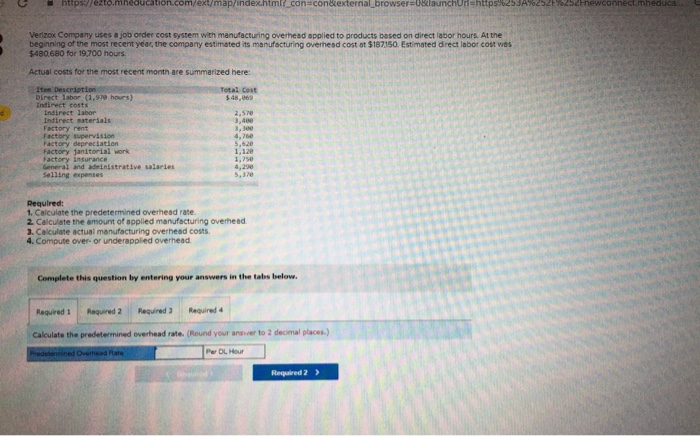

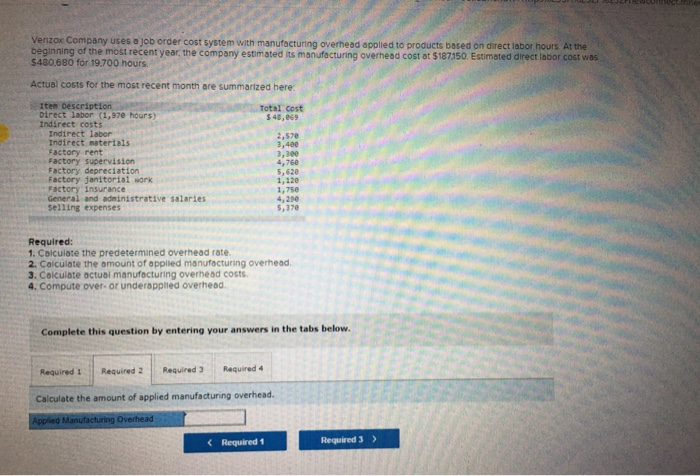

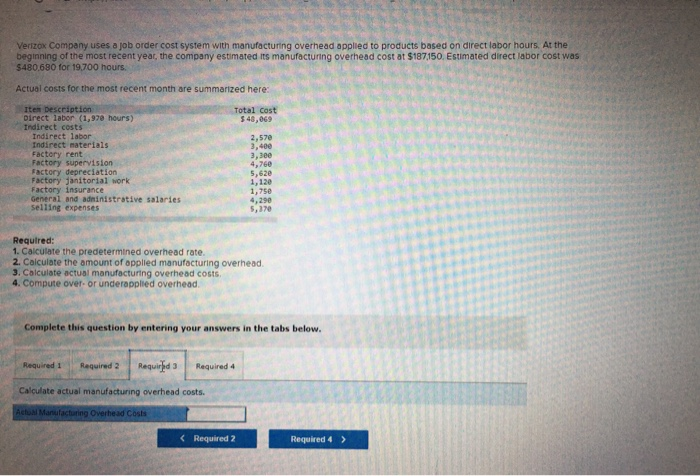

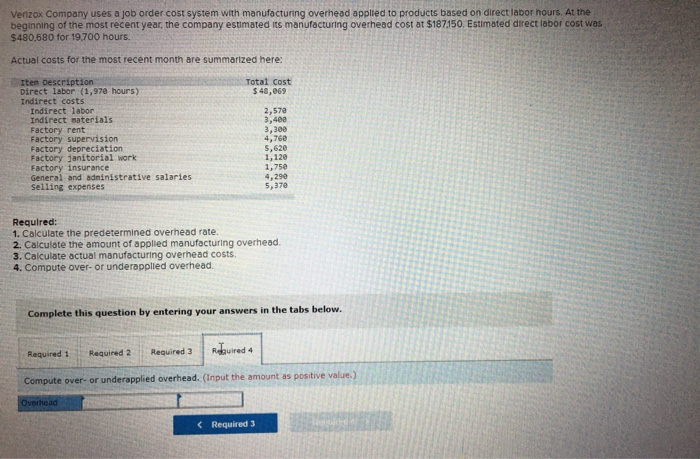

https://ezto.mn n.com/ext/map/index.html_con=constexternal browser=0&launchurahttps%253A newconnectmheduca Verizox Company uses a job order cost system with manufacturing overhead applied to products based on direct labor hours. At the beginning of the most recent year, the company estimated its manufacturing overhead cost at $187150. Estimated direct labor cost was $480 680 for 19,700 hours Actual costs for the most recent month are summarized here: Total Cost $48.869 Item Description Direct labor (1,99 hours) Indirect costs Indirect labor Indirect materials Factory Factory supervision Factory depreciation Factory janitorial work Factory insurance General and ministrative salaries Selling expenses 2,57 3,400 3,100 4,760 5,620 1,120 1.250 4,200 5,30 Required: 1. Calculate the predetermined overhead rate. 2. Calculate the amount of applied manufacturing overhead. 3. Calculate actual manufacturing overhead costs. 4. Compute over or underapplied overhead Complete this question by entering your answers in the tabs below. Required Required 2 Required 3 Required 4 Calculate the predetermined overhead rate. (Round your answer to 2 decimal places) Predenied Overhale Per DL Hour Required 2 > Emne Verizox Company uses a job order cost system with manufacturing overhead applied to products based on direct labor hours At the beginning of the most recent year, the company estimated its manufacturing overhead cost at $187150. Estimated direct labor cost was $480,680 for 19.700 hours Actual costs for the most recent month are summarized here: Total Cost $ 48,869 Item Description Direct labor (1,970 hours) Indirect costs Indirect labor Indirect materials Factory rent Factory supervision Factory depreciation Factory janitorial work Factory Insurance General and administrative salaries Selling expenses 2,570 3,400 3,300 4,760 5,620 1,120 1,750 4,290 5,370 Required: 1. Calculate the predetermined overhead rate. 2. Calculate the amount of applied manufacturing overhead 3. Calculate actual manufacturing overhead costs. 4. Compute over. or underapplied overhead Complete this question by entering your answers in the tabs below. Required: Required 2 Required 3 Required 4 Calculate the amount of applied manufacturing overhead. Applied Manufacturing Overhead Verizox Company uses a job order cost system with manufacturing overhead applied to products based on direct labor hours. At the beginning of the most recent year, the company estimated its manufacturing overhead cost at $187.150. Estimated direct labor cost was $480.680 for 19,700 hours. Actual costs for the most recent month are summarized here Total cost $ 48,069 Item Description Direct labor (1,970 hours) Indirect costs Indirect labor Indirect materials Factory rent Factory supervision Factory depreciation Factory janitorial work Factory insurance General and administrative salaries Selling expenses 2,57 3,400 3,300 4,760 5,62e 1,120 1,75e 5,170 Required: 1. Calculate the predetermined overhead rate. 2. Calculate the amount of applied manufacturing overhead. 3. Calculate actual manufacturing overhead costs 4. Compute over or underapplied overhead Complete this question by entering your answers in the tabs below. Required 1 Required 2 Requirfido Required 4 Calculate actual manufacturing overhead costs. Achol Manufacturing Overhead Costs Verizox Company uses a job order cost system with manufacturing overhead applied to products based on direct labor hours. At the beginning of the most recent year, the company estimated its manufacturing overhead cost at $187.150. Estimated direct labor cost was $480.680 for 19,700 hours Actual costs for the most recent month are summarized here: Total cost $ 48,069 Item Description Direct labor (1,978 hours) Indirect costs Indirect labor Indirect materials Factory rent Factory supervision Factory depreciation Factory janitorial work Factory insurance General and administrative salaries selling expenses 2,570 3,40 3,300 4,760 5,620 1,120 1,750 4,290 5,370 Required: 1. Calculate the predetermined overhead rate. 2. Calculate the amount of applied manufacturing overhead 3. Calculate actual manufacturing overhead costs. 4. Compute over- or underopplied overhead. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Rotavired 4 Compute over- or underapplied overhead. (Input the amount as positive value.) Overhead