Answered step by step

Verified Expert Solution

Question

1 Approved Answer

HTL currently generates $12 million worth of credit sales, which earns a net profit margin of 18%. Due to fierce competition, the firm is concerned

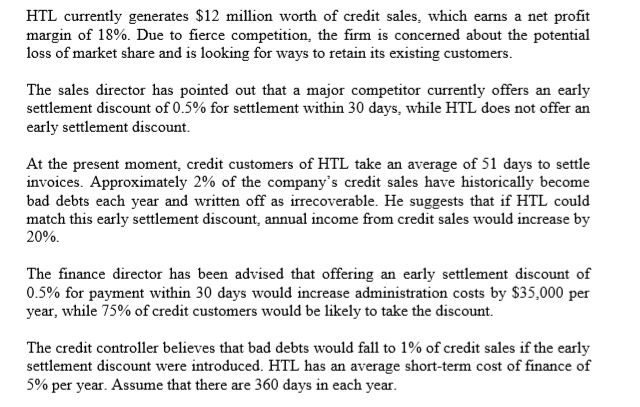

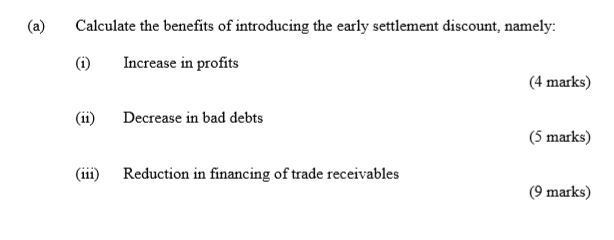

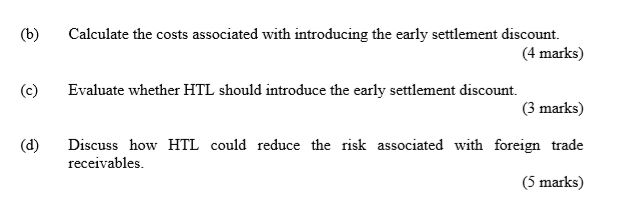

HTL currently generates $12 million worth of credit sales, which earns a net profit margin of 18%. Due to fierce competition, the firm is concerned about the potential loss of market share and is looking for ways to retain its existing customers. The sales director has pointed out that a major competitor currently offers an early settlement discount of 0.5% for settlement within 30 days, while HTL does not offer an early settlement discount. At the present moment, credit customers of HTL take an average of 51 days to settle invoices. Approximately 2% of the company's credit sales have historically become bad debts each year and written off as irrecoverable. He suggests that if HTL could match this early settlement discount, annual income from credit sales would increase by 20%. The finance director has been advised that offering an early settlement discount of 0.5% for payment within 30 days would increase administration costs by $35,000 per year, while 75% of credit customers would be likely to take the discount. The credit controller believes that bad debts would fall to 1% of credit sales if the early settlement discount were introduced. HTL has an average short-term cost of finance of 5% per year. Assume that there are 360 days in each year

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started