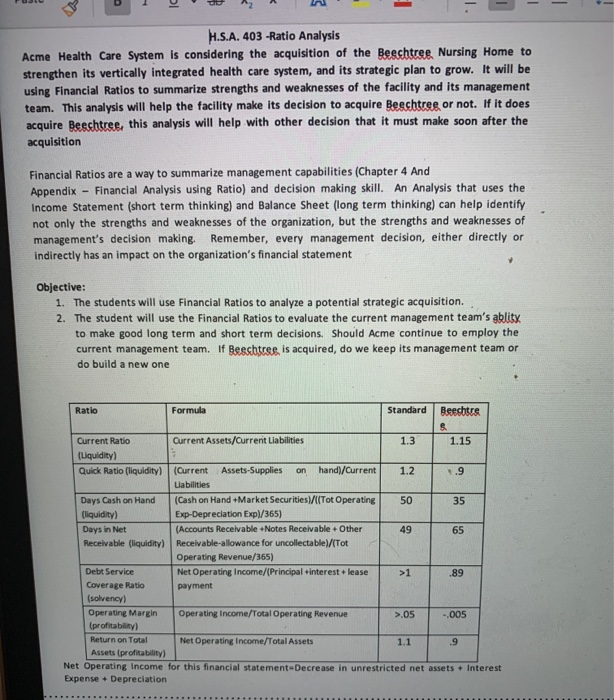

H.S.A. 403 -Ratio Analysis Acme Health Care System is considering the acquisition of the Beschtree Nursing Home to strengthen its vertically integrated health care system, and its strategic plan to grow. It will be using Financial Ratios to summarize strengths and weaknesses of the facility and its management team. This analysis will help the facility make its decision to acquire Beschtree or not. If it does acquire Beechtree, this analysis will help with other decision that it must make soon after the acquisition Financial Ratios are a way to summarize management capabilities (Chapter 4 And Appendix - Financial Analysis using Ratio) and decision making skill. An Analysis that uses the Income Statement (short term thinking) and Balance Sheet (long term thinking) can help identify not only the strengths and weaknesses of the organization, but the strengths and weaknesses of management's decision making. Remember, every management decision, either directly or indirectly has an impact on the organization's financial statement Objective: 1. The students will use Financial Ratios to analyze a potential strategic acquisition. 2. The student will use the Financial Ratios to evaluate the current management team's ablity to make good long term and short term decisions. Should Acme continue to employ the current management team. If Besshtree is acquired, do we keep its management team or do build a new one Ratio Formula Standard Beesbtre 1.3 1.2 Current Ratio Current Assets/Current Liabilities 1.15 (Liquidity) Quick Ratio (liquidity) (Current Assets-Supplies on hand)/Current Uabilities Days Cash on Hand (Cash on Hand+Market Securities)/([Tot Operating (liquidity) Exp-Depreciation Expl/365) Days in Net (Accounts Receivable +Notes Receivable + Other Receivable (liquidity) Receivable-allowance for uncollectable)/(Tot Operating Revenue/365) Debt Service Net Operating Income/(Principal interest+lease Coverage Ratio payment (solvency) Operating Margin Operating Income/Total Operating Revenue (profitability) Return on Total Net Operating Income/Total Assets Assets (profitability Net Operating Income for this financial statement-Decrease in unrestricted net assets + Interest Expense + Depreciation -005 Remember the standard is a comparison point. It is sometimes better when the facility is lower than the standard. For example, Days in Net Receivable is a ratio that looks at how long it takes to collect payment after the bill/invoice has been sent. It is always better to get paid sooner than later. In contrast, Days Cash on Hand is a ratio where being above standard is better. Think of this ratio in the following manner. If an organization billing system blows up and we cannot bill/collect payment (no cash coming in) - how many days can the facility operate because it has cash in the bank (cash on hand)? Keep in mind that having too much cash on hand is not a good thing either. Cash sitting in the bank doesn't earn enough interest to help support strategic activities You will submit a one page memo that explains how the ratios help identify the strengths and weaknesses of the facility and the management team. Financial ratios were covered in Financial Accounting Health Care Finance and again in this course. Consult you text books, the net and contact me with any questions