Question

HQ Connect (Pty) Ltd (referred to hereunder as HQC), is a resident company that sells various technological products, including smartphones and tablets. The company is

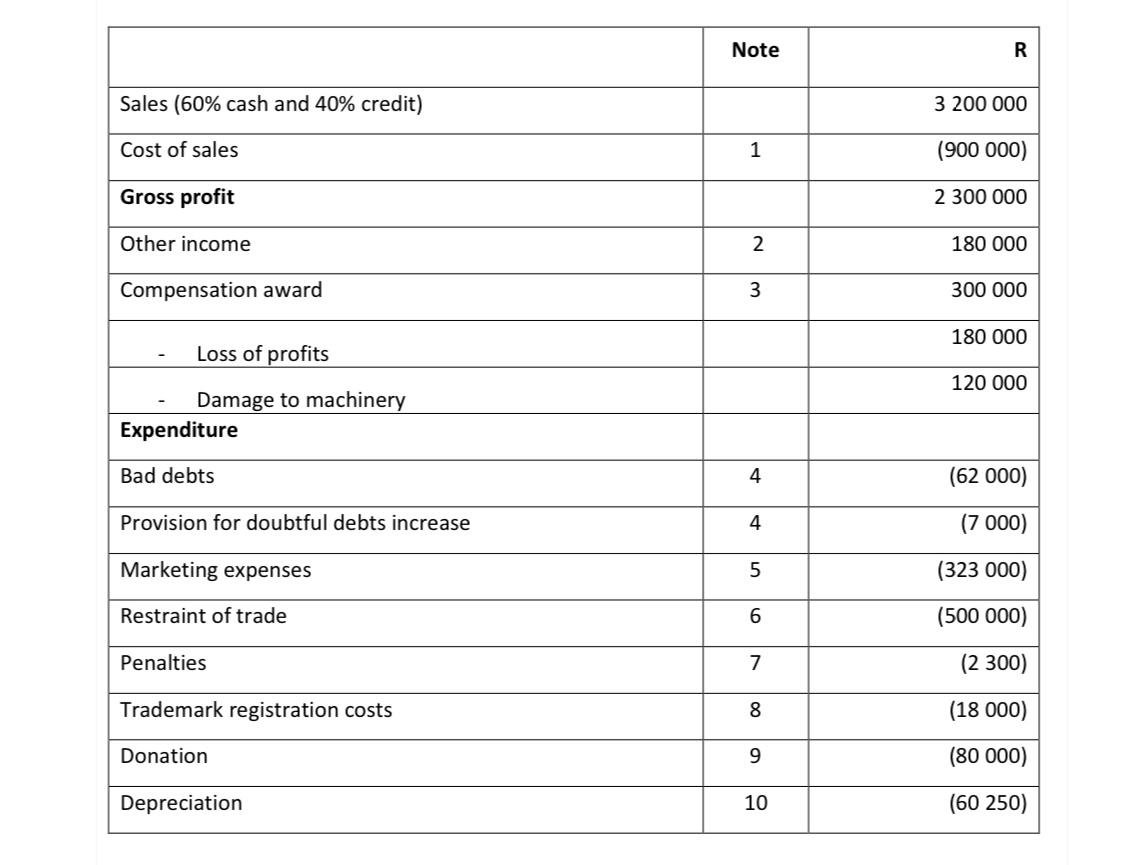

HQ Connect (Pty) Ltd (referred to hereunder as HQC), is a resident company that sells various technological products, including smartphones and tablets. The company is a small business corporation as defined in the Income Tax Act and its financial year ends on the last day of March. You are provided with an extract of the statement of profit or loss and other comprehensive income of HQ Connect (Pty) Ltd for the year of assessment ending 31 March 2024:

Notes:

1. Cost of Sales

The cost of sales is made up as follows:

R Opening stock (at cost price) 220 000

Add: Purchases 980 000

Less: Closing stock (at cost price) (300 000)

=Cost of sales 900 000

The market value of the opening stock is R200 000. The Commissioner accepts this market value as reasonable.

2.Other income

HQC received local dividends from a South African entity of R145 000. The company also received local interest of R35 000.

3. Compensation award

HQC's compensation award of R300 000 resulted from a fire at its business premises on 20 December 2023. The machinery affected by the fire incurred severe damage and was deemed irreparable. To replace the damaged machinery, HQC purchased new machinery for R200 000. On 29 February 2024, the new machinery was put into use for manufacturing purposes. The tax value and book value of its damaged machinery at the date of the fire was Rnil, having originally cost R150 000. The machinery had previously qualified for a section 12E(l) deduction equivalent to its full cost (100%) in the year that it was brought into use.

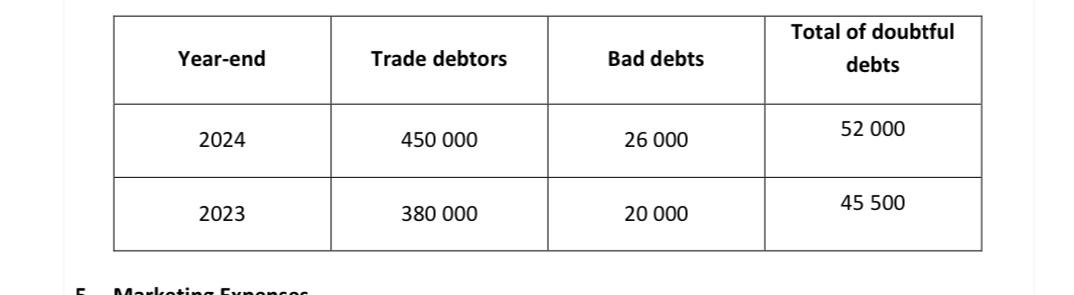

4. Bad debts

The company does not apply IFRS 9 for financial reporting purposes. The doubtful debts have been overdue for a period ranging from 60 days to 120 days. SARS approved an allowance for doubtful debts in the previous year of assessment.

5. Marketing Expenses

In a campaign to gain exposure and grow its sales, the company launched a campaign which was approved at the shareholders’ meeting. A billboard was erected on the busy highway at a cost of R300 000. The company also rented a billboard that is to be used in the outlying areas of KZN. The rental costs amounted to R23 000 in the current year of assessment.

6. Restraint of trade

On 25 March 2024, HQC made a restraint of trade payment of R500 000 to Mr Engelbrecht, one of their lead engineers. This payment was made to restrict Mr Engelbrecht from competing with the company for a period of two years starting from the date of the payment. However, only R450 000 out of the total payment will be considered as income in the hands of Mr Engelbrecht.

7.Penalties

HQC incurred a late payment penalty of R2 300 from the South African Revenue Service for paying their January 2024 PAYE after the due date.

8. Trademarks

A trademark was purchased for use over a four-year period for R220 000 during the 2020 year of assessment. The registration of this trademark was renewed on 1 January 2024 for four years at a cost of R18 000.

9. Donations

HQC donated 5 tablets with a cost price of R16 000 each and a market value of R33 000 each, to a local children’s organisation. The company received a valid section 18A receipt. 10.

Depreciation The depreciation relates to the following assets:

• Second-hand equipment purchased for R132 250 (including VAT) on 02 January 2024.

• Furniture for the company was purchased for a total value of R90 000 on 01 April 2022.

SARS allows the following write-off periods for purposes of section 11(e), according to Interpretation Note No. 47:

• Furniture - 4 years

• Equipment – 5 years

Additional Information: Assume that HQ Connect (Pty) Ltd would like to minimise its normal tax liability for the 2024 year of assessment. The company will make any available elections in order to achieve this and will also duly notify the Commissioner in writing of its election where applicable.

Q.2 Calculate the net normal tax payable by HQ Connect (Pty) Ltd for the year of assessment ended 31 March 2024. Show all calculations and round off all amounts to the nearest rand. Include nil value items in your answer and provide a reason for doing so.

Sales (60% cash and 40% credit) Cost of sales Gross profit Other income Compensation award Loss of profits Damage to machinery Expenditure Bad debts Provision for doubtful debts increase Marketing expenses Restraint of trade Penalties Trademark registration costs Donation Depreciation Note 1 2 3 4 4 5 6 7 8 9 10 R 3 200 000 (900 000) 2 300 000 180 000 300 000 180 000 120 000 (62 000) (7 000) (323 000) (500 000) (2 300) (18 000) (80 000) (60 250)

Step by Step Solution

3.49 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the net normal tax payable by HQ Connect Pty Ltd for the year of assessment ended 31 March 2024 we need to consider various income and expense items and apply the relevant tax rules Lets ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started