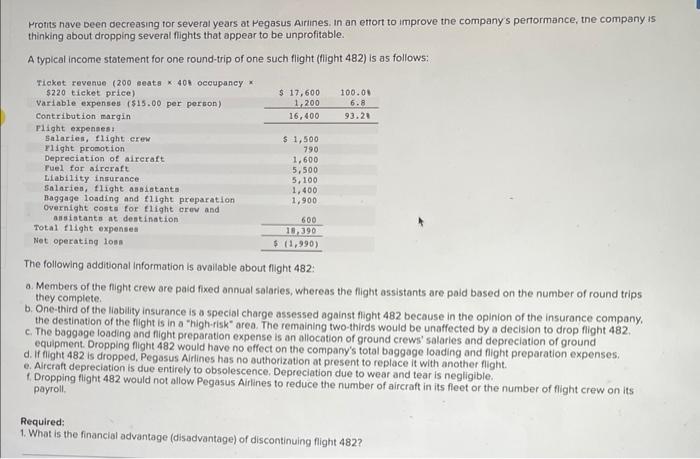

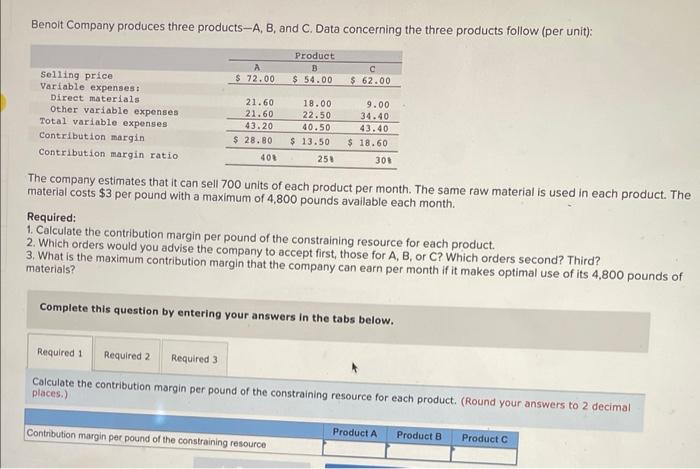

Hronts nave been decreasing tor several years at Fegasus Airines, in an ettort to improve the company's pertormance, the company is thinking about dropping several fights that appear to be unprofitable. A typical income statement for one round-trip of one such flight (llight 482 ) is as follows: The following additional information is avaliable about filght 482 : a. Members of the filght crew are paid fixed annual salaries, whereas the flight assistants are paid based on the number of round trips they complete. b. One-third of the liablity insurance is a special charge assessed against flight 482 because in the opinion of the insurance company. the destination of the filight is in a "high-fisk" area. The remaining two-thirds would be unaffected by a decislon to drop flight 482 . c. The baggage loading and filght preparation expense is an allocation of ground crews' salaries and depreciation of ground equipment. Dropping flight 482 would have no effect on the company's total baggage loading and flight preparation expenses: d. If flight 482 is dropped, Pegasus Airlines has no outhorization at present to replace it with another flight. e. Aircraft depreciation is due entirely to obsolescence. Depreciation due to wear and tear is negligible. f. Droppin payroll. Required: 1. What is the financial advantage (disadvantage) of discontinuing flight 482? Benoit Company produces three products-A, B, and C. Data concerning the three products follow (per unit): The company estimates that it can sell 700 units of each product per month. The same raw material is used in each product. The material costs $3 per pound with a maximum of 4,800 pounds available each month. Required: 1. Calculate the contribution margin per pound of the constraining resource for each product. 2. Which orders would you advise the company to accept first, those for A, B, or C? Which orders second? Third? 3. What is the maximum contribution margin that the company can earn per month if it makes optimal use of its 4,800 pounds of materials? Complete this question by entering your answers in the tabs below. Calculate the contribution margin per pound of the constraining resource for each product. (Round your answers to 2 decimal