https:/exfordu-my.sharepoint.com/:w:/g/personal/gsyah_learner_nexford_org/EeKU_PxUZotBqcMHZUb7da0B_MpQEnxPIRcKnLEbKV4dUw?e=TRkleu

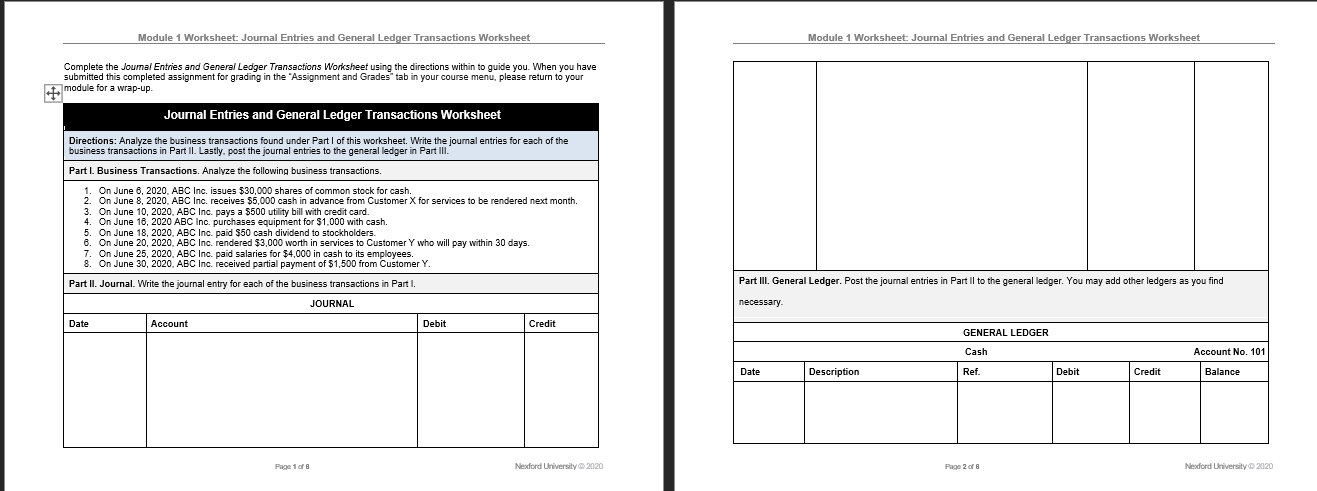

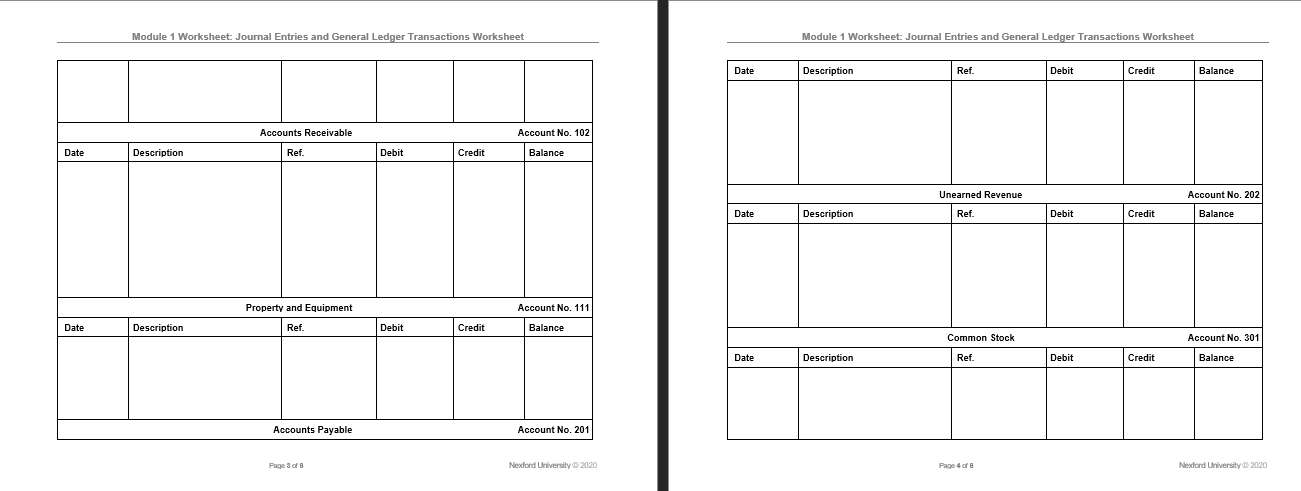

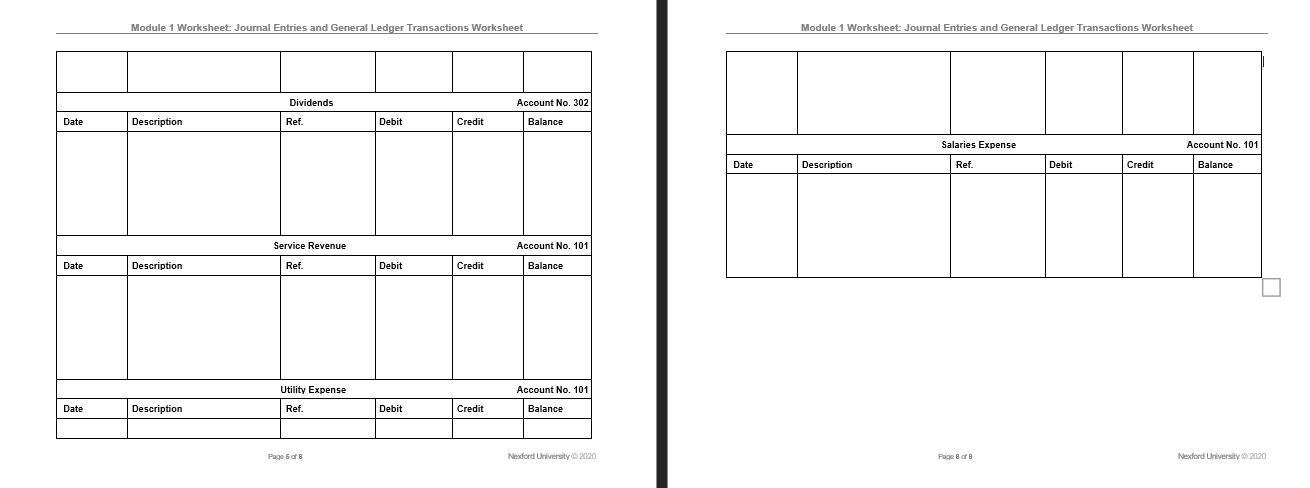

Module 1 Worksheet: Journal Entries and General Ledger Transactions Worksheet Module 1 Worksheet: Journal Entries and General Ledger Transactions Worksheet Complete the Journal Entries and General Ledger Transactions Worksheet using the directions within to guide you. When you have submitted this completed assignment for grading in the "Assignment and Grades" tab in your course menu, please return to your module for a wrap-up. Journal Entries and General Ledger Transactions Worksheet Directions: Analyze the business transactions found under Part I of this worksheet. Write the journal entries for each of the business transactions in Part II. Lastly. post the journal entries to the general ledger in Part III. Part I. Business Transactions. Analyze the following business transactions On June 6, 2020. ABC Inc. issues $30,000 shares of common stock for cash. On June 8, 2020. ABC Inc. receives $5,000 cash in advance from Customer X for services to be rendered next month. On June 10, 2020. ABC Inc. pays a $500 utility bill with credit card. On June 16, 2020 ABC Inc. purchases equipment for $1.000 with cash On June 18, 2020. ABC Inc. paid $50 cash dividend to stockholders. On June 20, 2020. ABC Inc. rendered $3,000 worth in services to Customer Y who will pay within 30 days. On June 25, 2020. ABC Inc. paid salaries for $4,000 in cash to its employees. On June 30, 2020. ABC Inc. received partial payment of $1,500 from Customer Y. Part II. Journal. Write the journal entry for each of the business transactions in Part I Part III. General Ledger. Post the journal entries in Part II to the general ledger. You may add other ledgers as you find JOURNAL necessary. Date Account Debi Credit GENERAL LEDGER Cast Account No. 101 Date Description Ref . Debit Credit Balance Page 1 of B Nexford University @ 2020 Page 2 of B Nexford University @ 2020Module 1 Worksheet: Journal Entries and General Ledger Transactions Worksheet Module 1 Worksheet: Journal Entries and General Ledger Transactions Worksheet Date Description Ref. Debit Credit Balance Accounts Receivable Account No. 102 Date Description Ref. Debit Credit Balance Unearned Revenue Account No. 202 Date Description Ref. Debit Credit Balance Property and Equipment Account No. 111 Date Description Ref. Debit Credit Balance Common Stock Account No. 301 Date Description Ref. Debit Credi Balance Accounts Payable Account No. 201 Page 3 of B Nexford University @ 2020 Page 4 of B Nexford University @ 2020Module 1 Worksheet: Journal Entries and General Ledger Transactions Worksheet Module 1 Worksheet: Journal Entries and General Ledger Transactions Worksheet Dividends Account No. 302 Date Description Ref. Debit Credit Balance Salaries Expense Account No. 101 Date Description Ref. Debit Credit Balance Service Revenue Account No. 101 Date Description Ref. Debit Credit Balance Utility Expense Account No. 101 Date Description Ref Debit Credit Balance Page 6 of B Nexford University @ 2020 Page B of B Nexford University @ 2020