Question

Castrol - An Innovative Distribution Channel ( Case in Pictures below ): In this project, you will apply your learnings through a case study on

Castrol - An Innovative Distribution Channel (Case in Pictures below):

In this project, you will apply your learnings through a case study on Castrol India Limited, a leading automotive and industrial lubricant manufacturing company, known for its technological innovation and marketing expertise.

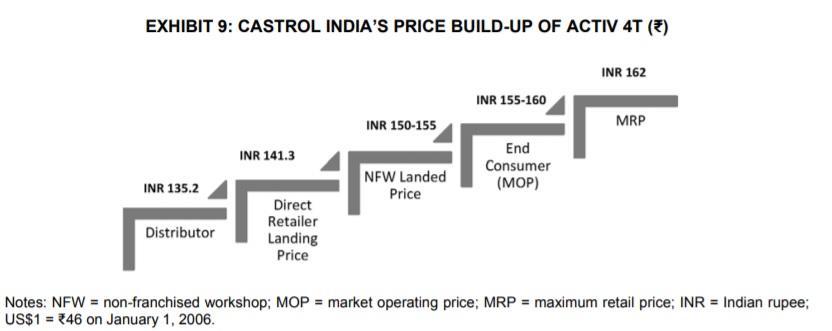

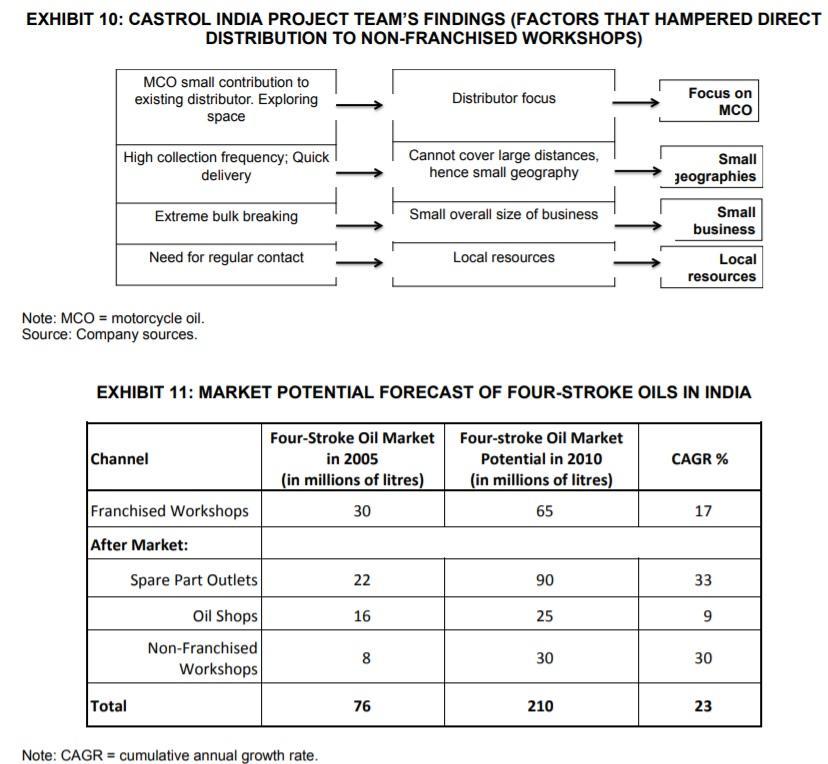

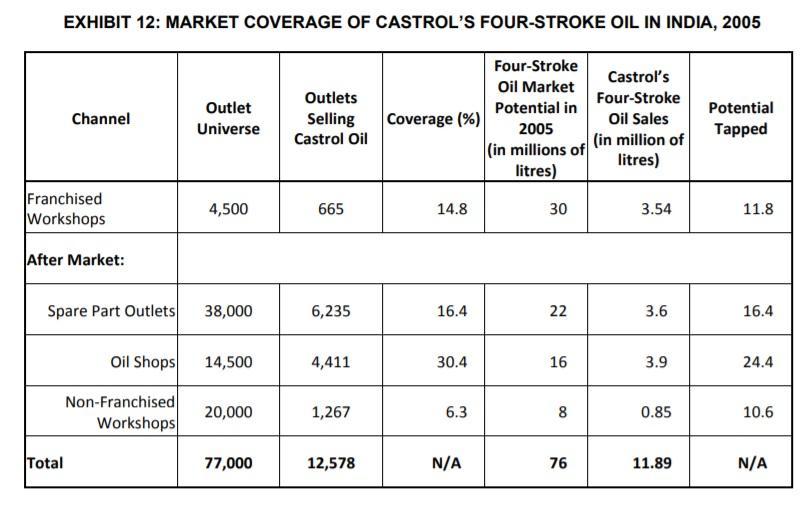

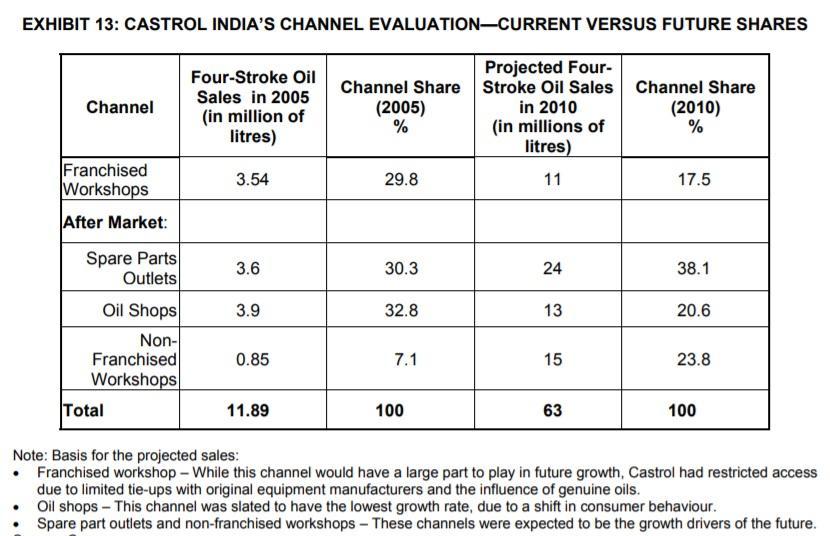

Here's the case scenario. The top management at Castrol India is concerned that the market potential for motorcycle oils, which is one of their product categories, is much higher than the current sales level. While working on this project, you need to understand the gap in the current distribution strategy. You need to evaluate three new distribution strategy models and suggest a suitable model that caters to the changing market conditions and is cost-neutral to the company as well.

1.

The case indicates that the Indian two-wheeler market was expected to grow from 2004 to 2015.

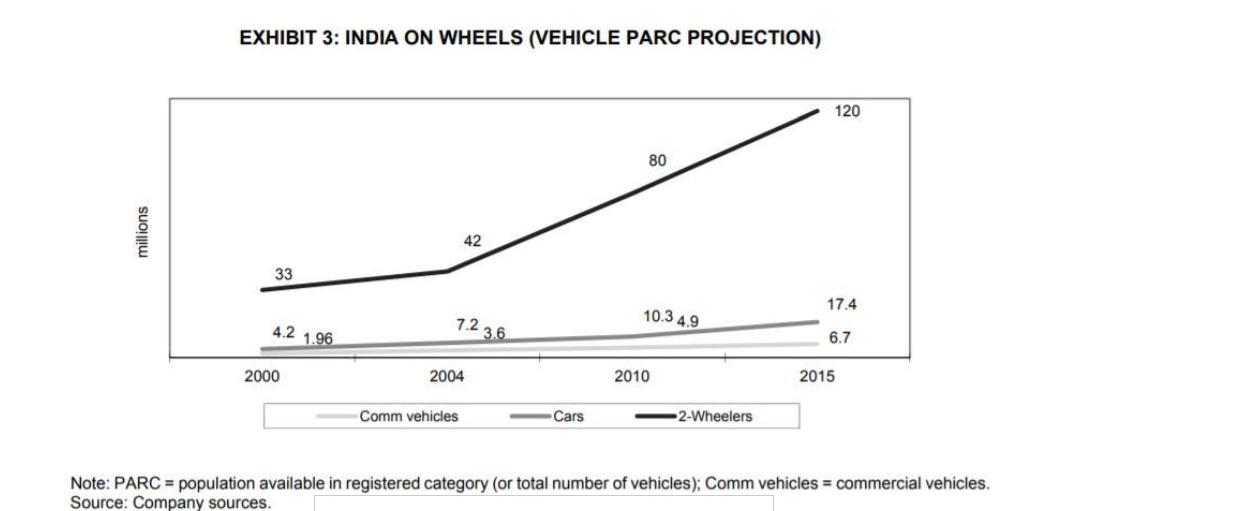

Question 1A: Based on the data provided in exhibit 3, find out the rate of growth (in percentage terms) of two-wheeler vehicles in India for the following periods:

| Period | Rate of Growth |

| 2000-2004 | ? |

| 2004-2010 | ? |

| 2010-2015 | ? |

Question 1B: Also, list down the three factors (mentioned in the case) responsible for the growth (or decline) of the two-wheeler market in India?

The case indicates that the Indian MCO market was highly fragmented.

Question 1C: List down three private- and three public-sector players in the industry?

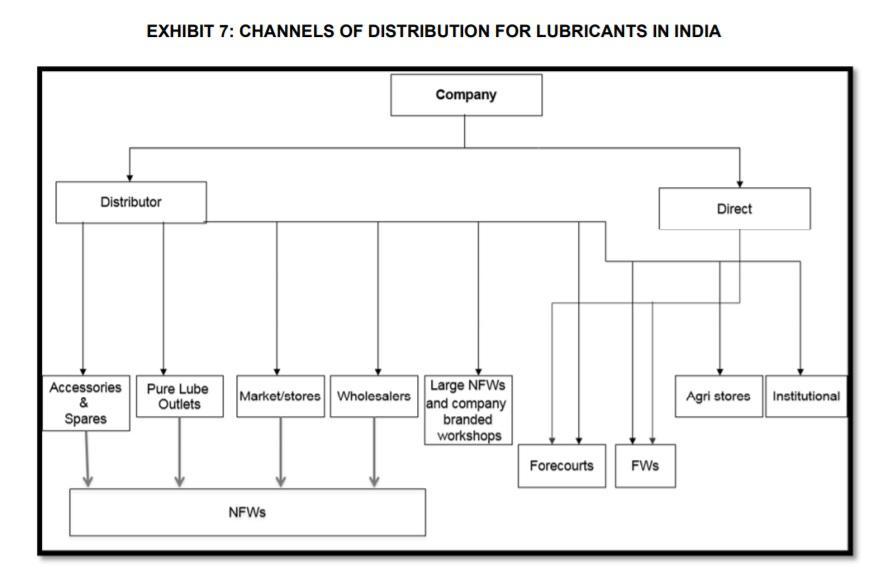

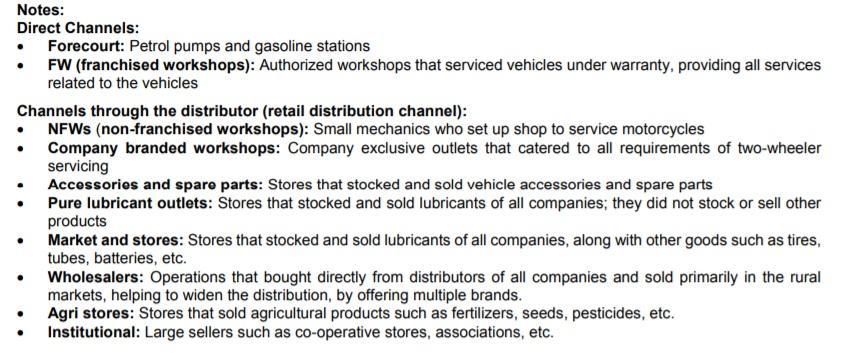

Question 1D: Also, determine two direct distribution channels and three distribution channels serviced through the distributor for the lubricant market in India?

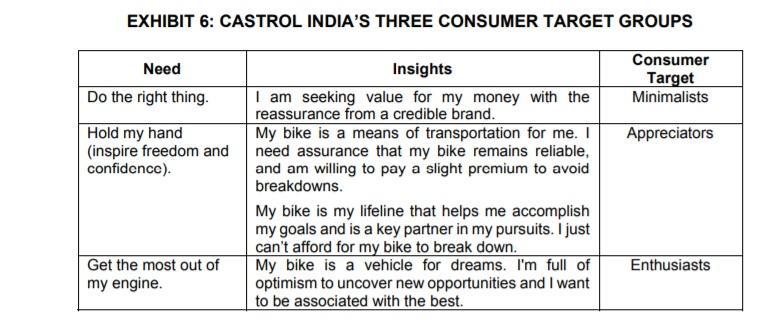

Read the given case carefully and answer the questions about the motorcycle oil market (MCO market). Determine the impact of the following parameters on the Indian motorcycle oil market (MCO market).

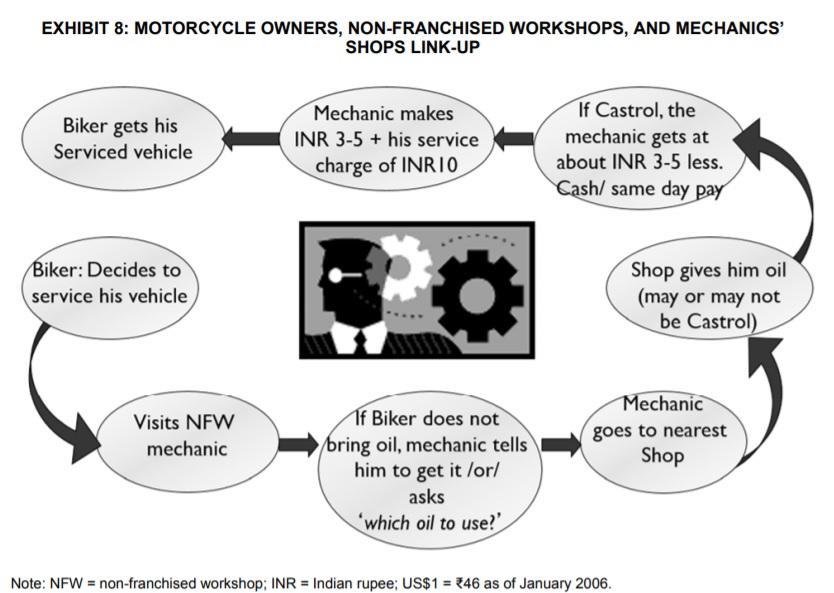

Question 2A: Consumer buying behaviour ?

Question 2B: Technological advancements happening in the two-wheeler industry?

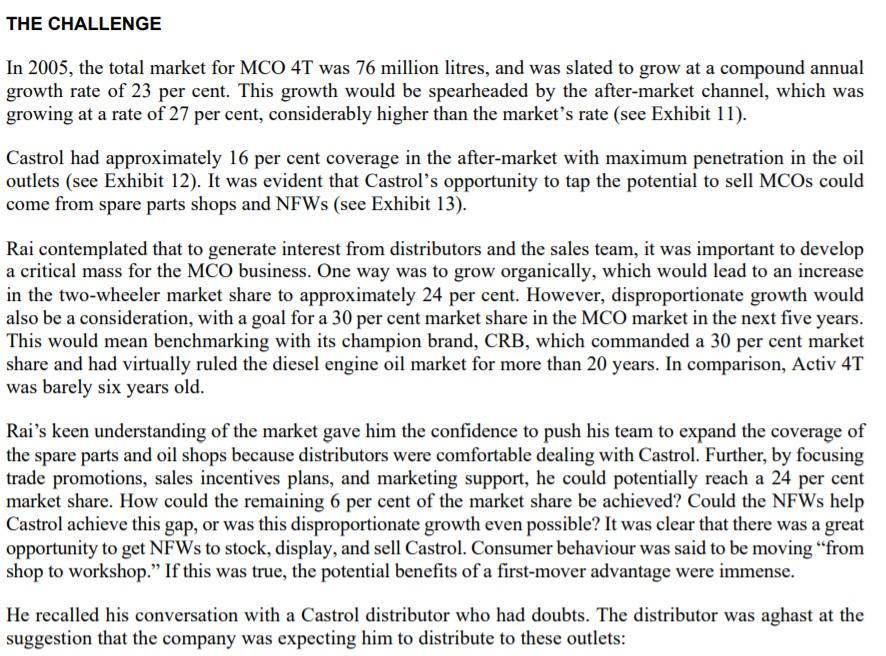

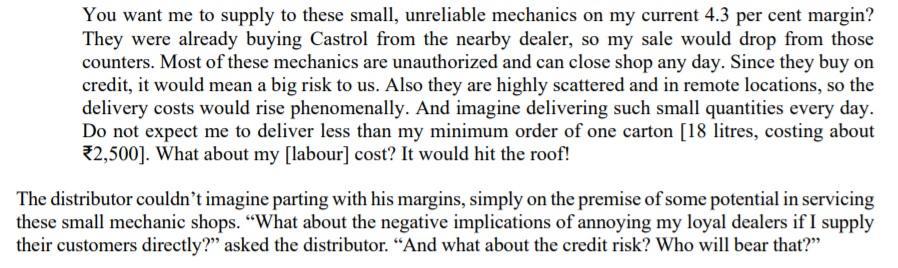

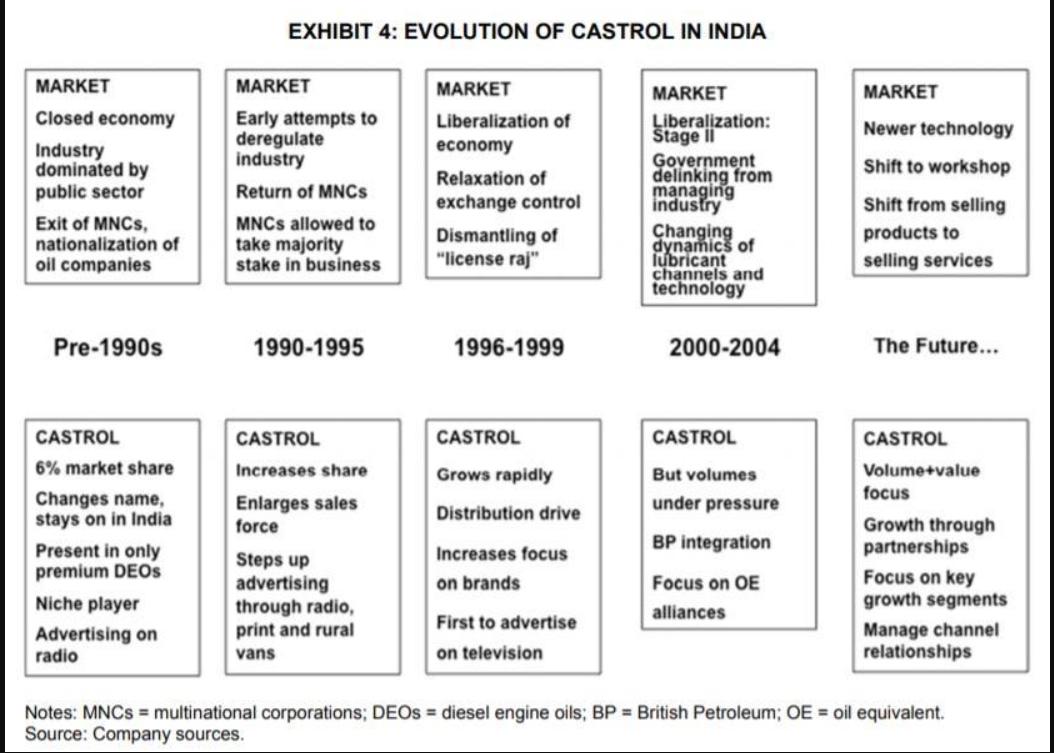

"There has to be an explanation!" thought Mohit Rai, the general manager of sales for Castrol India Limited (Castrol). The market potential estimates for sales of Castrol motoreycle oil (MCO) for four-stroke engines (referred to as MCO 4T)' were just not making sense. It was January 2006, and Rai was just back from the annual sales conference where he had been lauded for substantial growth in the sales of Castrol MCO 4T. While presenting the sales plans, he had niggling doubts about his presentation. On his flight back home, he decided to re-examine the numbers. India was showing great demand for motorcycles (casually referred to as bikes), resulting in 5 million bikes being added on the road each year. After the 18-24 months of the warranty period, almost all of the bikes came into the after-market for their maintenance service and consequent oil changes. At 3.5 litres per bike per year, the MCO 4T market was growing by 17 million to 18 million litres per year. Castrol was present in most of the important outlets in the after-market and had a strong over-the-counter market share. However, Castrol was adding an average of only 2.5 million litres of MCO 4T per year, which was far less than the demand that its market dominance suggested. Was there a parallel universe of outlets where Castrol was not present? Was the data wrong? One thing was certain: over a period of time, Castrol would not only lose market share but also market dominance. Rai became restless and decided to set up a meeting with members of his sales and marketing teams to get to the root of this issue. INDIA, A GROWING ECONOMY India was a fast-growing economy with a large and expanding middle class (see Exhibit 1). The growth indicators for India's future pointed toward a stable and market-oriented economy (see Exhibit 2). The total number of two-wheelers in India was expected to jump from 42 million units in 2004 to 80 million units by 2010 (see Exhibit 3) and was being driven by a combination of factors, including consumers' increasing disposable incomes, the aspiration to own a motorized vehicle, and the availability of easy financing. The * Motorcycle oil was divided into two categories: two-stroke (2T) oil and four-stroke (4T) oil. 2 Once the warranty period expired, most motorcycles entered the after-warranty market, or bazaar, for service and oil changes. This channel consisted of spare parts shops, oil shops, and non-franchised workshops.

Step by Step Solution

3.34 Rating (145 Votes )

There are 3 Steps involved in it

Step: 1

Castrol Distribution Channel 1A Period Rate of Growth 20002004 9 20042010 38 20102015 40 1 B According to General Manager Mohit Rai he reviewed the market research studies on the motorcycle owners and ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started