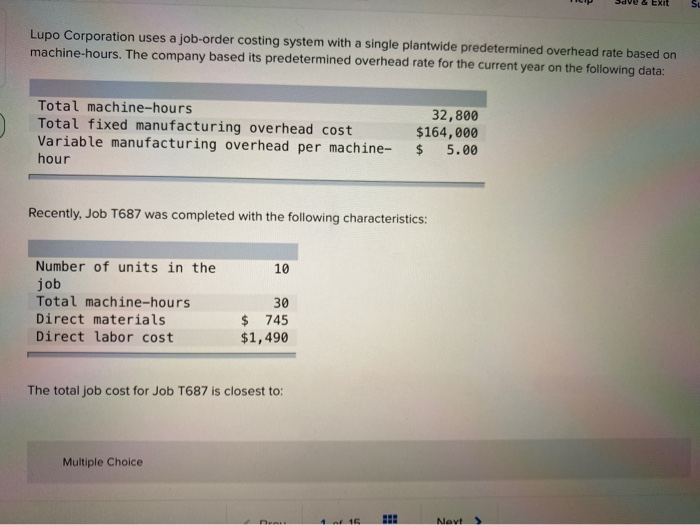

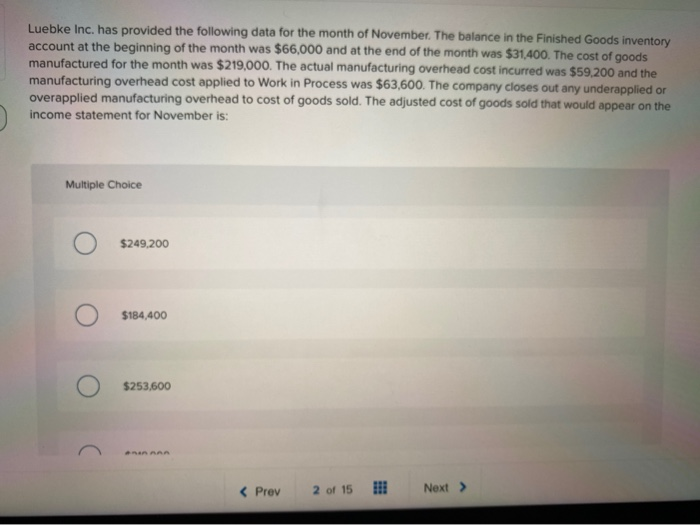

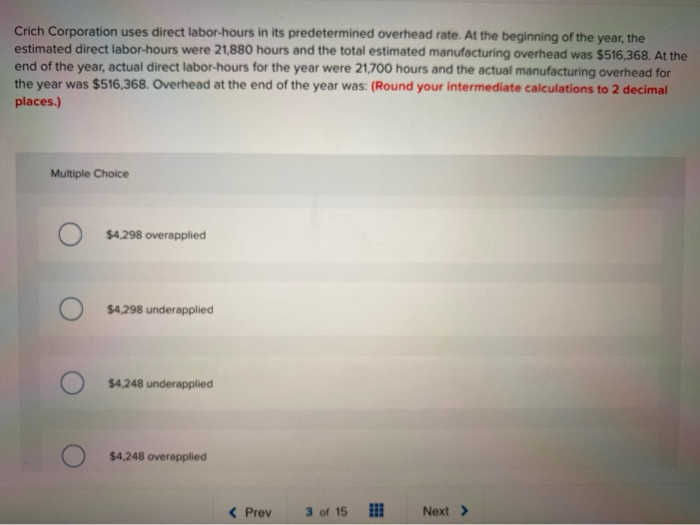

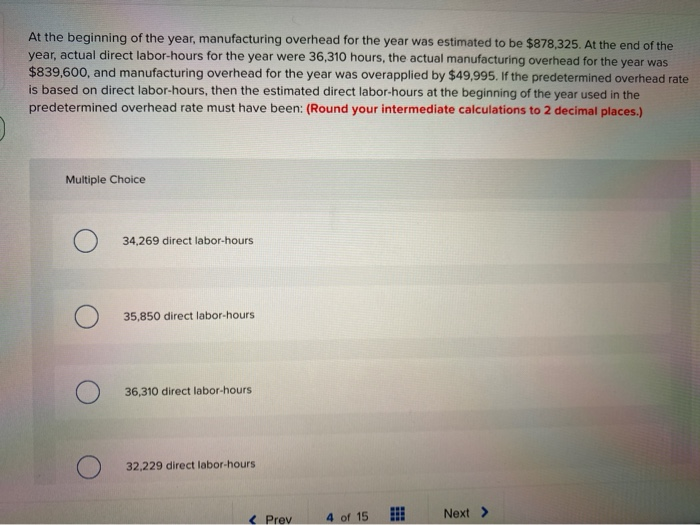

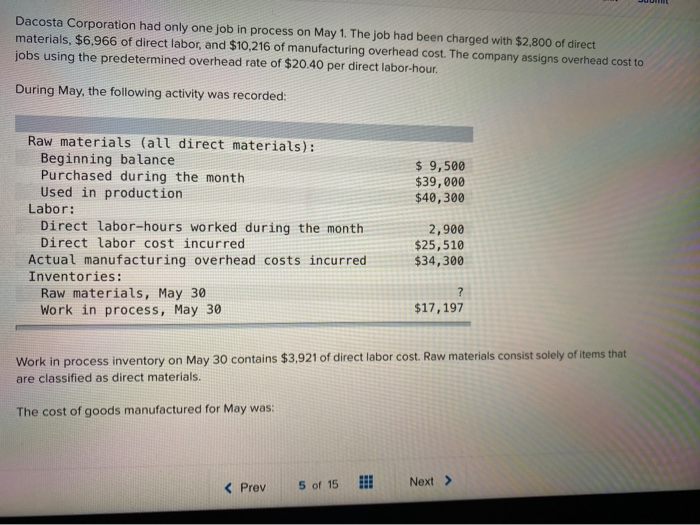

Hp Save & Exit Su Lupo Corporation uses a job-order costing system with a single plantwide predetermined overhead rate based on machine-hours. The company based its predetermined overhead rate for the current year on the following data: Total machine-hours Total fixed manufacturing overhead cost Variable manufacturing overhead per machine- hour 32,800 $164,000 $ 5.00 Recently, Job T687 was completed with the following characteristics: 10 Number of units in the job Total machine-hours Direct materials Direct labor cost 30 $ 745 $1,490 The total job cost for Job T687 is closest to: Multiple Choice .. .16 HH! Nevt Luebke Inc. has provided the following data for the month of November. The balance in the Finished Goods inventory account at the beginning of the month was $66,000 and at the end of the month was $31.400. The cost of goods manufactured for the month was $219,000. The actual manufacturing overhead cost incurred was $59.200 and the manufacturing overhead cost applied to Work in Process was $63,600. The company closes out any underapplied or overapplied manufacturing overhead to cost of goods sold. The adjusted cost of goods sold that would appear on the income statement for November is: Multiple Choice $249,200 Looo $184,400 $253,600 *nonnnn Crich Corporation uses direct labor-hours in its predetermined overhead rate. At the beginning of the year, the estimated direct labor-hours were 21,880 hours and the total estimated manufacturing overhead was $516,368. At the end of the year, actual direct labor-hours for the year were 21,700 hours and the actual manufacturing overhead for the year was $516,368. Overhead at the end of the year was: (Round your intermediate calculations to 2 decimal places.) Multiple Choice $4,298 overapplied $4,298 underapplied 10000 $4,248 underapplied $4,248 overapplied At the beginning of the year, manufacturing overhead for the year was estimated to be $878,325. At the end of the year, actual direct labor-hours for the year were 36,310 hours, the actual manufacturing overhead for the year was $839.600, and manufacturing overhead for the year was overapplied by $49,995. If the predetermined overhead rate is based on direct labor-hours, then the estimated direct labor-hours at the beginning of the year used in the predetermined overhead rate must have been: (Round your intermediate calculations to 2 decimal places.) Multiple Choice 34,269 direct labor-hours O 35,850 direct labor-hours O 36,310 direct labor-hours O 32,229 direct labor hours O Dacosta Corporation had only one job in process on May 1. The job had been charged with $2,800 of direct materials, $6,966 of direct labor, and $10,216 of manufacturing overhead cost. The company assigns overhead cost to jobs using the predetermined overhead rate of $20.40 per direct labor-hour. During May, the following activity was recorded: $ 9,500 $39,000 $40,300 Raw materials (all direct materials): Beginning balance Purchased during the month Used in production Labor: Direct labor-hours worked during the month Direct labor cost incurred Actual manufacturing overhead costs incurred Inventories: Raw materials, May 30 Work in process, May 30 2,900 $25,510 $34,300 $17,197 Work in process inventory on May 30 contains $3,921 of direct labor cost. Raw materials consist solely of items that are classified as direct materials. The cost of goods manufactured for May was: