Answered step by step

Verified Expert Solution

Question

1 Approved Answer

After reading and reviewing the Tipped Employees fact sheet http://www.dol.gov/whd/regs/compliance/whdfs15.pdf, think about how this affects you personally . https://mycourses.cnm.edu/d2l/common/dialogs/quickLink/quickLink.d2l?ou=131423&type=coursefile&fileId=whdfs15.pdf a. C reate your own thread

After reading and reviewing the Tipped Employees fact sheet http://www.dol.gov/whd/regs/compliance/whdfs15.pdf, think about how this affects you personally.

https://mycourses.cnm.edu/d2l/common/dialogs/quickLink/quickLink.d2l?ou=131423&type=coursefile&fileId=whdfs15.pdf

a. C reate your own thread and make a post in the Tipped Employees forum discussing:

- The main points

- Your thoughts on a couple of the requirements, and

- Your experience with tips or with tipping.

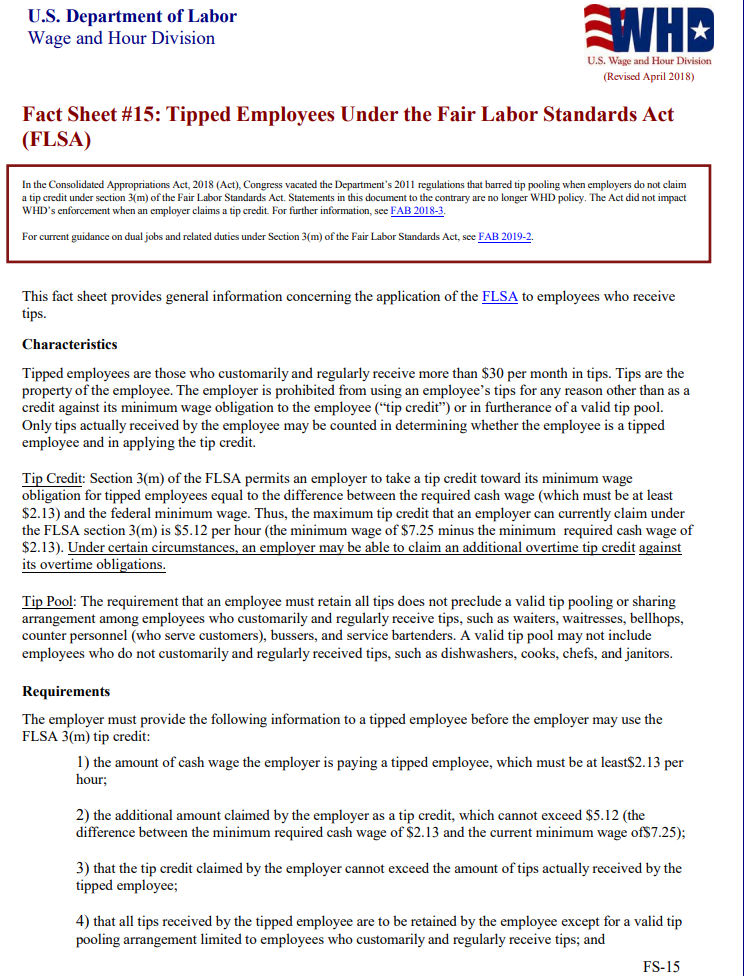

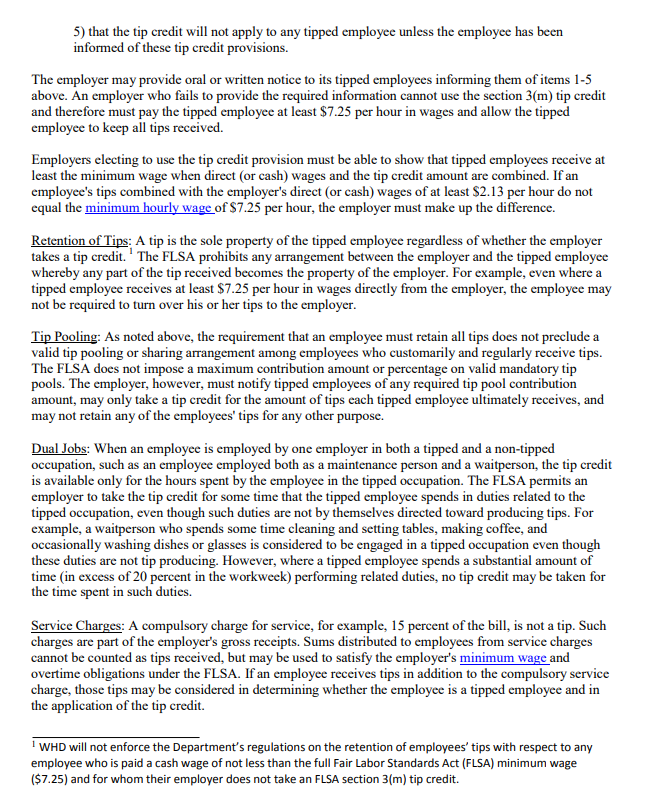

U.S. Department of Labor Wage and Hour Division WHO U.S. Wage and Hour Division (Revised April 2018) Fact Sheet #15: Tipped Employees Under the Fair Labor Standards Act (FLSA) In the Consolidated Appropriations Act, 2018 (Act), Congress vacated the Department's 2011 regulations that barred tip pooling when employers do not claim a tip credit under section 3(m) of the Fair Labor Standards Act. Statements in this document to the contrary are no longer WHD policy. The Act did not impact WHD's enforcement when an employer claims a tip credit. For further information, see FAB 2018-3. For current guidance on dual jobs and related duties under Section 3(m) of the Fair Labor Standards Act, see FAB 2019-2. This fact sheet provides general information concerning the application of the FLSA to employees who receive tips. Characteristics Tipped employees are those who customarily and regularly receive more than $30 per month in tips. Tips are the property of the employee. The employer is prohibited from using an employee's tips for any reason other than as a credit against its minimum wage obligation to the employee ("tip credit") or in furtherance of a valid tip pool. Only tips actually received by the employee may be counted in determining whether the employee is a tipped employee and in applying the tip credit. Tip Credit: Section 3(m) of the FLSA permits an employer to take a tip credit toward its minimum wage obligation for tipped employees equal to the difference between the required cash wage (which must be at least $2.13) and the federal minimum wage. Thus, the maximum tip credit that an employer can currently claim under the FLSA section 3(m) is $5.12 per hour (the minimum wage of $7.25 minus the minimum required cash wage of $2.13). Under certain circumstances, an employer may be able to claim an additional overtime tip credit against its overtime obligations. Tip Pool: The requirement that an employee must retain all tips does not preclude a valid tip pooling or sharing arrangement among employees who customarily and regularly receive tips, such as waiters, waitresses, bellhops, counter personnel (who serve customers), bussers, and service bartenders. A valid tip pool may not include employees who do not customarily and regularly received tips, such as dishwashers, cooks, chefs, and janitors. Requirements The employer must provide the following information to a tipped employee before the employer may use the FLSA 3(m) tip credit: 1) the amount of cash wage the employer is paying a tipped employee, which must be at least$2.13 per hour; 2) the additional amount claimed by the employer as a tip credit, which cannot exceed $5.12 (the difference between the minimum required cash wage of $2.13 and the current minimum wage of $7.25); 3) that the tip credit claimed by the employer cannot exceed the amount of tips actually received by the tipped employee; 4) that all tips received by the tipped employee are to be retained by the employee except for a valid tip pooling arrangement limited to employees who customarily and regularly receive tips; and FS-15

Step by Step Solution

★★★★★

3.55 Rating (141 Votes )

There are 3 Steps involved in it

Step: 1

ANSWER Main Points from the Fact Sheet Definition of Tipped Employee A tipped employee is someone en...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started