentage of the professional labor cost traced to the jobs should Howe and Halling charge to achieve a total billing (i.e., total revenues) that will provide the target income? That is, what is the billing rate as a percentage of "direct labor" cost? 4. In addition to billing, how might Howe and Halling use the data compiled on the job records