Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Howie Star Company manufactures men clothing, It uses a job costing system that allocates factory overhead on the basis of direct labor- hours. Budgeted factory

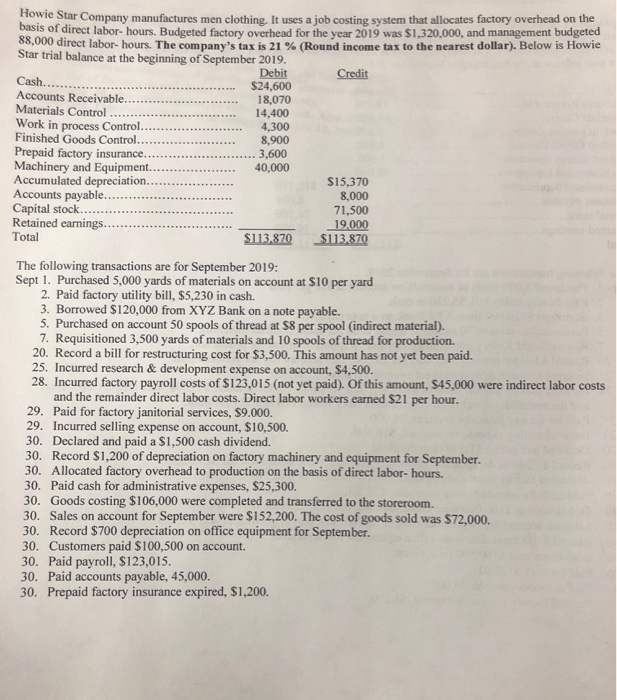

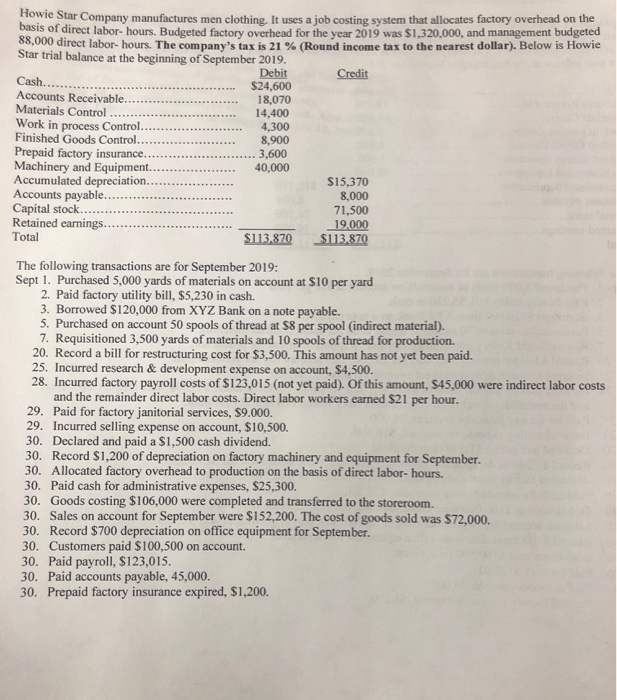

Howie Star Company manufactures men clothing, It uses a job costing system that allocates factory overhead on the basis of direct labor- hours. Budgeted factory overhead for the year 2019 was $1,320,000, and management budgeted 88,000 direct labor- hours. The company's tax is 21 % (Round income tax to the nearest dollar). Below is Howie Star trial balance at the beginning of September 2019 Debit $24,600 18,070 14,400 4,300 8,900 3,600 40,000 Credit Cash.. Accounts Receivable... Materials Control Work in process Control. Finished Goods Control... Prepaid factory insurance... Machinery and Equipment.. Accumulated depreciation.. Accounts payable.. Capital stock... Retained earnings.. $15,370 8,000 71,500 19.000 $113,870 Total $113.870 The following transactions are for September 2019: Sept 1. Purchased 5,000 yards of materials on account at $10 per yard 2. Paid factory utility bill, $5,230 in cash. 3. Borrowed $120,000 from XYZ Bank on a note payable. 5. Purchased on account 50 spools of thread at $8 per spool (indirect material). 7. Requisitioned 3,500 yards of materials and 10 spools of thread for production. 20. Record a bill for restructuring cost for $3,500. This amount has not yet been paid. 25. Incurred research & development expense on account, $4,500. 28. Incurred factory payroll costs of $123,015 (not yet paid). Of this amount, $45,000 were indirect labor costs and the remainder direct labor costs. Direct labor workers earned $21 per hour. 29. Paid for factory janitorial services, $9.000. 29. Incurred selling expense on account, $10,500. 30. Declared and paid a $1,500 cash dividend. 30. Record $1,200 of depreciation on factory machinery and equipment for September. 30. Allocated factory overhead to production on the basis of direct labor- hours. 30. Paid cash for administrative expenses, $25,300. 30. Goods costing $106,000 were completed and transferred to the storeroom. 30. Sales on account for September were $152,200. The cost of goods sold was $72,000. 30. Record $700 depreciation on office equipment for September. 30. Customers paid $100,500 on account. 30. Paid payroll, $123,015. 30. Paid accounts payable, 45,000. 30. Prepaid factory insurance expired, $1,200. 30. Accrue $1,050 interest expense. 30. Calculate the overallocated or underallocated overhead and close this amount to the Cost of Goods Sold account. Required 1. Compute the company's factory overhead allocation rate for the year. 2. Prepare journal entries to record September transactions. Explanations are not required. If needed round numbers to the nearest dollar. Skip a line after each completed journal entry 3. Post the journal entries to the appropriate general ledger accounts. 4. Prepare a trial balance for September 2019 6. Prepare a multiple-step income statement and a classi fied balance sheet for September 2019. Frint and submit the general journal, general ledger, trial balance, income statement and balance sheet. Attach these documents to this project sheet with the team members' names. 8. Also, email me your Excel income statement and balance sheet only on or before the due date

Howie Star Company manufactures men clothing, It uses a job costing system that allocates factory overhead on the basis of direct labor- hours. Budgeted factory overhead for the year 2019 was $1,320,000, and management budgeted 88,000 direct labor- hours. The company's tax is 21 % (Round income tax to the nearest dollar). Below is Howie Star trial balance at the beginning of September 2019 Debit $24,600 18,070 14,400 4,300 8,900 3,600 40,000 Credit Cash.. Accounts Receivable... Materials Control Work in process Control. Finished Goods Control... Prepaid factory insurance... Machinery and Equipment.. Accumulated depreciation.. Accounts payable.. Capital stock... Retained earnings.. $15,370 8,000 71,500 19.000 $113,870 Total $113.870 The following transactions are for September 2019: Sept 1. Purchased 5,000 yards of materials on account at $10 per yard 2. Paid factory utility bill, $5,230 in cash. 3. Borrowed $120,000 from XYZ Bank on a note payable. 5. Purchased on account 50 spools of thread at $8 per spool (indirect material). 7. Requisitioned 3,500 yards of materials and 10 spools of thread for production. 20. Record a bill for restructuring cost for $3,500. This amount has not yet been paid. 25. Incurred research & development expense on account, $4,500. 28. Incurred factory payroll costs of $123,015 (not yet paid). Of this amount, $45,000 were indirect labor costs and the remainder direct labor costs. Direct labor workers earned $21 per hour. 29. Paid for factory janitorial services, $9.000. 29. Incurred selling expense on account, $10,500. 30. Declared and paid a $1,500 cash dividend. 30. Record $1,200 of depreciation on factory machinery and equipment for September. 30. Allocated factory overhead to production on the basis of direct labor- hours. 30. Paid cash for administrative expenses, $25,300. 30. Goods costing $106,000 were completed and transferred to the storeroom. 30. Sales on account for September were $152,200. The cost of goods sold was $72,000. 30. Record $700 depreciation on office equipment for September. 30. Customers paid $100,500 on account. 30. Paid payroll, $123,015. 30. Paid accounts payable, 45,000. 30. Prepaid factory insurance expired, $1,200. 30. Accrue $1,050 interest expense. 30. Calculate the overallocated or underallocated overhead and close this amount to the Cost of Goods Sold account. Required 1. Compute the company's factory overhead allocation rate for the year. 2. Prepare journal entries to record September transactions. Explanations are not required. If needed round numbers to the nearest dollar. Skip a line after each completed journal entry 3. Post the journal entries to the appropriate general ledger accounts. 4. Prepare a trial balance for September 2019 6. Prepare a multiple-step income statement and a classi fied balance sheet for September 2019. Frint and submit the general journal, general ledger, trial balance, income statement and balance sheet. Attach these documents to this project sheet with the team members' names. 8. Also, email me your Excel income statement and balance sheet only on or before the due date

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started