Hrudka Corp. has manufactured a broad range of quality products since 1991. The operating cycle of the business is less than one year. The

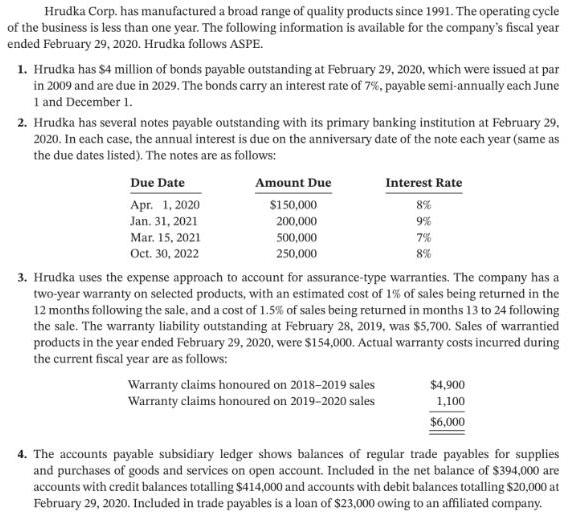

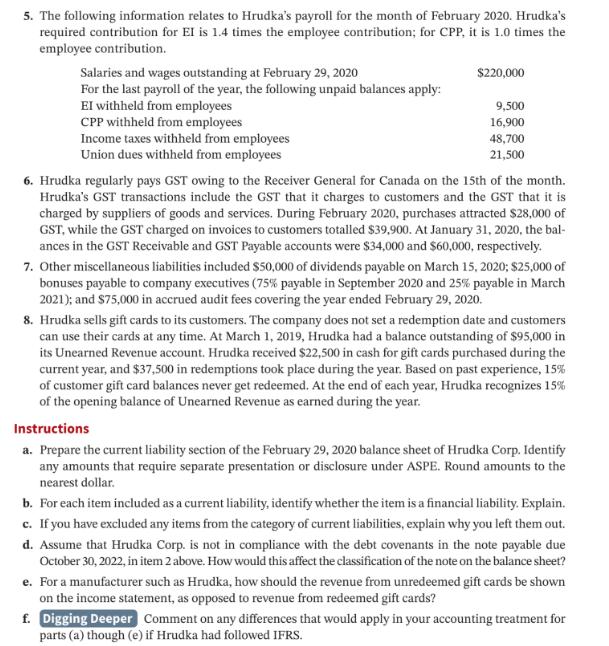

Hrudka Corp. has manufactured a broad range of quality products since 1991. The operating cycle of the business is less than one year. The following information is available for the company's fiscal year ended February 29, 2020. Hrudka follows ASPE. 1. Hrudka has $4 million of bonds payable outstanding at February 29, 2020, which were issued at par in 2009 and are due in 2029. The bonds carry an interest rate of 7%, payable semi-annually each June 1 and December 1. 2. Hrudka has several notes payable outstanding with its primary banking institution at February 29, 2020. In each case, the annual interest is due on the anniversary date of the note each year (same as the due dates listed). The notes are as follows: Due Date Apr. 1, 2020 Jan. 31, 2021 Mar. 15, 2021 Oct. 30, 2022 Amount Due $150,000 200,000 500,000 250,000 Interest Rate 8% 9% 7% 8% 3. Hrudka uses the expense approach to account for assurance-type warranties. The company has a two-year warranty on selected products, with an estimated cost of 1% of sales being returned in the 12 months following the sale, and a cost of 1.5% of sales being returned in months 13 to 24 following the sale. The warranty liability outstanding at February 28, 2019, was $5,700. Sales of warrantied products in the year ended February 29, 2020, were $154,000. Actual warranty costs incurred during the current fiscal year are as follows: Warranty claims honoured on 2018-2019 sales Warranty claims honoured on 2019-2020 sales $4,900 1,100 $6,000 4. The accounts payable subsidiary ledger shows balances of regular trade payables for supplies and purchases of goods and services on open account. Included in the net balance of $394,000 are accounts with credit balances totalling $414,000 and accounts with debit balances totalling $20,000 at February 29, 2020. Included in trade payables is a loan of $23,000 owing to an affiliated company. 5. The following information relates to Hrudka's payroll for the month of February 2020. Hrudka's required contribution for EI is 1.4 times the employee contribution; for CPP, it is 1.0 times the employee contribution. Salaries and wages outstanding at February 29, 2020 For the last payroll of the year, the following unpaid balances apply: El withheld from employees CPP withheld from employees Income taxes withheld from employees Union dues withheld from employees $220,000 9,500 16,900 48,700 21,500 6. Hrudka regularly pays GST owing to the Receiver General for Canada on the 15th of the month. Hrudka's GST transactions include the GST that it charges to customers and the GST that it is charged by suppliers of goods and services. During February 2020, purchases attracted $28,000 of GST, while the GST charged on invoices to customers totalled $39,900. At January 31, 2020, the bal- ances in the GST Receivable and GST Payable accounts were $34,000 and $60,000, respectively. 7. Other miscellaneous liabilities included $50,000 of dividends payable on March 15, 2020; $25,000 of bonuses payable to company executives (75% payable in September 2020 and 25% payable in March 2021); and $75,000 in accrued audit fees covering the year ended February 29, 2020. 8. Hrudka sells gift cards to its customers. The company does not set a redemption date and customers can use their cards at any time. At March 1, 2019, Hrudka had a balance outstanding of $95,000 in its Unearned Revenue account. Hrudka received $22,500 in cash for gift cards purchased during the current year, and $37,500 in redemptions took place during the year. Based on past experience, 15% of customer gift card balances never get redeemed. At the end of each year, Hrudka recognizes 15% of the opening balance of Unearned Revenue as earned during the year. Instructions a. Prepare the current liability section of the February 29, 2020 balance sheet of Hrudka Corp. Identify any amounts that require separate presentation or disclosure under ASPE. Round amounts to the nearest dollar. b. For each item included as a current liability, identify whether the item is a financial liability. Explain. c. If you have excluded any items from the category of current liabilities, explain why you left them out. d. Assume that Hrudka Corp. is not in compliance with the debt covenants in the note payable due October 30, 2022, in item 2 above. How would this affect the classification of the note on the balance sheet? e. For a manufacturer such as Hrudka, how should the revenue from unredeemed gift cards be shown on the income statement, as opposed to revenue from redeemed gift cards? f. Digging Deeper Comment on any differences that would apply in your accounting treatment for parts (a) though (e) if Hrudka had followed IFRS.

Step by Step Solution

3.67 Rating (180 Votes )

There are 3 Steps involved in it

Step: 1

a Prepare Curre lability secue c4 feb 29 2020 balane sheet Current Labilit...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started